The Israeli Economy's Greatest Growth Generator Is Also its Biggest Enemy

The biggest boost to Israel’s economy in 2019 came from new car purchases, but these are also the main inhibitors of economic growth, due to the loss of work hours caused by traffic jams

At first glance, it seems like great news for the Israeli economy. A closer inspection, however, reveals that this quarterly success is based on one parameter only: new car purchases. Israel's economic growth is dependent on and fluctuates according to local car buying. Its effects extend beyond private expenditure, as car purchases made by leasing companies also count towards quarterly investments.

Traffic congestion, Tel Aviv. Photo: Shutterstock

Traffic congestion, Tel Aviv. Photo: Shutterstock

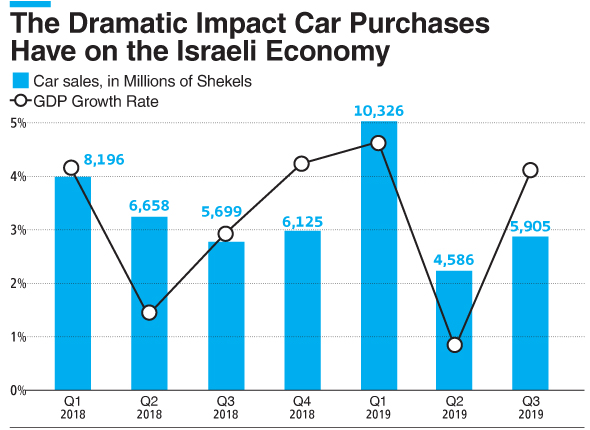

Private car acquisitions jumped from a total of NIS 6.1 billion (approximately $1.76 billion at the current exchange rates) in the fourth quarter of 2018 to NIS 10.3 billion (approximately $2.96 billion at the current exchange rates) in the first quarter of 2019, a 68% jump, or an increase of 694% in annual terms, making for a 4.5% GDP growth rate. The reason: changes in Israeli car taxation rules that demanded stricter adherence to non-pollution standards and thus reduced tax benefits for car importers. Originally planned for April 2019, the upcoming changes boosted car prices, as many Israelis move up planned purchases to the first quarter. Accordingly, in the second quarter of 2019, car sales dropped to NIS 4.6 billion (approximately $1.33 billion), and the GDP growth rate dropped to 0.8%. In the third quarter of 2019, sales amounted to NIS 5.9 billion (approximately $1.7 billion), private car acquisitions jumped 169.7%, and the growth rate rallied as well, to 4.1%.

There is a clear correlation between car sales and the Israeli economy, and there's the rub. The greatest growth generator of the Israeli economy is also the main obstacle of economic growth—the endless traffic jams that decimate millions of work hours for the Israeli workforce. All research conducted by the Bank of Israel, the Israeli Ministry of Finance, and the OECD points to one conclusion: Israel's traffic density is one of the worst inhibitors to its economic productivity and growth.

Furthermore, it turns out most new cars are being purchased by those who cannot afford them. The banks and credit card companies, which are looking to generate returns for investors, leverage the minuscule interest rates to push credit to consumers. According to data from the Bank of Israel, between mid-2016 and the end of 2017 credit issued for car purchases jumped almost 25%, from NIS 11.1 billion (approximately $3.2 billion at the current exchange rates) to almost NIS 14 billion (approximately $4.04 billion at the current exchange rate). In 2018, banking regulator Hedva Bar took action to contain the phenomenon, leading car credit issued by banks to drop to NIS 12 billion (approximately $3.46 billion at the current exchange rate) in the second quarter of 2019. But there are non-bank players not under Bar's purview that continued pushing car credit, such as Israeli loan agency Mimun Yashir, which handed out NIS 3.5 billion (approximately $1.01 billion at the current exchange rates) worth of car purchase loans in 2018.

The Dramatic Impact Car Purchases Have on the Israeli Economy

The Dramatic Impact Car Purchases Have on the Israeli Economy

Neutralizing the influence of car purchases, the picture that remains is not all that favorable. Private consumption expenditure accounts for around 60% of Israel’s GDP, but it increased by only 2.8% in the third quarter, equaling a 0.8% increase in private consumption per capita. How is it that car acquisitions jumped significantly but private consumption did not? Because people cut expenses elsewhere. Acquisition of household appliances such as refrigerators and washing machines dropped 15.1%. Furnishing and jewelry expenses dropped 3.6%.

Expenses on household needs such as rent, water, gas, electricity, food, and services increased by only 0.8%. Expenses on semi durable goods such as clothing and footwear dropped by 10%. Without car buying expenses, private consumption would have dropped this quarter, not increased, and that is a very worrying sign.

The plateauing of private consumption is just the first in a list of bad news for the Israeli economy. Investment in fixed assets dropped 6% in the third quarter, after dropping 5% in the second quarter. This is one of the most important parameters when considering long-term economic growth and it seems Israel's business sector is not building or renovating, nor is it buying equipment and machinery. The report offers another bit of troubling data: when excluding diamonds and early stage startup companies, both of which draw in much money but make a low net contribution overall, Israeli export of goods and services dropped 4% in the third quarter of 2019. That equals a 7.4% drop in industrial export without diamonds.

- Clashes With Gaza Are Still Ongoing, But History Shows Their Effects on Israel’s Economy Will Likely Be Minimal

- A Third of Israeli Employees Make Less Than the Minimum Wage, Report Says

- The Shekel Continues to Appreciate

Aside from car sales—which are also heading towards a slowdown—there is another parameter that contributes to economic growth but could take a heavy hit soon: public consumption, which grew by 4%. Over the past two years, the government budget and expenditure grew fast. But the end is both known and near here as well. An enormous government deficit of 3.8%, which has already surpassed the legal threshold by NIS 14 billion ($4.04 billion), and will necessitate budget cuts and tax raises. That specific growth engine will therefore also reduce its contributions once a new government is formed.

The Bank of Israel, the finance ministry, the International Monetary Fund, and the OECD are therefore all in accord: Israel's annual growth for 2019 will slow down to only 3%. Current estimates for 2020 will be updated, downwards. And as long as Israel remains in a political statement and with an interim government, those problems will not be addressed.