Riskified aiming for $3 billion valuation in NYSE IPO

The Israeli online payments fraud prevention company is looking to raise at least $315 million

Tel Aviv-based online payments fraud prevention company Riskified is targeting a valuation of over $3 billion in its New York Stock Exchange offering, the company announced on Monday.

Riskified plans to offer 17,500,000 Class A ordinary shares at a price currently expected to be between $18.00 and $20.00 per share, meaning it aims to raise a minimum of $315 million. 17,300,000 Class A ordinary shares will be on offer, as well as 200,000 Class A ordinary shares to be sold by Riskified’s co-founder Assaf Feldman. Feldman will still maintain a 9.5% stake in the company following the sale, the same as co-founder CEO Eido Gal. The underwriters will have a 30-day option to buy an additional 2,625,000 Class A ordinary shares from Riskified at the initial public offering price. Riskified intends to list its shares under the ticker symbol “RSKD”. The IPO is expected to take place towards the end of next week.

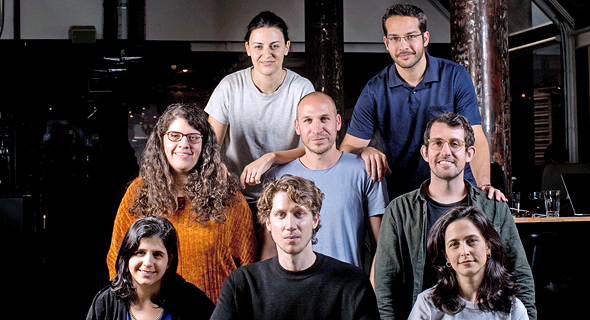

Riskified executives. Photo: Amit Shaal

Riskified executives. Photo: Amit Shaal

Riskified, which works with retailers like Macy's and Wayfair, generated revenue of $169.7 million in 2020, up from $130.6 million in 2019. During the first quarter of 2021, revenue climbed 54% to $51.1 million. Riskified generated a net loss of $11.3 million in 2020, whereas it posted a loss of $14.2 million a year prior.

Goldman Sachs, JPMorgan, and Credit Suisse are acting as the lead book runners for the proposed offering.

Founded in 2013 by CEO Eido Gal and CTO Assaf Feldman, Riskified’s products for online retailers utilize machine learning algorithms and user behavioral analytics to prevent account takeover, monitor payments, and detect fraudulent transactions. The company has raised $229 million to date.

The company has around 650 employees across three locations - Tel Aviv, New York City, and Shanghai. Tel Aviv is home to Riskified’s R&D Center with over 150 engineers and data scientists.

Riskified's most recent round was led by New York-based General Atlantic. Minneapolis-based Winslow Capital participated in the round, as did existing investors Qumra Capital, Entrée Capital, and Pitango Growth.

Riskified was ranked first in Calcalist's 2019 annual list of most promising startups.