Top 50 Startups List

The 50 most promising Israeli startups - 2023

With the fall in venture capital investments removing the background noise, this year’s list of the 50 most promising Israeli startups highlights the companies with a real profit model

The atmosphere outside is gloomy, both because of the judicial overhaul in Israel that has led to a rift in the nation and because of the winds of recession blowing from the direction of the U.S. The changes in the macroeconomic situation have made everyone's life more difficult, whether it is a startup fighting for survival or a veteran public company.

High interest rates have returned after two decades during which there were those who forgot they could rise, and others who had never even experienced such a reality. After years in which deposits and investments in bonds yielded zero returns and pushed everyone into the circle of risks that characterize high-tech investments, suddenly it is no longer worth the risk. A 5% return is now available at zero effort and even more if it's larger amounts, and with no risk at all, certainly nothing like the risk levels that characterize investment in venture capital funds.

And so, after the phenomenal 2021 and a strong 2022, the winter of 2023 has arrived. The companies, who may already be ready to get off the fence they sat on last year and recognize that the value levels of 2021 were unrealistic, are now encountering investment funds that are largely “sitting on their hands". The funds waited until the high-tech companies internalized the change in the situation in order to take part in fundraising rounds under more favorable conditions, but now many of them have difficulty calling for money or are afraid to make investments, preferring to keep funds for emergencies in the best companies in their portfolio.

This is what led to the snowball that rolled into every sector of high-tech investments and froze them almost completely in the first quarter of 2023, continuing the considerable deterioration already recorded in 2022. Last year, in the article that accompanied the ranking of the most promising Israeli startups for 2022, we wrote that a brilliant idea and a fast growth rate are no longer enough to enter the list. Heading into more complex years in the global economy, the criterion of a sustainable business model that ultimately leads to profitability and not just to growth fueled by wasteful marketing and sales budgets, takes on new importance.

This year, the reality became even more complex, and in examining the promising startups we added new criteria in the spirit of these times: how long will the money in the company's coffers last and what is happening with its personnel. Many companies laid off workers in the last year and it seems that even these very days, after the spring holidays, there is another wave of layoffs taking place. But good management is tested precisely in times like these. Those who did not go crazy during the good times and made sure to conduct themselves responsibly and carefully, managed to escape the waves of layoffs and will probably be able to do so in the future as well.

It can be said, perhaps counterintuitively, that this year the task of choosing Israel's 50 most promising startups was easier than in the previous two years. There are several reasons for this. First of all, there is much less background noise: as soon as the nominations have to pass through the filter of the criteria, many fall by the wayside. Second, the unicorn baby boom is over and this also has its advantages. The transformation of many startups into companies worth a billion dollars or more created a real distortion. Companies with revenues that sometimes did not even reach $50 million, let alone $100 million or more, suddenly seemingly fulfilled their promise - but only apparently. The same is true of companies that went public prematurely at valuations of billions of dollars and now find themselves in Wall Street’s spam box. Against this background, the top ten most promising startups are made up of much more mature companies, with a proven product-to-market fit and a proven business model. In other words, a year ago most of them would probably have already become unicorns and be drawn into the race for growth at any cost.

1. Semperis

Sector: Cybersecurity

Established: 2014 • Founders: Michael Brezman, Guy Teverovsky, and Matan Liberman • Employees: 400 • Funding: $254 million from Insight Partners, KKR, and Ten Eleven Ventures.

“We had to be commandos": How Semperis became one of the fastest-growing companies in the world

Matan Liberman and Guy Teverovsky remember when Semperis - the cyber company they founded with Michael Brezman - achieved its major breakthrough. "Each of us remembers the moment when an order arrived from a certain British client, a giant global retailer whose trust had taken us a long time to win," says Lieberman, VP Business Development. Teverovsky, the CTO, smiles, saying to Calcalist, "It was our biggest contract at the time, the first seven-figure contract. When the order arrived I was sitting in a restaurant in New York, I saw the order and shouted, “Yes!” in the middle of the restaurant. Everyone thought I should be hospitalized. For me, it was doubly exciting, because this customer who chose us wrote the books I learned from. It was amazing.”

"It's a huge client, which naturally raises concerns," Lieberman continues. "I flew to England to do a demo, the client approved, and we started installing on the spot. We set aside more than a week for it, but it took two days. The client was shocked that it worked so quickly, and we were shocked by the quick success. It was amazing. And since then the bar has only gone up."

Considering the unusual story of Semperis, which developed a disaster recovery system that knows how to detect cyber attacks, neutralize them, and restore the organization's activities automatically, it is indeed amazing. Founded in 2014, the company did not follow the typical path of Israeli cyber entrepreneurs, which includes starting in one of the army’s technology units of the intelligence corps, creating an extensive network of connections, receiving investments from senior angel investors in the industry, and a supportive business environment. "We are a strange bird: we weren’t in the IDF’s technology units," says Lieberman. "I served in the Prime Minister's Office, Guy was in infantry] and we both served as reservists in infantry."

2. AI21 Labs

Sector: AI

Established: 2017 • Founders: Amnon Shashua, Yoav Shoham, and Ori Goshen • Employees: 200 • Funding: $117 million from Ahren Innovation Capital Fund, Amnon Shashua, Pitango, Walden Catalyst, TPY Capital, and Mark Leslie.

“It’s like the mobile revolution but even bigger"

"We live in a new era, there were problems that for 20 years there was no significant progress in solving and suddenly everything works, including things that half a year ago were seen as imaginary," explained Ori Goshen, co-founder and CEO of AI21 Labs.

The dramatic decision by OpenAI to make its conversation model available to users sparked the Generative AI revolution and, above all, made it public.

Calcalist chose to rank AI21 Labs in second place even before the Israeli startup's dramatic announcement a few days later that it would be teaming up with Amazon to launch its Bedrock AI tool. The American giant, lagging behind what Microsoft and Google had already recognized, announced that AI21 will be one of the companies whose AI technology will be integrated into its AWS platforms. In doing so, Amazon joins the race with Microsoft’s investment in OpenAI and Google, which developed its own tool called Bard.

One of the main questions since the world realized the tremendous capabilities of generative AI - and its potential to transform life as we know it - is whether this arena will be exclusively dominated by giant corporations: Google vs. Microsoft vs. Amazon vs. Meta with no breathing space for small players.

Co-founder Yoav Shoham speaking to CTech in 2022

(Sinai David)

"There is indeed a very limited number of companies that are really able to play in this arena, and indeed these are mainly the big tech companies," AI21 co-founder Ori Goshen says in an interview with Calcalist. “But there is room for several players who are already operating in the field and have the same technological ability as us, such as OpenAI and Anthropic."

