eToro heading for $10 billion SPAC offering in coming weeks

The Israeli fintech company is looking to capitalize on its surging valuation by going public on Wall Street via a special purpose acquisition company

UPDATE (March 16): Betsy Cohen’s FinTech Acquisition revealed as eToro’s SPAC merger partner

Israeli fintech company, eToro, a social trading and multi-asset brokerage company, is on its way to Nasdaq via a SPAC at a valuation of $10 billion, a person familiar with the move told Calcalist under the condition of anonymity. The deal is expected to be completed in the coming weeks.

eToro has developed a platform to manage investments for private investors, and has enjoyed a sharp increase in its value since the pandemic’s outbreak.

The 2020 financial crisis turned young investors into one of the most significant players in the stock market, with the general public’s volume of trading rising from 10%-15% to over 20%. That has helped eToro enjoy an unprecedented year, recruiting five million new users, and climbing to a total of 17 million registered customers. In addition, its volume of stock trading through the platform has tripled. The company's revenue doubled to $500 million, and it is profitable.

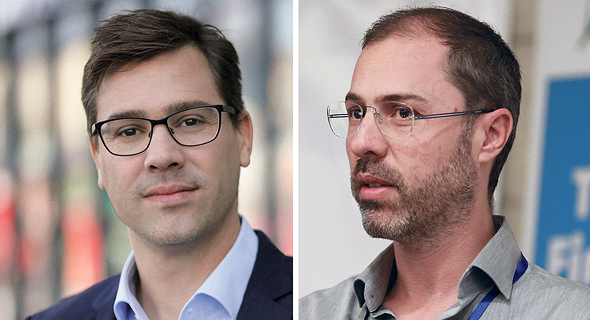

eToro founders Yoni and Ronen Assia. Photo: Orel Cohen and Dudi Hason

eToro founders Yoni and Ronen Assia. Photo: Orel Cohen and Dudi Hason

eToro's valuation has multiplied by 12.5 in less than three years, with the company raising $100 million at an $800 million valuation in 2018. Late last year, it was valued at $2.5 billion in the purchase of shares in the secondary market by a U.S. institutional investor at a sum of at least $50 million, with the unnamed U.S. firm purchasing shares from previous investors and employees.

eToro was founded in 2007 by brothers Ronen and Yoni Assia, with the latter currently serving as the company’s CEO. In an ironic twist, Israeli customers can’t trade using the eToro platform, as it doesn’t have approval from the local regulator. eToro has been recognized by regulatory authorities in the U.K, Australia, and Cyprus, and has gained popularity in European and Asian countries.

eToro has recruited hundreds of employees over the past year, and today employs some 1,100 people, 700 of them in Israel. The company plans to recruit hundreds of additional employees in 2021. Since its founding, eToro has raised $200 million. Some of its investors include the well-known venture capitalist Chemi Peres, Ping An Insurance, and China Minsheng Financial.

The business model of fintech trading apps is based on charging users a minimum fee and increasing revenue by charging commission from market makers. Robinhood also has a premium level of subscription, where for a fee of $5 a month, users can gain access to a loan platform as well as portfolio investment managing tools. eToro, which started out as a type of social network platform for investments, doesn’t charge users for following other investment portfolios.