Opinion

The rise of thematic investing

"For many, thematic investing represents a fundamental shift in their approach to portfolio management," writes Jay Jacobs, Head of Research & Strategy at Global X ETFs

The implications of these disruptions are numerous. It can affect the car we drive, the health care we receive, how we spend our free time, and or even the very nature of our occupations. Increasingly, it is also changing how investors manage their portfolios.

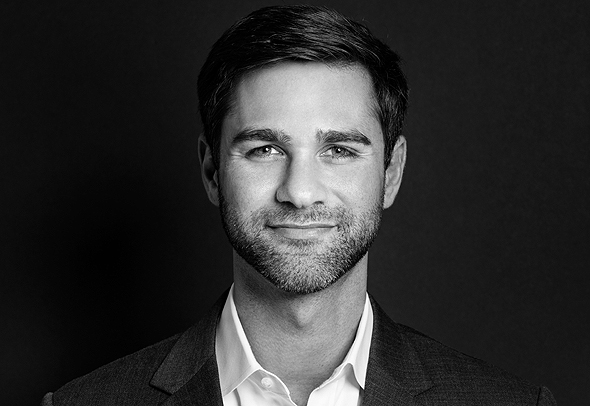

Jay Jacobs, CFA, is the Head of Research & Strategy at Global X ETFs. Photo: Global X

Jay Jacobs, CFA, is the Head of Research & Strategy at Global X ETFs. Photo: Global X

Seeking to capture the growth opportunities associated with these disruptions, more than $130 billion has poured into the nearly 200 thematic ETFs in the U.S. Over $100 billion of that has come since the pandemic began, as COVID-19 highlighted and accelerated many of these structural changes, like telemedicine, cloud computing, e-commerce, and genomics. Yet despite this relatively recent surge in interest in thematic investing, it is still the early days for this investment approach. Just 2% of U.S. ETF assets under management are in thematic funds.

For many, thematic investing represents a fundamental shift in their approach to portfolio management for several reasons. First, it is difficult to measure and analyze themes historically. Powerful themes tend to be fairly recent and the very nature of thematic investing requires anticipating changes that yet to fully materialize. So rather than looking backwards at historical data, it requires a rigorous forward-looking approach to identify the most attractive opportunities.

Second, thematic investments rarely fit neatly into the sector-based or geographic-based buckets that investors are accustomed to. The robotics theme for example includes stocks from the Industrials, Information Technology, and even Health Care sectors, as well as stocks from the U.S., Europe, and Japan. As such, investors often need to create separate satellite portions of their portfolios to accommodate diverse themes.

- "The gaming industry's biggest growth opportunity comes from the cloud"

- ESG investing strategies powered by public data – predicting companies future performance and impacting evaluation

- “The lesson that actually goes from those days till today is that everything is about people; it's all about people"

Third, there is a lack of consensus around how to define individual themes and identify the companies that stand to benefit from their materialization. While most can agree robotics is a powerful multi-year trend, several funds targeting this theme share very limited overlap in holdings. Some may focus on the users of robotics, like Amazon or Fedex, whereas others may focus on the builders, like a Fanuc or Omron. These disagreements force investors to make more active decisions on how to get exposure to a particular theme.

Yet as the economy adapts to powerful structural changes, investors would be wise to adapt their investments as well to harness these generational opportunities.

Jay Jacobs, CFA, is the Head of Research & Strategy at Global X ETFs