According to Goshen, since ChatGPT's breakthrough into everyday life, AI21 has been flooded with inquiries - because every company that wants to secure its future understands that the future includes artificial intelligence. "There isn't a CEO today who hasn't ordered the integration of generative AI elements into the company's systems," he says, "It's like the mobile revolution, and maybe even a bigger revolution."

3. Locusview

Sector: Cleantech (software for managing and establishing energy infrastructures)

Established: 2015 • Founders: Shahar Levi • Employees: 60 • Funding: $80 million from Leumi Partners, Clal Insurance, Clal Tech, Discount Capital, and IGP

"We take a process that used to take nine months, and complete it in 24 hours"

Locusview, which has received little exposure in Israel, is a small company with big numbers. If the vision of the founder Shahar Levi is realized, the large numbers of the field in which it operates will make it a significant player in the hot markets of cleantech and smart cities. The company's platform, designed for the replacement, establishment, and management of energy infrastructures, managed 300,000 projects last year with a total value of $15 billion.

The regulation in the United States strongly encourages the replacement of outdated and polluting energy infrastructures that do not meet modern standards. To encourage the companies to meet new and stricter requirements, the government provides significant economic incentives for upgrading, such as permission to raise electricity or gas rates. The incentives encourage the energy companies to take on the projects, but these tend to get very complicated: dozens of suppliers and contractors work on each such project, employing hundreds of workers, and the main difficulty is synchronizing them all.

Locusview solves this synchronization problem brilliantly. The Israeli startup's system provides a super-accurate image of the project, at the centimeter level (compared to meters in Google Maps, for example), and at the same time manages and synchronizes the contractors who are simultaneously working on the project. The nut the company has been able to "crack" is a convenient interface for the work teams: each contractor receives a tablet from the company with precise details about the project, its goals, tasks, and the integration with the other contractors. The result is a tremendous streamlining of the work process. Thus, for example, Levi describes that in the past merely the process of approving the infrastructure after the completion of the project took nine months. Locusview's system shortens it to 24 hours.

4. Weka

Sector: AI

Established: 2013 • Founders: Liran Zvibel, Omri Palmon, and Maor Ben-Dayan • Employees: 350 (in Israel and U.S) • Funding: $275 million raised from Generation Investment Management, Hitachi, Gemini, Norwest Venture Partners, Nvidia, Qualcomm Ventures, and Ibex Investors

If it weren't for market stagnation, it would already be a unicorn

Weka, developer of a technology for storing and retrieving data, required a decade of development, but is now cashing in big.

If one had to bet which company from the list of promising startups would make it to a Wall Street IPO, the safest bet would probably be Weka, which develops technology for storing and retrieving data.

It took the three founders of the deep tech company, Omri Palamon, Maor Ben-Dayan and CEO Liran Zvibel, all graduates of the Talpiot program, almost ten years to develop their system - but at the end of 2021 the company was already on the right track, and began to sign agreements with huge companies at an accelerated pace, including HP and Hitachi (who also invested in the Israeli company), so Weka's revenues are growing at a fast pace.

Against this background, starting in the second half of 2022, even the most frugal investors could not ignore Weka’s rise. About six months ago, the company completed a huge funding round of $135 million at a value of $750 million, and if it were not for the frozen year of 2022, it is likely that Weka would have already become a unicorn. This fundraising came less than a year after the previous capital raising, in which Weka received $73 million. According to market estimates, Weka completed another round in 2023, consisting only of secondary deals - that is, employees and long-time shareholders sold part of their shares to investors, who are still thirsty for the company's stock.

Weka’s system allows very fast access and retrieval of data, thus enabling the efficient operation of many applications. For the time being, the company is focusing most of its efforts in the fields of artificial intelligence, finance and genomics - all very large markets, but ones that will also allow Weka to easily present the change occurring as a result of the use of its product. The numbers do not require an in-depth examination: for example, one of the customers used Weka’s software and reduced the retrieval time from the information system from two weeks to a mere four hours.

Weka sells its solutions mainly through OEM agreements. Through the giant companies, its technology reaches many companies across the world, so it has quite a few eight-figure deals. This allows the company a fairly high level of predictability regarding the scope of future revenues - and at this point the picture is quite rosy, despite the significant slowdown in the global economy. Because of this, Weka not only did not lay off employees in the last year, but also increased its workforce, from 250 employees to 350 today.

Weka’s success has attracted quite a few acquisition offers, but the company's three founders have already experienced an exit. The group was previously part of XIV, which in 2008 was sold to IBM for $300 million. This time round, according to them, they want to build a huge company.

5. SuperPlay

Sector: Gaming

Established: 2019 • Founders: Gilad Almog and Eyal Netzer • Employees: 200 (in Israel, Ukraine, Poland, and Romania) • Funding: $54 million raised from NFX, North83, vgames, General Catalyst, and Key1

Knowing how to play the game

SuperPlay from Rosh Ha'ayin has so far released only two games but enjoys high revenues and rosy forecasts.

The local gaming industry knows how to produce significant players for the global market. Playtika and Moon Active are just two of the companies that bring in billions of dollars a year, and there are many other companies operating in the industry with huge revenues that prefer to keep it a secret. Last year, Calcalist shined a light on Candivore and now it's SuperPlay's turn. The company, founded in 2019 by two childhood friends from Rosh Ha'ayin, currently generates revenues that would not put most startup companies in Israel to shame. The founders, Gilad Almog, who serves as CEO, and Eyal Netzer, are formerly of Playtika, the Israeli gaming giant. In 2015, the company founded by Almog was sold and he joined Playtika, where Netzer was already working.

So far the company has launched two games from the world of casual games. The first, Dice Dreams, is a dice board game that allows you to build kingdoms, go on quests and face off against other players. The game has annual revenues of $200 million, with tens of millions of downloads. The second game, Domino Dreams, has just started its journey, but within a year it is expected to reach $30 million in revenue. The secret of the company's success lies in the fact that since its inception, its founders have chosen a unique path compared to the other companies in the field, and they make sure to combine a high artistic level with a solid technological base. This combination allowed them to create familiar games such as Solitaire and Dominoes while giving them an innovative twist.

The company's headquarters are located in Israel, and it also employs workers in Ukraine, Poland and Romania. Among its investors is Gigi Levy-Weiss's NFX investment fund, which has invested in most of the successful gaming companies in Israel, including Moon Active.

The company's future is very promising, with another game currently in development. Thanks to its significant revenues, SuperPlay is already starting to think about expansion, similar to other gaming companies of the likes of Playtika, which grew thanks to the acquisition of similar companies.

