Satellite Operator Spacecom Plans to Raise $110 Million in Collateral Bonds and Bond Options

Of the sum, $50 million will be used to cover some of the costs of its new satellite, AMOS-8, intended to replace a satellite lost at a pre-launch explosion in 2016

13:1910.04.18

Israel-based satellite operator Space Communication Ltd., also known as Spacecom, is planning to raise $110 million, the company announced in a Tel Aviv Stock Exchange filling on Sunday. In order to finance its new satellite AMOS-8, Spacecom will issue a series of new collateral bonds worth $50 million, guaranteed by AMOS-8 and its assets. The company also plans to issue $60 million worth of bond options.

For daily updates, subscribe to our newsletter by clicking here.

Spacecom is a subsidiary of holding company Eurocom Group, the controlling stakeholder of Israel’s largest telecommunication provider Bezeq. Eurocom, its subsidiaries and its co-owner Shaul Elovitch, are facing a total debt of around $420 million, and the future of the company is currently at the hands of its institutional creditors, which include Israel’s three largest banks. Choosing to combine collateral bonds with bond options keeps the collateral bonds held by Eurocom’s creditors at 35%, allowing them to keep a controlling stake in Spacecom.

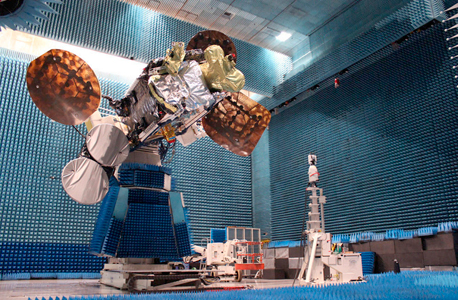

AMOS 6. Photo: PR

AMOS 6. Photo: PR Spacecom will issue three types of bond options—three-month bonds at $3.7 (NIS 13) per share; six-month bonds at $4.2 (NIS 15); and 12-month bonds at $4.8 (NIS 17). By market close on Sunday, Spacecom’s stock was traded at $4.6 (NIS 16), representing a 0.82% rise.

In March, IDB Development Corporation Ltd., through its subsidiary, Discount Investment Corporation, made a $45.75 million bid for the acquisition of a controlling stake in Spacecom. On Monday, in a filing to the Tel Aviv Stock Exchange, Discount announced that its offer has expired due to Eurocom and its creditors’ failure to approve the deal. Discount also said it is continuing to examine a possible investment in the company.

The negotiations were led by IDB’s owner and chairman, Argentinian businessman Eduardo Elsztain. According to two people familiar with the subject who spoke to Calcalist on conditions of anonymity, collateral bond-holders refused to grant Mr. Elsztain the two-year waiver on loan covenants, which he requested.

In 2016, Spacecom’s AMOS-6 satellite was destroyed in a pre-launch explosion, causing the company to lose a $95 million leasing deal with Facebook, as well as a planned $285 million acquisition by Shanghai-listed telecommunication technologies supplier Beijing Xinwei Technology Group Ltd. Spacecom was also forced to lease a replacement satellite for $22 million a year.

Related stories:

- IDB’s Bid for Israeli Satellite Operator Spacecom Nearing Closure

- Spacecom’s New Satellite Contract Ignites a Ministerial Tiff

- Caving to Shareholder Demand, Bezeq Expedites Annual Meeting to April

After losing the tender for AMOS-8, state-owned Israel Aerospace Industries Ltd., which has built five of Spacecom’s seven satellites to date, announced on Monday that it is considering manufacturing, launching and operating a satellite of its own, using government funds.