Fintech Startup Tipigo Raises One Million Dollars in Seed Funding

The Israel-based company’s robo-adviser lets customers automate their investment portfolio

11:0916.11.17

Financial technology startup Tipigo Ventures Ltd. has raised one million dollars in seed funding at a company valuation of $10 million, the company announced Tuesday.

Alon Arabov “It’s an automated advisor,” said Tipigo’s chief executive officer Elran Bor in an interview. “The system’s engine recognizes when there is a match between a specific investment opportunity and a customer’s investment profile. The algorithm analyzes customer characteristics such as available budget and risk preference.”

“6,000 customers at two Israeli investment companies will be provided with customized investment opportunities in the U.S. market on an ongoing basis,” Mr. Carmel said. “Our system automatically connects to the stock trading platform of Interactive Brokers LLC.”

Alon Arabov “It’s an automated advisor,” said Tipigo’s chief executive officer Elran Bor in an interview. “The system’s engine recognizes when there is a match between a specific investment opportunity and a customer’s investment profile. The algorithm analyzes customer characteristics such as available budget and risk preference.”

“6,000 customers at two Israeli investment companies will be provided with customized investment opportunities in the U.S. market on an ongoing basis,” Mr. Carmel said. “Our system automatically connects to the stock trading platform of Interactive Brokers LLC.”

For daily updates, subscribe to our newsletter by clicking here.

Israel-based Tipigo develops software that allows customers to automate their investment portfolios using algorithms, known as robo-advisers, that take into account market data and research and user preferences.

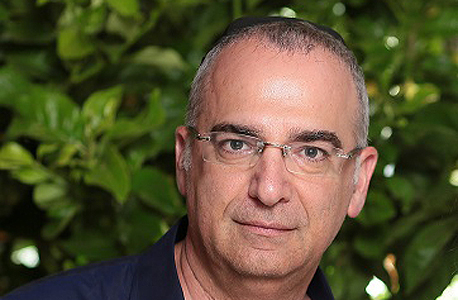

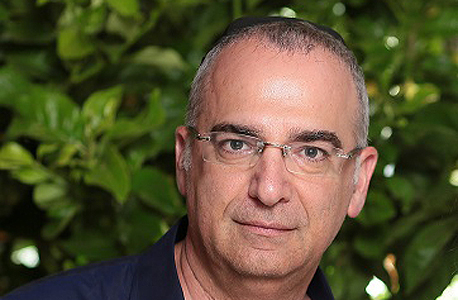

Alon Arabov

Alon Arabov Tipigo was founded in 2014 by Nechemia Bor and Yehuda Carmel. Mr. Bor has been developing the algorithm with private funding. He previously founded and ran Multiconn International Ltd., a software company that provided services to banks and investment firms, eventually acquired by Formula Systems Ltd.

Tipigo’s software has been sold to two investment firms and service will start by the of the month, Mr. Carmel said.

More by CTech:

- Asset Management Is Stuck in the Past, Says Pagaya Group CEO

- Fintech Will Save the Bank, Says Head of Digital Banking in Israel’s Bank Leumi

- Finance Companies Should Look to Amazon for Inspiration, Says Fintech Executive

The seed funding came from Israeli diamond trader Alon Arabov.