6. Hello Heart

Sector: Healthtech

Year founded: 2013 • Founders: Ziv Meltzer, Maayan Cohen, and Michal Gutman • Employees: 180 (in Israel and U.S.) • Funding: $138 million raised from BlueRun Ventures, Maven Ventures, Resolute Ventures, and IVP

Touching the heart

Hello Heart, which helps users track health indicators, has proven that it also tracks the risks in the markets very well.

There are very few women entrepreneurs in Israel whose companies have reached revenues of tens of millions of dollars. One of these companies is Hello Heart, founded by Ziv Meltzer, Maayan Cohen, who manages the company, and Michal Gutman. The company has developed a monitor for measuring blood pressure, which is integrated into an application that allows people to keep track of all their medical indicators.

In the last year, Hello Heart recorded a jump in its activity, with revenues of $55 million in 2022 and a significant growth forecast into 2023 and 2024. This is despite operating in a market facing a recession. The recession has nevertheless affected the company's managers, who chose to change direction and now prefer to work with the American government and federal companies, instead of with corporations. This change in direction saved the company's income and created a secure future for it in the coming years as well. This is also reflected in fundraising, with the company managing to raise $70 million last May when winds of uncertainty were already blowing in the market.

Maayan Cohen speaking to CTech's James Spiro

(Photo: Sinai David)

The leadership of the company stood out in the crisis of Silicon Valley Bank when Cohen decided to quickly withdraw the company's funds from the bank out of deep concern that the company would not be able to pay its employees and suppliers and would face an existential threat. The relatively low number of employees at Hello Heart connects to the ethos of the company, which strives to be built efficiently and digitally - just as it builds its products. However, the number of employees is expected to increase from 180 to 230, of which 90 are in Israel.

Hello Heart recently noted two significant milestones. As part of its vision to become a digital treatment tool for all aspects of heart health, it launched a tool that provides users with personalized tips to improve cholesterol and triglyceride levels, with the tips being optimized using AI. The second milestone is the recognition the company received from the American Heart Health Organization as a technology that provides an answer to one of the profound problems of the U.S. healthcare system - poor treatment of heart diseases caused by incorrect diagnosis, and the need to prevent them among minorities and women. The company also developed a supplement that reminds users to take their medication, including the exact dosage and timing. Another product of theirs checks the behavior patterns of the users and advises them on how to improve them - for example, adding more daily walking time. The personal insights users receive help them feel better and enjoy normal blood pressure - as well as other improved health metrics.

7. Travelier (previously Bookaway)

Sector: Travel Tech

Established: 2017 • Founders: Noam Toister, David Yitzhaki, Omer Chehmer and Jonathan Bensaid • Employees: 460 • Funding: $81 million from Aleph, Corner Ventures, Red Dot Capital Partners, Menorah Mivtachim, and Tenere Capital.

Traveiler brings the digital booking revolution to land and seas

Along with the entire tourism industry, the Coronavirus pandemic significantly impacted Travelier, a platform for booking tickets for land and sea transportation. Once the pandemic hit, almost overnight, their revenues fell to zero.

The leadership of the company was forced to make a major shift. They made significant cuts, realizing that they had an opportunity to rethink and create a breakthrough technology, which would allow them to provide a solution to the issues shaping the tourism industry. While numerous options existed for booking flights quickly and conveniently, there were very few options for maritime and especially land transport, including trains, buses, and ferries, in large parts of the world. Travelier saw an opportunity to fill this void, and to digitize bookings for maritime and land transit.

Noa Greenfield, VP Brand and Communications speaking to CTech in 2023

(Sinai David)

In 2022, the company acquired four competitor companies in Asia, South America, and Eastern Europe, allowing Travelier to build an international platform that includes 6,200 different suppliers all over the world. As a result of their reorientation, Bookaway’s revenues have grown immensely and are only expected to increase.

Last year, amidst the global economic downturn, Travelier raised $35 million in a Series C of funding. The company raised a similar amount in 2020 in its Series B and a total of $81 million since its inception. The company operates in about 90 countries around the world, including 13,000 cities and more than 300,000 transportation routes.

8. Zesty

Sector: Optimization of cloud infrastructures

Established: 2019 • Founders: Maxim Melamedov and Alexey Baikov. • Employees: 170 (in Israel and U.S) • Funding: $117 million raised from Next47, S-Capital, Sapphire, B-Capital

Cloudy with a chance of savings

Zesty is so confident in its product that in the first year of a contract with a customer they do not charge them a subscription fee, but only a success fee: the company takes 25% of the value of the savings it created for the customer in their cloud costs. According to the company's data, it provides its hundreds of customers with a 400% return on their investment in just one month.

Zesty identified an acute "pain point": companies that transferred organizational infrastructures to the cloud discovered that it is very difficult to predict the number of computing resources they will require. Forecasting should hold both ends of the stick: both prepare the organization with enough computing resources for its needs, and also limit them to avoid unnecessary costs. Zesty’s solution is simple: it connects as a "plug-in" to the corporate infrastructure, and finds the balance point between these extremes. Its service supports Amazon's AWS and Microsoft's Azure. Amazon even presents Zesty's solution in its marketplace, and its salespeople receive a commission for selling Zesty services. It also helps Amazon convince organizations not to return part of their computing infrastructure to the physical office given the increase in cloud spending that accompanies all growth.

Zesty is not the only company in the optimization market, but in light of the predictions that the scope of the cloud market will be more than a trillion dollars in 2030, it has room to grow. It is not impossible that Microsoft or Amazon will simply swallow it over time, and integrate the tool into their cloud services. In the meantime, it is deepening its penetration into the American market, and Maxim Melamedov, the co-founder and CEO, to soon move to California. His partner, CTO Alexey Baikov, will manage the activity in Israel.

9. Mesh Payments

Sector: Fintech

Year founded: 2018 • Founders: Oded Zehavi and Eran Katoni • Employees: 150 (in Israel and U.S) • Funding: $123 million raised from Alpha Wave, Tiger Global, TLV Partners, Entrée Capital, and Meron Capital

Controlling all the expenses of the organization - and saving

These days, when American companies seek to save and cut almost every possible expense, the Israeli fintech company Mesh Payments is on the right side of the industry. Mesh's platform allows finance managers to centralize and manage all company payments in one place and is designed to replace corporate credit cards, which have no real-time control or information. Mesh's solution optimizes the work of finance managers and employees and enables total management of the payment process - from payment approval to automatically updating payments.

