With 100 Million Shekels Already Funded, Meet ExitValley—the Revolutionary Way to Invest in the Start-Up Nation

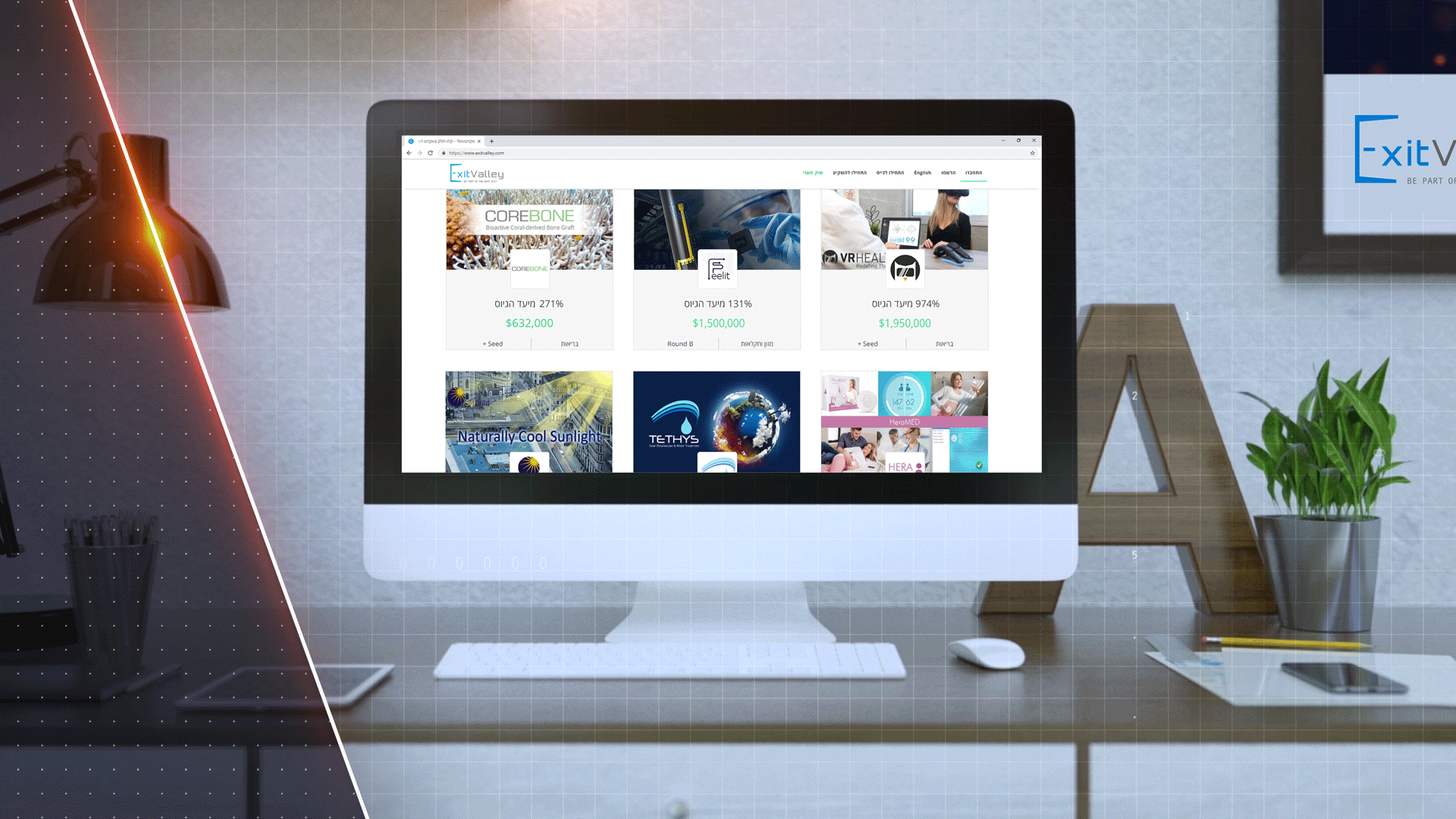

ExitValley is the most successful investment platform in Israel, giving everyone the opportunity to invest in Israeli startups and ventures. After recently crossing the impressive NIS 100 million mark, now is the time to join in the platforms' success.

