PoV

Raising Capital With Equity: How Expensive Is Expensive?

Oron Maymon is the chief science officer at Tel Aviv-based Liquidity Capital, of Tel Aviv-listed investment house Meitav Dash Investments

15:3015.07.19

Startups require large amounts of cash to finance growth. Most startups obtain the funds through later stages of equity rounds. While it is indisputable that equity is the most expensive financing option, the question is how expensive is it really?

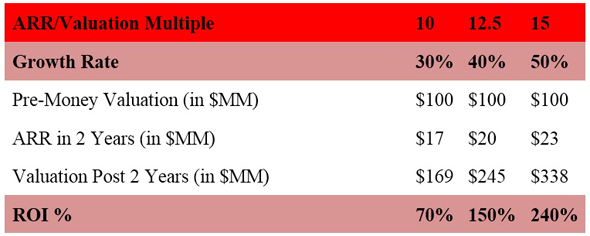

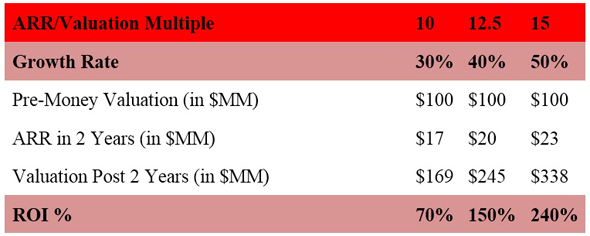

The table The sharp rise in annual recurring revenue (ARR) multiplier in the higher growth rates generates a significant step-up in valuation and high return on investment for investors. This, of course, suggests that shareholding investors and founders in the pre-money valuation stage would benefit from postponing the round, as the funding in this stage is significantly more costly.

You probably ask what the deal IRR has to do with the cost of financing incurred by the founders and original shareholders. Well, it’s actually quite simple. The IRR is equivalent to the cost of capital. In other words, financing your startup by selling equity so that it becomes a unicorn in its growth stage is like taking a loan with an annual interest rate of 50–150%.

The table The sharp rise in annual recurring revenue (ARR) multiplier in the higher growth rates generates a significant step-up in valuation and high return on investment for investors. This, of course, suggests that shareholding investors and founders in the pre-money valuation stage would benefit from postponing the round, as the funding in this stage is significantly more costly.

You probably ask what the deal IRR has to do with the cost of financing incurred by the founders and original shareholders. Well, it’s actually quite simple. The IRR is equivalent to the cost of capital. In other words, financing your startup by selling equity so that it becomes a unicorn in its growth stage is like taking a loan with an annual interest rate of 50–150%.

For daily updates, subscribe to our newsletter by clicking here.

Our friend and investor Ran Oz built this simple table to demonstrate typical valuation growth for a startup, focusing on recurring revenues and commonly used revenue multipliers.

The table

The table Despite these solid facts, a discussion of these findings with startup CEOs is invariably accompanied by healthy skepticism and down-to-earth pragmatism. After all, the models are only a gross simplification of reality.

So, we decided to put the premise to the test with real data: is financing startups with equity really that expensive?

We looked at the top startup IPOs and mergers and acquisitions from 2017 to 2019 and compared the valuation of the last round before an exit was made with the valuation during the exit. Using the time that elapsed between the two points and the funds invested, we computed the estimated internal rate of return (IRR) for each deal.

The results were very much in alignment with the findings of the rough valuation model. The median IRR in the last round before the exit was 50%, while the upper 25% of the deals demonstrate IRR that was larger than 150%. As could be expected, the distribution was skewed to the right, representing deals with extremely high returns.

Related stories:

- Autoloan Company Lendbuzz Raises $150 Million in Debt Financing, Equity

- Traditional VC Firm Viola Meets Equity Crowdfunding Firm OurCrowd

- As Market Matures, Israeli Tech Valuations Continue to Climb

Would you agree it’s time startups seriously rethink how they should finance their growth stage?

Oron Maymon is the chief science officer at Tel Aviv-based Liquidity Capital, of Tel Aviv-listed investment house Meitav Dash Investments Ltd.