CEO Oded Zehavi speaking to CTech in 2021

(Calcalist)

In the last year, Mesh registered significant growth with an impressive increase in its revenues to many tens of millions of dollars, and a forecast for growth in the future as well. According to an estimate, at least $1 billion in credit transactions passed through the company, which has accumulated more than 1,000 customers.

Mesh, founded by Oded Zehavi and Eran Katoni, completed a significant funding round of approximately $60 million in September. The founders made sure throughout the process to carefully recruit employees, and the increase in the company's value was also measured, without ambitions to reach unicorn status or disclosing the value.

10. Eleos Health

Sector: Healthtech

Established: 2014 • Founders: Alon Joffe, Dror Zaide, and Alon Rabinovich. Employees: 73 • Funding: $28 million from Eight Roads Ventures, aMoon, F-Prime Capital, lool ventures, and Arkin Holdings.

Eleos helps mental health professionals summarize and analyze their meetings with their patients

While many Israeli entrepreneurs establish startups because they are focused on solutions, the founders of Eleos established their company out of a deep familiarity with the problem. Eleos’ founders met while studying together at Reichman University and during their military service in the Air Force. All three had experience with mental health issues, including PTSD and anxiety, which they experienced personally or with family members. They observed that many mental health treatments are not measurable, which impairs their effectiveness.

To solve this problem, they built software for the analysis of mental therapy, which is based on voice and natural language processing (NLP). At the end of each session, therapists who use Eleos receive a summary, which they can also add insights to in the patient's file. Beyond the benefit for the patient, the technology not only reduces the time therapists devote to administrative work documenting sessions by 40%, but also provides an evaluation of the effectiveness of the treatment. Additionally, the software provides an analysis of the patient's condition during treatment, and even helps diagnose mental illnesses, which Elios refers to as an "MRI for mental health.”

Dr Shiri Sadeh Sharvit and Alon Rabinovich speaking in May 2021

(Photo: Sinai David)

Eleos was established in March 2020, when the world went into lockdown following the outbreak of the Coronavirus pandemic. This was during a time of increased awareness and demand for mental health services, providing demand for treatment conducted remotely via video. The company has only grown since, having quadrupled its revenue every year, which it is expected to do this year as well.

Its profit margin is around 80% today and it is expected to reach profitability soon. Some of the growth is due to funding provided by the American government to mental health organizations. Eleos concentrates on sales to large clinics, a strategy that is based on utilizing Medicare, which covers 70% of mental health expenses in the United States.

Like any market, Eleos' market is saturated with competitors, but most of them have turned to the fields of automating clinical summaries or collecting data regarding mental health in the general population, without analysis and measurement, which Eleos focuses on.

11. UVeye

Sector: Automotive

Established: 2016 • Founders: Amir and Ohad Hever. Employees: 180 • Funding: $95 million from Toyota, Hyundai, Volvo, GM Ventures, CarMax, Meitav, and Menorah Mivtachim Group.

UVeye tech inspects vehicle condition in seconds

During their military service, brothers Amir and Ohad Hever observed that vehicle underbelly scans used to identify possible threats could be improved upon and used for identifying maintenance issues in a regular vehicle.

After a few years of finding the right market match for its technology, UVeye has realized its vision as an MRI for the automotive market. Instead of conducting manual inspections, UVeye technology conducts a series of tests, examining anything from oil leaks to the condition of the tires, and within 20 seconds produces a full report on the condition of the vehicle.

UVeye's technology is already being installed in garages, used by car dealerships and vehicle inspection centers, and recently the company also began installing its system in automatic car wash facilities and parking lots.

The investors in the company include several of the largest car manufacturers in the world, including GM, Volvo, and Toyota, many of whom are also among the company's customers. Volvo signed an agreement about a year ago to install UVeye's systems in its dealerships on the East Coast of the United States, a deal that may include more than 200 stores of the Swedish car manufacturer. Similar agreements were signed with GM and CarMax, one of the largest used car dealerships in the United States, which sells about a million cars a year.

The company's main challenge is scaling, and to date, it has installed only a few hundred of its systems. However, sales are expected to increase in the coming years. Most of the production will be carried out in the United States and Canada, and some in Israel.

UVeye’s technology also works for electrical vehicles, even though they don’t have internal combustion engines, as they possess many parts that can malfunction, chief among them the central battery.

12. Apiiro

Sector: Application Security

Established: 2019 • Founders: Idan Plotnik and Yonatan Eldar. Employees: 120 • Funding: $135 million from General Catalyst Partners, Greylock Partners, and Kleiner Perkins.

Apiiro's half-a-billion dollar sale fell through, but it emerged victorious in the end

It has been a rollercoaster year for Israeli cyber company Apiiro. The company's technology helps software developers scan code and identify issues and risks while still in the development process, thereby significantly reducing the difficulties that will arise after the software is developed.

In September 2022, the company was on the verge of being sold for a handsome sum of about $500 million after having raised tens of millions of dollars by then, but the deal fell through. Apiiro was then approached by potential investors and partners who understood its value. As a result, about two months after the first deal fell through, the company announced it had raised $100 million. This funding round included major American VCs as well as leading cyber entrepreneurs, such as Mickey Boodaei, Rakesh Loonkar, Amichai Shulman, and Demisto founders Slavik Markovich, Guy Rinat, Dan Seral, and others.

Since then, the company's revenues have grown immensely, and in the first quarter of 2023 alone, Appiro recorded a growth of 531%. The company expects very significant revenues in the tens of millions of dollars by the end of 2023.

Apiiro has also experienced increased recruitment and is expected to hire an additional 80 employees, mostly in sales and marketing.

13. BeeHero

Sector: Agritech

Established: 2017 • Founders: Omer Davidi, Michal Roizman, Itai Kanot, and Yuval Regev. Employees: 60 • Funding: $65 million from General Mills, Convent Capital, Entrée Capital, Firstime Ventures, Rabobank, iAngels and Upwest.

Introducing big data to beehives

The past year marked a huge breakthrough for BeeHero. The company recorded massive growth not only in revenues and the number of beehives where its technology was installed but also in funding. At the end of 2022, when the flow of high-tech investments was extremely low, BeeHero completed a funding round of $42 million - three times more than its previous Series A in 2021. This round included the entry of the American food giant General Mills as an investor.

BeeHero's big data platform is based on smart sensors, which are installed in hives and monitor the condition of the hive, including temperature, humidity, and even the anxiety of the Queen Bee. This data makes it possible to optimize pollination processes and prevent cases of "colony collapse disorder" (CCD) - a phenomenon in which the worker bees disappear and the hive collapses - and provide farmers with certainty regarding crop levels.