ExitValley

ExitValley

Overall Solution - The Right Way to Invest in Israeli Technology Companies and Ventures

The idea that underpins the platform is to allow the public the chance to invest in technology companies and take part in the success of the Israeli high-tech industry, something we have now become accustomed to hearing about weekly in the media. To this end, ExitValley has developed an advanced investment mechanism that provides the investor community with an overall solution – from finding attractive investment opportunities, through to the diversification of risk and regulating the terms of the transaction, to receiving ongoing reports regarding the advancement of the company in which one has invested.

This is how it works: ExitValley meets hundreds of startups every month, from which it selects only the best and most suitable for the platform. Each company undergoes legal review and analysis. The terms of the investment are regulated through uniform and controlled investment contracts, which guarantee investors' rights (including ensuring equity liquidity and regulating the reporting obligations of the companies to their shareholders). ExitValley allows investors to diversify and minimize risk by investing small amounts in a number of companies from different fields, and even in different industries (e.g.: recently the real estate industry launched on the platform).

Also, as part of the "investing together" concept, derived from the “wisdom of the masses” philosophy, ExitValley allows its investor community to track all the companies running fundraising campaigns; examine the degree of trust expressed by other investors (through the rate of investment progress, number of investors etc.); and decide whether or not to join the investment accordingly. Another element derived from the "investing together" concept is the ability to connect with other investors, whether online through platform features, or offline through the monthly investor events held by ExitValley.

In addition, ExitValley collaborates with the Israel Innovation Authority, encourages investments under the Angels Law and launches numerous investment rounds together with venture capital funds and leading technology incubators. In doing so, the company enables its investor community to join leading investment entities and invest under the ideal investment conditions.

ExitValley

ExitValley

Israel's Most Successful Investment Platform, with the Largest Investor Community in the Country

ExitValley is by far the most successful investment platform in Israel. The company was founded by Yaron Adler, Oded Federbusch and Yaniv Shiryon, senior executives in the Israeli investment and high-tech industry, and has raised over NIS 100 million for more than 65 companies to date. ExitValley has a long and impressive record of accomplishments. This includes: establishing and institutionalizing the private investment industry in Israel (among other things, by taking the lead in efforts to pass government legislation for this type of investment in Israel); creating the largest investors community in the country, with over 16,000 registered investors; launching the first Israeli Crowd IPO; concluding three exits; conducting Israel's largest ever crowd funded campaign; and introducing a variety of successful portfolio companies, which have completed advanced rounds of funding with a significant increase in value to each.

ExitValley

ExitValley

Among ExitValley's most notable portfolio companies are:

HeraMed - a successful start-up company that has developed a home pregnancy monitoring system that allows continuous home monitoring of fetal health, while responding to early identification of potential complications; VRHealth - the first company in the world to use VR systems as a certified rehabilitative medical product; SolCold – a company which has developed material that uses solar radiation emitted from the sun for cooling; Hargol FoodTech – a company which has developed new breakthrough agricultural technology for industrialized cultivation of grasshoppers for food, thereby addressing the growing global need for new protein sources.

Since completing their ExitValley fundraising rounds, these companies have scored impressive achievements: HeraMed has launched an IPO on the Australian stock exchange; VRHealth and SolCold have completed series A Rounds ($ 5 million in aggregate) with considerable increase in company value; and Hargol FoodTech, which completed their A Round through the ExitValley platform, continues to increase the company's production capacity in order to meet the growing demand for their product in US and European markets.

Investing Together – A World Trend

Private investment in startups is growing at an unprecedented rate, and what started as something unique in the UK in 2013 has now become widespread. During the past year, over $ 4.6 billion were invested in 46,000 companies by over one million private investors from around the world, using online investment platforms. Almost all developed countries encourage Internet investment in startups through a variety of means, from enabling legislation and tax benefits to providing development grants to fundraising companies. These countries rightly see this method of investing as a needed and welcome support system for technology companies, which are the growth engine of many economies around the world, as well as a new investment channel for the public to diversify their investment portfolio and attain favorable returns.

How it Works

With ExitValley, investing in private technology companies and Israeli ventures has become very simple. Once you enter the platform, you can see the variety of investment opportunities and can choose what interests you most. Each company will present you with the required information, along with a uniform and controlled investment agreement. In addition, you can consult with other investors and talk directly to the entrepreneurs. If you decide to invest, all you need to do is choose the amount and complete the process through the site, just like a regular online purchase. Following the completion of the fundraising campaign, investors receive regular reports on the company's progress through the platform’s investor relations system, and are able to offer their shares for sale through its secondary market.