Opinion

Metrics to Focus on During the Growth Stage of your SaaS Journey

As your company grows, you may find that while metrics are necessary to track progress, they are insufficient to deeply understand how to maximize your company’s growth trajectory

The software-as-a-service (SaaS) industry has evolved so much in the last ten years. How? We’ve standardized many ways of measuring and benchmarking different SaaS companies. If you’re a SaaS enthusiast or a metrics geek, I can assume you are familiar with some basic SaaS terms like annual recurring revenue (ARR), customer acquisition cost (CAC), lifetime value (LTV), and annual contract value ACV).

For daily updates, subscribe to our newsletter by clicking here.

As your company grows though, you may find that these metrics are not enough to effectively scale your business. They are definitely necessary to track the progress of your company, and they’re an absolute must if you’re planning to raise capital. That said, they are insufficient to truly understand how to maximize your company’s growth trajectory or to determine which figures may come back to haunt you as your revenue increases.

Eran Zinman, monday.com co-founder and CTO. Photo: PR

Eran Zinman, monday.com co-founder and CTO. Photo: PR

In this article, I’ll share some of the challenges and additional metrics that we track now at monday.com to help us scale effectively. I hope you’ll find them relevant to your company, too.

Intent and Predictions

Acquiring new customers requires a lot of cash. Often, customer acquisition grows into your largest expense as your company scales. The more money you efficiently invest in performance marketing, the more customers you acquire, the faster you scale your company.

At monday.com, we’re metrics-obsessed and this mentality has been essential to our growth. We built our own business intelligence (BI) tool, fondly called BigBrain, which tracks every dollar that goes into the company, every dollar that goes out, and just about every key performance indicator (KPI) in between.

As we have scaled, we expanded our marketing budget from $5,000 per day to more than 20x that, and growing! In addition, we’ve always offered a 14-day trial to new users. We’ve encountered situations where we spend large amounts of money on marketing, only to find out 14 or 21 days later that the marketing audience we reached didn’t convert as well as expected. As a result, a ton of cash goes down the drain.

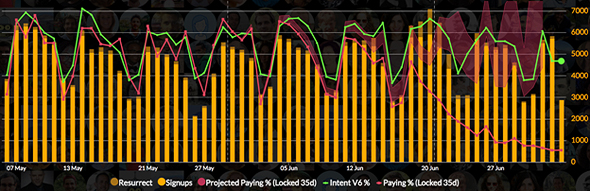

In order to improve that, we built a prediction model, which you can see below, that assesses our daily signups and predicts how many will convert to paying users. Models like this are super important as our performance marketing budgets continue to scale rapidly. Because of the free trial we offer, we know we are not going to get our money back for at least two weeks. The model takes into account our potential user’s activity within the system and outside. Outside of system, we evaluate things like the source of the traffic or the operating system used. Within the system, we look at which features are used within the first 24 hours, how many users are invited, and so on. We rely on our hyper-accurate prediction model to keep us on track. The model helps us decide where to spend every marketing dollar. If we see a campaign is doing well, we will increase the budget but if we see it is underperforming, we can adjust the budget almost in real time.

The monday.com prediction model: the left axis is conversion to paid and the right is the number of signups. Image: monday.com

The monday.com prediction model: the left axis is conversion to paid and the right is the number of signups. Image: monday.com

Sometimes, it happens that we receive a ton of sign-ups but they do not convert well. An example of why this could happen is that our models don’t consider specific behavioral trends of different countries. We’re always refining our models to reflect what we learn along the way and intent remains a critical metric for us. I highly recommend figuring out something similar that makes sense for your business to always keep you alert.

Cash Payback and Cash Cycle

Measuring your cash payback is essential. Cash payback is really the measurement of how much time it takes to return (reinvest) your marketing budget, and in our case, keep our sanity. Why is this so important? Because no company has endless buckets of money. Tracking your cash payback helps you figure out the most efficient way to utilize your funding, how to maintain strong cash flow, and how to best reinvest the money to increase your growth. Other related metrics like ARR, CAC, LTV or churn don’t take cash flow into account and that’s an important differentiator.

But measuring cash payback is not enough, let’s talk Cash Cycle…

It’s great to know when your company reaches 100% positive return on investment (ROI) on your marketing budget, but are two companies with the same payback period equal? Well, no.

Consider two companies that have a 7-month payback period. Company A has a rate of return of 80% after the first month and the other 20% after 6 months. Company B’s rate of return is 30% return on the first month and the remaining 70% after 6 months. In this situation, you learn that the rate of return is even more critical than the payback period. The faster you get your money back, the faster you can reinvest it into marketing again, and accelerate your growth rate. We measure Cash Cycle as the ratio between a dollar invested in January and how many times we can reinvest it repeatedly throughout the year, considering our rate of return.

Sales Net Contribution

So, we are new to the world of sales. We operated (almost) entirely as a no-touch funnel until we reached 10,000 paying companies. Once we passed that landmark, we decided to add an “account management” or “inside sales” team to help grow accounts that signed up through the funnel. Our overall goal with the team is to optimize the ARR overlap of the no-touch funnel and the sales funnel. We optimize our sales-qualified leads (SQL) to be the ones with the biggest net gain potential. All leads go through BigBrain, which assesses them according to a bunch of algorithms evaluating account size, intent, activity, signup date, and many other differentiating factors. We determined that focusing on these qualified leads has the greatest impact on the overall company ARR. We built the team to enhance our growth so it’s really important to effectively measure their efforts to make sure they’re succeeding.

- When Good Companies Choose Bad Names

- Peak-End Rule: Why You Make Terrible Life Choices

- Entrepreneurship Will Continue to Drive Israel’s Economy Forward

To understand an essential part of how we measure sales net contribution, allow me to introduce you to Mushon. We added a fake alias to our sales team named Mushon and we assign him quality leads as we do to the rest of our reps. Unlike the rest of our reps though, Mushon does nothing to improve the monetization of the leads he’s assigned. We use his presence to set benchmarks to assess the impact of the actual humans on the team. To achieve this, we measure their net revenue contribution instead of total added revenue. We deduct the revenue generated by Mushon to determine the team’s actual contribution, compared to what would happen naturally from the no-touch funnel. To make a long story short, the actual humans we hired rock and make a huge impact. But, Mushon is critical to knowing just how effective they are.

Eran Zinman is the co-founder and CTO of monday.com, a team management tool designed to be the first thing users check upon arriving in the office and the last before they leave.