BeeHero is not the only company of its nature on the market, but at this stage, it appears to be the most significant player by a considerable margin. In the last year, it doubled the number of hives utilizing its technology to 200,000, most of them in the United States. In order to maintain growth rates and increase geographic distribution, the company also entered the Australian market this year as well as the field of seed pollination, partnering with an Israeli seed company. BeeHero also collaborates with international bodies such as the USDA against the spread of the Asian wasp, and with the World Bee Project organization, which uses AI tools to support pollinators and biodiversity.

14. 8fig

Sector: E-commerce

Established: 2020 • Founders: Yaron Shapira, Assaf Dagan, and Roei Yellin • Employees: 85 • Funding: $57 million from Battery Ventures and LocalGlobe

Supporting online trade

The increase in interest rates, it turns out, is not only a problem but also an opportunity for some startups. One of them is Israel’si 8fig, which provides merchants in sites such as Amazon, Shopify, and eBay with technological tools to manage their online stores - along with financing for their ongoing operation.

The target audience is merchants with sales of $100k-$20 million per year, who need a large amount of working capital for the purpose of operating the store, promotion in the site, and purchase of goods. Until now, the company was able to get financing from a wide variety of credit providers, but the rise in interest rates drove many of them out of the market. On the other hand, the Israeli company, which is at the heart of the important trading sites and knows how to predict cash flows and revenues of each store, was not afraid to give credit and even increased it significantly in recent months. According to estimates, to date, 8fig has provided hundreds of millions of dollars in credit, on which it pays a lower interest rate, thanks to better credit lines than those available to most merchants.

The fact that the company is not satisfied with the financial side, but also provides customers with a comprehensive technological solution for managing their stores, is one of the main reasons for 8fig's success - especially when many merchants manage their stores alone, or with only one partner.

8fig was founded in 2020 by Yaron Shapira, the company's CEO, Assaf Dagan (CTO), and Roei Yellin (CRO). It has operations in Tel Aviv and Austin, Texas. This year, revenues jumped 900% to tens of millions of dollars, and in 2023 the company expects to make another jump. There was also a significant increase in the number of employees, from 38 last year to about 85 currently.

Throughout the crisis in the markets, the company operated significantly differently from other companies. 8fig was in no hurry to raise funds, nor to fire employees. The company's last funding round was in 2021 and amounted to $50 million, with participation from Battery Ventures and LocalGlobe, and others. The recruitment is sufficient to date for the needs of the company, which, as mentioned, registers very significant revenues. Although 8fig is not done raising funds, it managed to get through the difficult years relying only on its own resources.

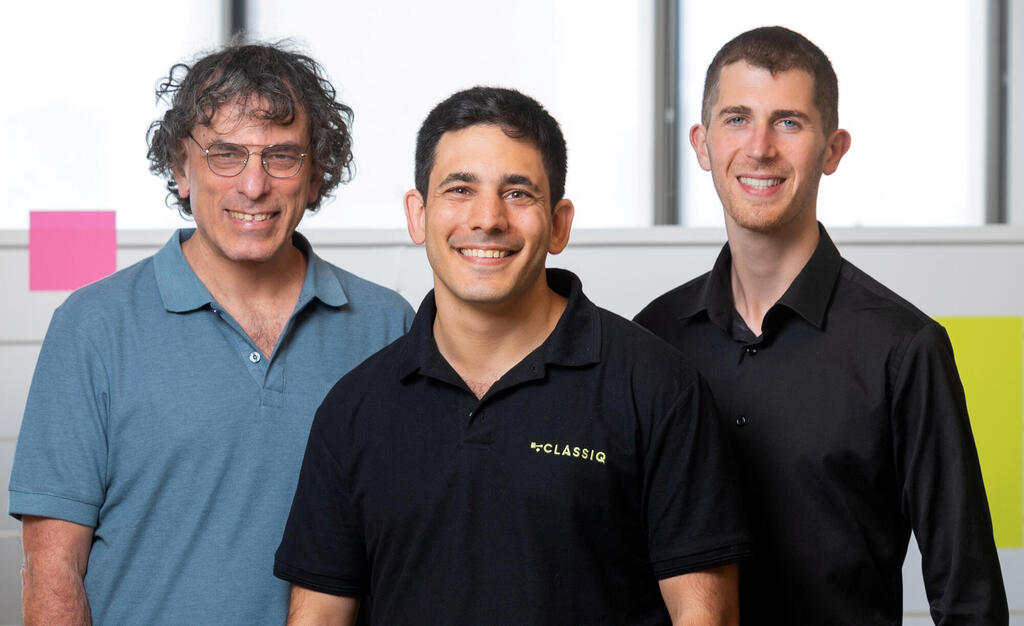

15. Classiq

Sector: Quantum Computing

Established: 2020 • Founders: Nir Minerbi, Amir Naveh and Dr. Yehuda Naveh. Employees: 65 • Funding: $63 million from Entrée Capital, HPE, Intesa, AWZ Ventures, Wing Capital, Sumitomo, HSBC, Team8, IN Venture, and Samsung Next.

Classiq was founded by friends Amir Naveh and Nir Minerbi with Naveh’s father Dr. Yehuda Naveh in 2020. The company does not have an HR department, as it only recruits by word of mouth.

Unlike many companies that are trying to build a quantum computer of their own, Classiq is focused on developing software that facilitates a simpler way for communication between man and these powerful machines. Classiq’s ambition is to be the Microsoft of the field, so it is no coincidence that it has a new collaboration with the computing giant in which academia is being offered access to state-of-the-art quantum algorithm design, analysis, and hardware execution via Azure Quantum.

Classiq obviously has many competitors, but it has aggressively signed joint development and implementation agreements of its solution with major computer companies around the world. It recently signed an agreement with the accounting firm KPMG, which is already introducing its clients to quantum computing.

The first markets expected to adopt quantum computing are financial institutions, which will use this technology to perform complex risk calculations, medical companies, which will use it for drug development, and chemical companies, which will use it for the development of new materials.

16. Masterschool

Sector: Edtech

Established: 2019 • Founders: Michael Shurp, Otni Levi, Roi Tzikorel, and Eran Glicksmani • Employees: 100 (in Israel and U.S) • Funding: $117 million raised from Target Global, Dynamic Loop Capital, Pitango Ventures, Group 11 and Sir Ronald Cohen

The school of tomorrow

Masterschool was established out of desperation: the founders of the company, some of whom are graduates of the IDF’s Sayeret Matkal (General Staff Reconnaissance Unit), and some graduates of Talpiot, gave up on attempts to bring about real change in the education systems. Roi Tzikorel was a former teacher and Michael Shurp tried to change the world of education both through the third sector and through consulting companies - and both of them came to the realization that as long as there are no measurable results, it is difficult to bring about change.

