Japanese NanoCarrier Partners with Cancer Treatment Company VBL Therapeutics

The companies signed an exclusive licensing agreement in Japan for VBL's anti-cancer drug

- Cancer Treatment Company Negotiating $20-25 Million Capital Injection

- Kite Pharma’s Cancer Drug Gets Regulatory Nod

- Generic Dependence Threatens Teva’s Ability to Haul Debt Load

NanoCarrier and VBL signed an exclusive licensing agreement for the development, commercialization, and supply of VBL's anti-cancer drug VB-111 in Japan. VBL will retain the rights in the rest of the world.

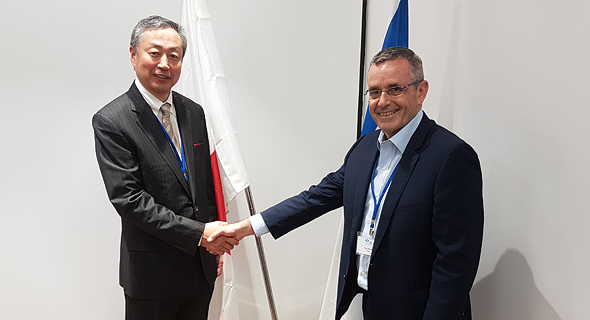

Left to right: NanoCarrier CEO Ichiro Nakatomi and VBL Therapeutics CEO Dror Harats

Left to right: NanoCarrier CEO Ichiro Nakatomi and VBL Therapeutics CEO Dror Harats

Established in 2000 and headquartered in Or Yehuda, 6 miles (10 km) southeast of Tel Aviv, VBL develops anti-cancer and anti-inflammatory drugs. The company started trading on Nasdaq in 2014, after revising its prospectus. At the time the company intended to raise $93 million at a company value of $260 million but raised $40 million at a value of $120 million. Following failed clinical trials for a psoriasis and colitis drug candidate, the company raised $24 million in 2016 to continue development.

VB-111, developed for the treatment of solid tumors, is the company's lead oncology drug candidate. The drug's technology employs a dual mechanism that blocks the tumor's blood vessels while inducing an anti-tumor immune response. VB-111 is currently in phase III clinical trial, after receiving orphan drug designation in both the US and Europe.

Under the agreement, VBL will receive an up-front payment of $15 million and is entitled to receive more than $100 million in development and commercial milestone payments, according to the company’s announcement. The two companies also intend to explore future collaborations in oncology.

“Japan is potentially a large market opportunity for VBL,” said Dror Harats, CEO of VBLT.

“We are continually looking for new opportunities in the treatment of cancer, and VB- 111 is an innovative gene therapy which, if approved, could have significant market potential in Japan,” said Ichiro Nakatomi, president and CEO of NanoCarrier.

Among VBL's investors are the Israel Innovation Authority, Israel-based venture capital firm Pitango Venture Capital, and Aurum Ventures MKI, the life sciences oriented investment arm of South-African born businessman Morris Kahn, founder of Nasdaq-traded billing company Amdocs Ltd.