Opinion

The technologies you didn’t know financial institutions are using

"Financial institutions are making big bets and even bigger investments in technology and while many of these capabilities are behind the scenes, it’s both clients and employees who will benefit in the long term," write Paul McEwen and David Yeger of UBS

There is a popular misconception in some circles that banks and other large financial institutions are not innovating at the speed of their smaller, leaner fintech counterparts. Behind the scenes though, companies like UBS are driving major advancements in client and employee experience by using some cutting edge technologies—all while maintaining the highest levels of security and compliance. So what are some of the most interesting technologies in play within this industry?

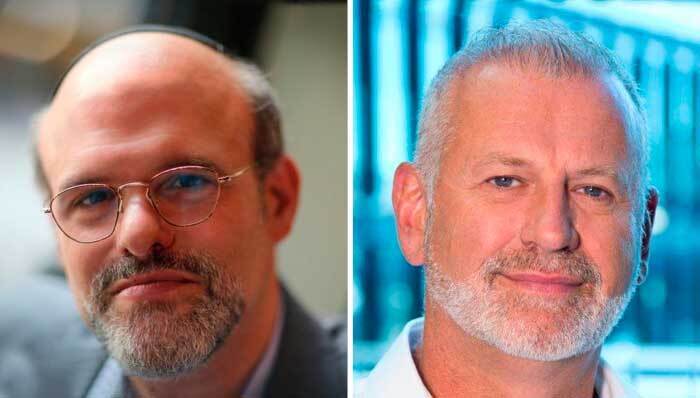

Paul McEwen, Group Head of Technology Services and David Yeger, Head of Automation Services, UBS. Photo: Courtesy

Paul McEwen, Group Head of Technology Services and David Yeger, Head of Automation Services, UBS. Photo: Courtesy Biometrics

Biometric authentication is not only highly secure but it offers one of the most frictionless authentication experiences for clients and employees—not to mention the inherent personalization that comes with using your face, voice or fingerprint. UBS is taking things one step further by trialling biometric building access in some of its locations.

Conversational AI

As the tools and capabilities continue to mature, you can expect to see more conversational AI transactions taking place. Not only can this offer faster resolution from clients, but if the tools are used correctly, companies can learn a lot from the kinds of queries clients are making—and using this to offer more of what they want.

Sustainable computing

The urgent need to battle the climate crisis means that large global firms will need to take the lead in advancing more carbon efficient computing. As the need to ingest and process data grows exponentially, practices like clean coding and green architecture need to become the norm. Whether this is through partnerships with Cloud service providers or by architecting infrastructure in a more energy efficient way, this is an area that should be adopted widely.

Financial institutions are making big bets and even bigger investments in technology and while many of these capabilities are behind the scenes, it’s both clients and employees who will benefit in the long term.

Paul McEwen is Global Head of Technology Services at UBS and David Yeger is Head of Automation Services at UBS