The timing for establishing the company was perfect, because in the run-up to the coronavirus, when the demand for high-tech workers soared and everyone switched to remote learning, Masterschool was in the right place. Business was running so fast that until a year ago the company had not raised money and was profitable. It was not until May 2022 that it embarked on an unusually large first round of fundraising, $100 million, which allowed it to grow rapidly.

Masterchool's platform is a kind of Airbnb of courses in high-tech fields: a collection of ‘bootcamps on steroids’, which are managed online and prepare the graduates for the entrance exams of high-tech companies. The teachers, or "schoolmasters", are people from the industry, usually team leaders or higher, who build the syllabus together with the company to ensure that it covers the most recent material so that the graduates can easily find a job. For Masterschool, it is very important that the graduates find a job because the tuition fee is paid only after the graduate starts working in the profession they studied, and only after their salary has passed a certain threshold, which is determined according to the field.

Although the shortage of high-tech workers has apparently been resolved, the demand for Masterschool services has remained strong following the large waves of layoffs. This happens because the laid-off workers aim to acquire new skills, which will allow them to work in fields less glamorous than startups, but which are eager to move into the technological world. Thus, for example, today's hot courses prepare employees for the transition to the financial and energy markets.

17. PayEm

Sector: Fintech

Established: 2020 • Founders: Itamar Jobani and Omer Rimoch • Employees: 85 (in Israel and U.S) • Funding: $47 million and another $200 million in credit from Pitango, Viola Credit, NFX, Gillot Capital, Mitsubishi

Managing budgets

The two founders of PayEm previously worked together as developers in another startup, in the medical field, but Itamar Jobani, who today serves as the CEO of the company, hated preparing expense reports and was looking for a solution that would simplify the process. After not finding one, he decided to develop something that slowly became a much larger system than he intended. The system developed by the company was designed to manage all corporate procurement budgets, manage and process invoices, and manage expense reimbursements for employees and corporate credit cards.

PayEm focuses on the medium-sized business market, and its product excels mainly in procurement management capabilities, being both transparent and dynamic. It is installed in a large portion of the organization's departments, and allows every manager to work on the system, while the finance people see the activity and can manage the budget and set limits in real-time.

PayEm has two key role models: The first and closest one is that of Tipalti, one of the biggest and most successful Israeli unicorns. While Tipalti was born and developed primarily for financial managers in organizations, PayEm operates from a more decentralized approach. Recently, PayEm even succeeded in recruiting the VP of Revenue (CRO) of Tipalti.

Before that, the company followed in the footsteps of its second role model: the American company Coupa, one of the biggest fintech success stories in recent times, which was recently sold to the Thoma Bravo investment fund for $6 billion. Coupa has developed a product very similar to PayEm's, but aimed at larger organizations that can afford an expensive and heavy product that requires an annual payment of hundreds of thousands of dollars.

The increase in interest rates and the economic slowdown have made the lives of fintech companies extremely complex, but organizations need tools for savings and budget control more then ever these days. A similar moment also resulted in Coupa's great breakthrough, which made its big business leap in 2009, after the financial crisis of 2008. PayEm has experienced a jump in business in the last two quarters, and therefore the company believes that 2023, which appears to be a difficult year in the business sector, will give it a boost. In the last year, the company tripled the number of customers and increased its revenues fivefold.

In order to finance credit lines within the cards, PayEm raised a debt of $200 million, in a move that is not typical for startup companies. However, the very fact that credit institutions are willing to give large sums to a fairly young company shows their level of confidence in its future.

18. Exodigo

Sector: Infrastructure

Established: 2022 • Founders: Jeremy Suaard, Yogev Shifman, and Ido Gonen • Employees: 90 • Funding: $41 million from Zeev Ventures, 10D Ventures, SquarePeg Capital, JIBE Ventures, and WXG Ltd.

Underground imaging through AI-based analysis

Founded in 2022, Exodigo’s technology possesses the unique ability to identify what is happening underground. The company developed a platform that performs underground imaging through AI-based analysis of information and data received from sensors attached to drones.

In this way, the system quickly produces a 3D digital map, including all underground piping and cables, as well as information about the soil layers, rocks, minerals, and even groundwater. This ability to carry out accurate mapping of subsoil as well as infrastructure, reduces the need for physical excavations and drilling, resulting in massive savings and preventing unwanted surprises during the execution stages.

While many Israeli startups eventually target the U.S. market, Exodigo believes in investing in local markets alongside operations in the U.S. and the U.K. Israel is estimated to have transportation and energy infrastructure projects worth billions of shekels, of which Exodigo is competing for a significant share. The company is expected to grow significantly in the coming years since obtaining even a small number of projects will bring the company immediate revenues of millions and tens of millions of dollars.

19. Walnut

Sector: Software

Established: 2020 • Founders: Yoav Vilner and Danni Friedland • Employees: 120 • Funding: $56 million raised from Felicis, NFX, ACapital, SV Angel, Liquid2, Eight Roads, and angels including Avishai Abrahami (Wix), Ariel Cohen (TripActions), Eynat Guez (Papaya), and Sarah Franklin (Salesforce)

Leading by example

One of the biggest failures in the world of sales is the need to create demonstrations of the various products for each customer, new or existing - especially when they are connected to the world of development. Israeli startup Walnut has developed a platform that allows sales teams to create demos of digital products tailored to the customer and their specific needs instead of a generic presentation, without the need to burden the development and design teams with additional work.

Walnut was founded in 2020 by CEO Yoav Vilner and Danni Friedland. The two report significant growth this year in the company's revenues to tens of millions of dollars, mainly thanks to companies trying to improve the bottom line and achieve significant sales at a time when it is more difficult than ever to raise capital. The company's manpower has also increased in the past year, although very cautiously and in accordance with the situation.

The company's latest significant funding round of $35 million gave it some breathing room for a relatively long period. Walnut won the trust of prominent entrepreneurs in Israel and the world, including Frederic Kerrest, founder and chairman of Okta, and Michael Shaulov, founder and CEO of Fireblocks. The investment fund of football legend Joe Montana previously invested in the company. Last year, Walnut had about 100 clients and today their number reaches several hundred, including Adobe, Dell, NetApp, People AI, Varonis, and more.

20. Quantum Source

Sector: Quantum Computing

Established: 2021 • Founders: Oded Melamed, Gil Semo, Barak Dayan, and Dan Charash • Employees: 30 • Funding: $27 million from Grove Ventures, Pitango First, DTC, Eclipse, 10D

Quantum leap

Quantum Source (QS) is one of the most ambitious projects taking place in Israel. The company from Rehovot is trying to develop the most accurate and efficient quantum computer. If it succeeds, it will leave behind giants like IBM and Google, who have already built a quantum computer, and Israel will become a global quantum computing power. If not, investors' money will go down the drain. There is no middle ground.

