Opinion

My last board meeting at Fiverr

"In the six years on board, I have seen Fiverr grow from a young start-up to a mature and inspiring company," writes Shachar

Last week was my last board meeting at Fiverr. Exactly six years ago we made our initial investment in Fiverr, we led round C, investing $10 million out of a $30 million round. This was also Qumra’s first growth investment made in parallel to the first closing of the fund and therefore holds a special place in our hearts. I joined a board made up of an incredible group of earlier investors – Bessemer, Accel, and the original group of angel investors led by Jonathan Kolber and Guy Gamzu. An investor syndicate every entrepreneur would be lucky to have.

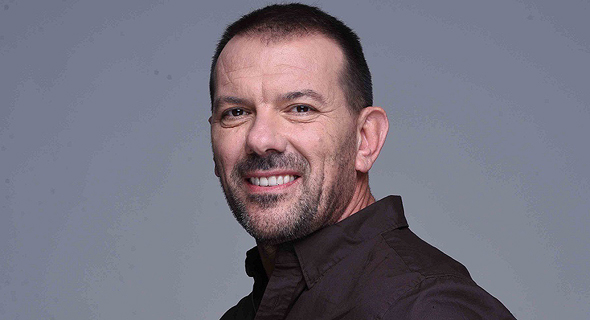

Erez Shachar, Managing Partner at QUMRA Capital Photo: Meir Cohen

Erez Shachar, Managing Partner at QUMRA Capital Photo: Meir Cohen

Leaving the Fiverr board was bittersweet. It is always sad to leave a group of people you enjoy working with, but leaving the board one year after the company is public, and the public market performance of the company has been phenomenal, is also a joyful closing of a circle. We, as VCs, see our role as private company investors. We don’t see ourselves as financial investors. When we invest in a company, we become partners of the founding and management team in different stages of company building. Today, the specialization of VCs in different markets, stages of investment, and types of companies have increased. Our specialization in Qumra is in Israeli tech companies, focusing on their growth stages. We are developing know-how and expertise that are specifically suited for the needs of Israeli tech companies, on their 10-100 journey. We invest in companies at around $10 million of Annual Recurring Revenues (or ARR), and we aspire to help them grow to $100 million ARR.

Even though each portfolio company is special and different, the challenges of Israeli tech companies on their 10-100 journey are surprisingly similar. So, when our companies reach this magic number of $100 million ARR, new types of investors join the company and take a more active role, and when our companies go public, our job is essentially over. Our investors don’t need us to invest their money in public companies, they back us to find the next companies that will become public in a few years and invest in them while they are private. We need to focus our efforts on finding and grooming the next Fiverrs to come.

- EU court ruling rendering Privacy Shield null has serious implications for Israeli companies

- Amid the Covid-19 crisis, it may be time to replace unicorns with camels

- This crisis will lead to a baby boom in the tech sector

In the six years on board, I have seen Fiverr grow from a young start-up to a mature and inspiring company. At the time, Fiverr was selling around $1 million a month, it is now at a run rate of over $15 million a month, and actually accelerating the growth of the business. It has become a public company and is on its way to becoming a household name. Fiverr took on itself the small challenge of “changing how the world works together”, and other than creating an incredible business from connecting freelancers with people and businesses requiring their services, Fiverr is actually changing how the world works together. Over the years I have heard and observed hundreds of stories of how transformative Fiverr has been in the life of its sellers. Offering opportunities for driven, entrepreneurial “doers” to work at what they love anytime, anywhere.

Six years later, I am grateful to Micha Kaufman, the founder, and CEO of Fiverr, that was willing to take a risk on a newly established Israeli growth fund, and welcome us as the lead investor of the company’s growth financing round. Micha has been a friend, an inspiration, and a model of leadership for many of the entrepreneurs we invest in today. Micha is always willing to take time from his crazy schedule, and talk to other entrepreneurs, mentor them and share his experiences. The new and exciting ecosystem of Israeli companies scaling to become global leaders owes a lot to Micha. Glass ceilings are broken by visionaries that help create new heights to aspire to. I am so proud to have been a small part of this incredible journey.

Erez Shachar is the Managing Partner at QUMRA Capital