Cyber insurance unicorn At-Bay raises another $20 million to take Series D to $205 million

The Israeli company, which is valued at $1.35 billion, added new investor ION Crossover Partners

14:0014.10.21

Cyber insurance company At-Bay has announced the closing of a $20 million extension to the company’s Series D financing, adding new investor ION Crossover Partners. The extension brings the Series D round to $205 million, valuing the company at $1.35 billion.

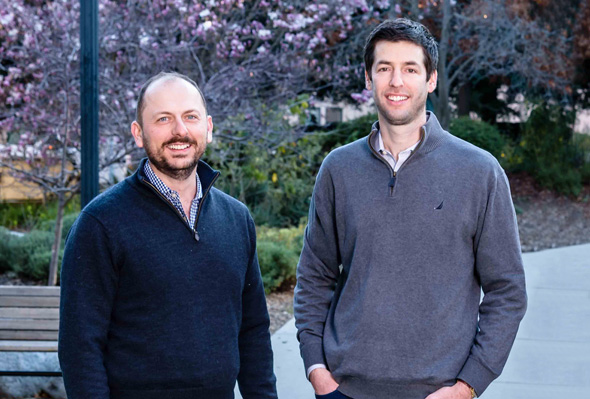

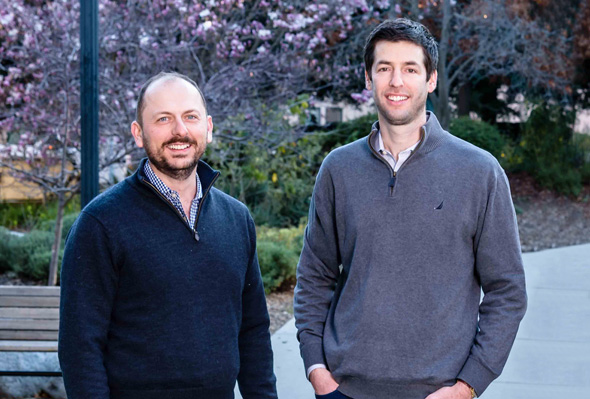

At-Bay founders Roman Itskovich (left) and Rotem Iram. Photo: Kevin Nilson

At-Bay founders Roman Itskovich (left) and Rotem Iram. Photo: Kevin Nilson

In July, At-Bay closed a $185 million Series D round co-led by Icon Ventures and Lightspeed Venture Partners, with participation from existing investors including Khosla Ventures, M12, Acrew Capital, Qumra Capital, the HSB fund of Munich Re Ventures, entrepreneur Shlomo Kramer, and Glilot Capital.

At-Bay founders Roman Itskovich (left) and Rotem Iram. Photo: Kevin Nilson

At-Bay founders Roman Itskovich (left) and Rotem Iram. Photo: Kevin Nilson At-Bay recently announced a collaboration with Microsoft to help SMBs proactively manage cyber risk. In the second quarter of 2021, the company surpassed $160 million in annual recurring revenue on 800% year-over-year premium growth. At-Bay has raised $292 million to date.

At-Bay’s innovation in the field of cyber insurance is the combination of an insurance policy with cybersecurity capabilities, which makes it possible to actively lower risk levels for its customers.

Related articles:

- Cyber insurance startup At-Bay raises $185 million at $1.35 billion valuation

- Every criminal on the planet is your next-door neighbor, says At-Bay CEO

- Israel’s At-Bay raises $34 million for cyber insurance

“At-Bay has a tremendous opportunity to redesign the insurance operating system,” said Jonathan Kolodny, Partner, ION Crossover Partners. “We are already seeing their positive impact on SMBs by reducing ransomware incidents, and we are excited to see their impact grow as they apply their proprietary automated underwriting platform to new products and services.”

At-Bay was founded in 2016 and employs 120 people, 50 of them in its R&D center in Israel and the rest in San Francisco, New York, and Atlanta. The new funds will be used, among other things, to double the company's workforce in Israel.