The holy grail of QS is building a photon-based quantum computer core with millions of qubits, which should make it immune to errors and noise. By comparison, IBM's quantum computer has hundreds of qubits, and its complex technology requires cooling the core almost to absolute zero (-273 degrees).

The basic technology was developed by Prof. Barak Dayan of the Weizmann Institute, who was joined by world-renowned chip experts: CEO Oded Melamed, who sold the company Altair which he founded to Sony for $212 million; Gil Semo, one of the founders of Anobit, which was Apple's first acquisition in Israel; and chairman Dan Charash, who sold Provigent to Broadcom for $300 million.

QS believes that the company's quantum computer will reach the market within 5-7 years. Google and IBM, as mentioned, already have such computers, but these are not always accurate due to the relative small number of qubits. There are other companies that are trying to develop a computer with technology similar to that of QS, including the American company PSI, which has already raised $700 million. However, PSI's computer will require an area the size of a basketball court, while QS's will suffice in an ordinary office.

Meanwhile, QS is content with more modest financial resources, raising $27 million, but its real resource is its 30 employees, 18 of whom have doctorates in physics and electronic engineering, and together they have published more than 170 scientific papers.

21. Talon Cyber Security

Sector: Cyber

Established: 2021 • Founders: Ofer Ben-Noon and CTO Ohad Bobrov • Employees: 140 (in Tel Aviv and New York) • Funding: $126 million from Evolution Equity Partners, Ballistic Ventures, Lightspeed Venture Partners, Sorenson Ventures, and Team8

Safe browsing

Talon Cyber Security is a groundbreaking company, founded by veterans of the local cyber industry: Ofer Ben-Noon, who sold the automotive cyber security company Argus to the German giant Continental, and Ohad Bobrov (CTO), founder of Lacoon Mobile Security, which was sold to Check Point. Talon was the first to develop a cyber browser similar to Chrome, but with multiple layers of security that allow any remote employee or vendor to connect to the organization's systems without the need for passwords or multiple security systems.

Ofer Ben-Noon speaking to James Spiro in 2022

(Sinai David)

Talon is currently registering significant growth in the number of companies that are already paying it - many dozens of companies that will grow to hundreds next year - alongside significant double-digit revenues at the end of 2024, as well as an expected increase in personnel. The field that the company developed is saturated with competition today, and now it must prove that it is not only groundbreaking but also able to lead the new market that is receiving a lot of attention from research companies such as Gartner and others.

22. Navina

Sector: Healthtech

Established: 2018 • Founders: Ronan Lavi and Shay Perera • Employees: 75 • Funding: $44 million from Grove Ventures, Vertex Ventures Israel, ALIVE Israel HealthTech Fund, and Schusterman Family Investments.

Navina providing doctors with health intelligence

Founded in 2018 by Ronen Lavi and Shay Perera, who were part of the team that set up the IDF’s Intelligence Corps AI lab, Navina helps doctors treat patients more effectively.

Most healthcare companies develop solutions for specialists, mainly in hospitals, but neglect family doctors, who are among the most busiest specialists in the healthcare system. Family doctors on average have only about seven minutes to devote to each patient, with no time to go over their medical history and background. This is exactly where Navina's system comes in. It collects information from the healthcare system and, based on that, provides the doctor with a summary, insights, and recommendations for treatment. Navina says that 90% of doctors use the summaries provided by the system, and in 80% of cases they use their recommendations.

Today, there are already thousands of doctors using Navina’s solution. The company's main growth is driven by increased interest from large clinics in the U.S. and from companies such as Amazon which recently acquired One Medical, and CVS Health, which recently acquired Oak Street Health. Another important growth engine for Navina has been the field of preventive medicine, which has become essential for Western health systems, encouraged by insurance companies.

23. Rivery

Sector: Cloud Data Management

Established: 2018 • Founders: Itamar Ben Hemo, Aviv Noy and Alon Reznik • Employees: 109 • Funding: $48 million from Tiger Global Ventures, State Of Mind Ventures, and Entrée Capital.

Automating and managing big data on cloud platforms

Rivery, which developed a platform for automation and management of big data on cloud platforms, raised $30 million in a Series B round in 2022 led by Tiger Global, State Of Minds Ventures, and Entrée Capital. Rivery’s solution significantly saves costs for its customers, making its product essential for companies that manage large data loads. As a result, it has impressively retained nearly every customer gained since its founding.

Although it already reports significant revenues of tens of millions of dollars, the company employs about 100 people and will grow to a maximum of 130 people by the end of the year. Due to its modest hiring rate, the company has been able to grow without requiring major cuts. Rivery’s customers include some of the biggest companies including EMAAR, Bayer, Webedia, BuzzFeed, Papaya Global, the American Cancer Society, NEXT, and WalkMe.

The future of the company looks very bright despite the current economic climate. With revenues of many millions of dollars today, Rivery is expected to only increase revenues in the coming year. It is also expanding geographically, mainly to Europe, where the company is about to sign a series of major contracts.

24. FundGuard

Sector: Fintech

Established: 2018 • Founders: Lior Yogev, Yaniv Zecharya, and Uri Katz • Employees: 90 • Funding: $55 million from Citibank, State Street, Blumberg Capital, LionBird Ventures, and Team8 Capital.

Changing the world of giant financial institutions

While many Israeli fintech companies are focused on the world of payments, few companies address the infrastructure problems of this world, especially in banking. FundGuard has taken this path, zeroing in on a market that was frozen and in need of fundamental change. FundGuard has developed a cloud platform for managing investment portfolios for many American financial institutions, where there has been a lack of innovation.

The company was founded in 2018 under the leadership of three veterans of the fintech industry: CEO Lior Yogev, CTO Yaniv Zecharya, and VP R&D Uri Katz.

Lior Yogev, CEO & Co-founder, speaking to CTech in 2022

In 2022, Fundguard raised $40 million in a Series B of funding led by Citibank and State Street. The two large American institutional bodies who lead the investment are also two of FundGuard's main customers.

Today, FundGuard generates revenues of tens of millions of dollars that are expected to grow in the coming years to hundreds of millions. FundGuard's AI-based solution enables automated administration and investment management for various products, including mutual funds, ETFs and hedge funds, and in large volumes.

Contrary to many other fintech companies that have struggled amidst the global economic downturn, FundGuard has actually grown with the addition of 40 employees in just one year.

25. Deepdub

Sector: Artificial Intelligence

Established: 2020 • Founders: Ofir and Nir Krakowski. Employees: 65 • Funding: $26 million from Insight Partners, Booster Ventures, Stardom Ventures, angel investors including Kevin Reilly, former CCO of HBO Max.

Dubbing films and TV using AI

Deepdub addresses a market that barely exists in Israel: film and TV dubbing. Brothers Ofir and Nir Krakowski channeled their AI and machine learning knowledge into the world of content and built a platform that automates film dubbing in different languages. They currently offer dubbing for eight languages and are in the process of adding more.

19 View gallery

Deepdub's CEO Ofir Karakovski (right) and the VP of Technologies Nir Karakovski

(Photo: Deepdub)

Deepdub's technology is a kind of ChatGPT for voice. The company has a collection of thousands of voices, from which it produces countless tones, which can dub dozens of characters in a movie or series. Using the platform reduces the expenses of dubbing production by 30%-70% (depending on the genre), and shortens dubbing production time by 80%.

The company already has contracts with streaming companies, major broadcast networks, and TV studios, although the names of customers remain undisclosed since they don't want audiences to know that voice actors are, in fact, voiced by AI. Recently, Deepdub also started to do dubbing for YouTube, as well as the business market, with dubbed content for companies that want to make their products accessible to an audience all over the world.

26. Sentra

Sector: Cyber

Funding: $53 million from Standard, MRV, Moore Strategic, Xerox, Int3, Zeev Ventures, Bessemer Venture Partners

27. Salto

Sector: Software

Funding: $70 million from Bessemer Venture Partners, Accel, Salesforce, Lightspeed Venture Partners

28. Justt

Sector: AI

Funding: $70 million from Oak Investment Partners, F2 Capital, Zeev Ventures

Justt Co-Founder and Chief Risk Officer Roenen Ben-Ami speaking to CTech in 2022

(Sinai David)

29. Nexite

Sector: E-commerce

Funding: $100 million from Pitango Growth, Saban Ventures, Battery Ventures, Intel Capital, Pitango First, Vertex Ventures

30. GrowthSpace

Sector: HR Tech

Funding: $44 million from Zeev Ventures, M12 Vertex Ventures

31. Trullion

Sector: Software

Funding: $33 million from Aleph VC, Stepstone Group, Third Point, Greycroft Partners

32. Dazz

Sector: Cyber

Funding: $60 million from Insight Partners, Greylock Partners, Cyberstarts, Index Ventures

Dazz Co-founder and CEO Merav Bahat speaking to CTech in 2022

(Sinai David)

33. BeamUP

Sector: AI

Funding: Ibex Investors, StageOne Ventures

34. Frontegg

Sector: Software

Funding: $70 million from Insight Partners, Pitango First, Global Founders, Stripes

CEO & Co-founder Sagi Rodin speaking in 2022

35. Chain Reaction

Sector: Semiconductors

Funding: $115 million from Morgan Creek Digital, Hanaco Ventures, JVP, KCK Capital, Exor, Atreides Management, Blue Run Ventures

36. proteanTecs

Sector: Semiconductors

Funding: $200 million from KDT, SE, MediaTek, Advantest, Champion Motors

37. Tabnine

Sector: AI

Funding: $27 million from OurCrowd, Headline, Khosla Ventures, TYP Capital, Arrow Ventures

38. NeuroBlade

Sector: Semiconductors

Funding: $110 million from Intel Capital, Grove Ventures, StageOne Ventures

39. Coralogix

Sector: Data

Funding: $238 million from StageOne Ventures, Red Dot Capital, Greenfield Partners, OG Tech, Revaia Ventures

40. 4M Analytics

Sector: Infrastructure

Funding: $45 million from Viola and F2 Venture Capital

41. Legit

Sector: Cyber

Funding: $30 million from Bessemer Venture Partners, TCV, Cyberstarts

42. Coro

Sector: Cyber

Funding: $125 million from Energy Impact, Balderton Capital, JVP

43. Hexa

Sector: Proptech

Funding: $27 million from Point72 , Samurai Incubate, Sarona Parners, HTC

44. LinearB

Sector: Software

Funding: $71 million from Tribe Capital, Battery Ventures, 83North, Salesforce

Ori Keren, CEO & Co-founder, speaking to CTech in 2022

45. Piggy

Sector: Content creation

Funding: $7.7 million from Insight Partners, Remagine Ventures

46. Qwak

Sector: AI

Funding: $27 million from Bessemer Venture Partners, StageOne Ventures, Amiti Ventures

Qwak Co-founder and CEO Alon Lev speaking to CTech in 2022

47. Triple Whale

Sector: E-commerce

Funding: $52 million from NFX, Elephant, Shopify

48. Agora

Sector: Proptech

Funding: $29 million from Insight Partners, Aleph VC

49. Descope

Sector: Cyber

Funding: $53 million from Lightspeed Venture Partners, GGV Capital, Dell, J Ventures, Triventures, Cerca Partners

50. Eleven Therapeutics

Sector: Life sciences

Funding: $22 million from the Bill and Melinda Gates Foundation, NFX Bio, Entrée Capital, Harel

Yaniv Erlich, CEO of Eleven Therapeutics, speaking at Mind The Tech London in 2023

(Calcalist)

This is the 15th year that Calcalist has ranked the top 50 private technology companies in Israel. For this purpose, we turned to a number of prominent investors, consultants, and entrepreneurs in the Israeli market. We asked the participants to pinpoint the startup companies that are growing, making money, that have the greatest momentum, and the highest chance of making a substantial business step in the coming year, while emphasizing companies that are not in their portfolios. After weighing the data and the variety of opinions collected from the best experts, the reporters and high-tech editors of Calcalist, who are well acquainted with the behind-the-scenes of these fields, compiled the list of the 50 most promising private technology companies in Israel.

This year’s ranking contributors are:

2B.VC

10D VC

Accel

Aleph

Amiti

aMoon

Bessemer Venture Partners

Blumberg Capital

BRM

Citi Ventures

Dell Technologies Capital

Eight Roads

Elron Ventures

Firstime Venture Capital

Fort Ross Ventures

General Atlantic

GlenRock

Greenfield Partners

Grove Ventures

Hetz Ventures

Ibex Investors

Index Ventures

Insight Partners

Intel Capital

JVP

LeumiTech

Meron Capital

OurCrowd

Peregrine

Pitango

PSG

Qumra Capital

SOMV

Square Peg Capital

StageOne Ventures

SYN Ventures

TAU Ventures

Team8

Third Point Ventures

TLV Partners

UpWest

Vertex Ventures

Viola

YL Ventures