eToro SPAC merger delayed again. Is the trading platform still worth $10 billion?

The trading platform will not complete its SPAC merger by the end of the year, which means investors can withdraw their funds. Will the Israeli company have to slash its valuation?

13:4212.12.21

One of the potential largest Israeli public offerings is up in the air. eToro, which back in March announced a planned merger with a SPAC company at a $10.3 billion valuation, will not be able to complete its plan by the end of the year, putting the deal at risk. The move was expected to inject into eToro $250 million from the SPAC’s funds, as well as another $650 million from institutional investors raised in PIPE funding (private investment in public equity).

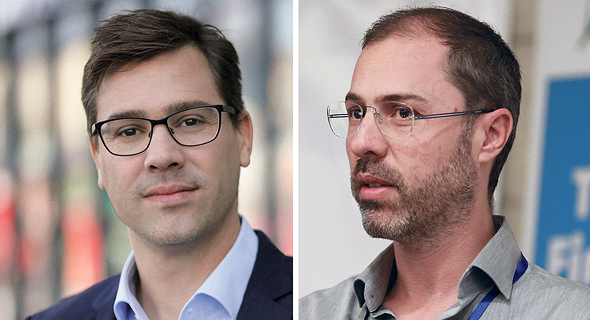

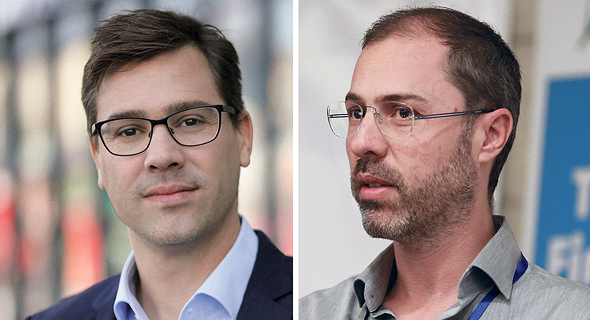

Yoni (left) and Ronen Assia, eToro founders. Photo: Orel Cohen and Dudi Hasson

Yoni (left) and Ronen Assia, eToro founders. Photo: Orel Cohen and Dudi Hasson

The company has already pushed the deal’s due date from this year’s third quarter to the fourth, however now, two weeks before the end of the quarter, and with no shareholders meetings in sight, it is clear that the merger will not be completed in 2021.

Yoni (left) and Ronen Assia, eToro founders. Photo: Orel Cohen and Dudi Hasson

Yoni (left) and Ronen Assia, eToro founders. Photo: Orel Cohen and Dudi Hasson What is currently threatening eToro isn't just the withdrawal of the SPAC funds, something which has already become a trend in the market, but rather the $650 million it is set to receive from PIPE investors. Unlike SPAC investors who can vote in favor of a merger but still choose to withdraw the money they invested, PIPE investors aren't allowed to backtrack on their commitment, unless the deadline has expired. With eToro's deadline coming up soon, institutional investors of the likes of SoftBank's Vision Fund 2, Third Point LLC, Fidelity Management & Research Company LLC, and Wellington Management, can all cancel their commitment and desert the offering without any fine.

While there is still a chance that eToro will succeed in convincing investors to renew the agreements for next year, it is estimated that it will have to dramatically cut either the size of the raising or valuation, which will be far from $10 billion. Betsy Cohen's fintech SPAC share Acquisition V fell last week to $10, its original price, which reflects the estimate that the SPAC will give investors their money soon.

It is not inconceivable that most of the institutional investors that have committed to participate in the PIPE phase will agree to extend the contract with eToro. While some are willing to give it another quarter to complete the move under the original terms, others, especially the smaller entities, will demand it to reduce either the raising or valuation, making it closer to around $5 billion, similar to the valuation the company estimated for a traditional IPO in the past.

eToro’s last fundraising round was in 2020 and generated $50 million at a $2.5 billion valuation. The round consisted only of secondary deals in which the veteran shareholders and employees sold part of their holdings. The SPAC merger also holds a significant secondary component of $300 million, which will probably be the first to “pay the price” if there will be a change in terms and a new agreement signed.

In such a scenario, eToro will face a dilemma, whether to go on with new terms or cancel the plan altogether and conduct a fundraising round in the private market. What might help eToro to complete the deal is the high costs it has already incurred since signing the agreement with the SPAC back in March. These costs have already reached more than $70 million, and are expected to reach $75 million by 2021, mostly due to payments to accountants, lawyers, bankers, etc. This is a significant expense that has already hurt the company's profitability this year and was among the factors that saw it suffer a loss in the third quarter.

SPACs are falling

The public offerings market in general, and the SPAC market especially, has undergone turbulence since March 2021, when the agreements between eToro and Betsy Cohen were signed. Shares of companies that began public trading through SPAC mergers have plunged by double digits, and most of the public offerings completed in recent months have suffered from the mass withdrawal of SPAC money, with the most profound change being institutional investors stopping participating in SPAC mergers due to the conclusion that these transactions reflected excessive value levels for companies.

To illustrate, even Betsy Cohen, who is considered an expert operating in the SPAC field even before the hype of the last two years, has not escaped the recent slide. The most notable example is American insurtech company Metromile, which was issued by Cohen's SPAC at a valuation of $1.3 billion, before it fell, and was acquired in November by the Israeli-founded Lemonade for $500 million. Israel’s Payoneer, which also merged with a Cohen SPAC at a valuation of $3.3 billion, has since dropped 33% to $2.2 billion.

Related articles:

- eToro adds 3.1 million users in the first quarter of 2021

- Police investigating alleged $1.5 million embezzlement at eToro

- There is a deep competitive advantage to Israel, since it’s very global, says eToro CEO Yoni Assia

Beyond the objective and substantial changes on Wall Street and in the world of SPACs, eToro has also been stuck in discussions with the U.S. Securities and Exchange Commission (SEC). A series of back and forth questions and answers, clarifications, and changes the SEC is demanding are holding back the merger. eToro has recruited the best in financial regulation in Israel, including Hedva Bar, former Supervisor of Banks at the Bank of Israel, now eToro’s deputy CEO, and Shmuel Hauser, former Chairman of the Israel Securities Authority, who joined the company’s advisory committee, but the saga has yet to end.

The two main issues in focus are the large share of cryptocurrency trading on the Israeli company's trading platform, and its original activity as a social network that allows not only to exchange ideas on investments but to follow opinion leaders and their portfolios. The SEC sees crypto as securities and not a currency, which demands different conduct from eToro as the platform provider.

The difficulty in justifying the valuation

Beyond the issues with the SEC, what is hurting eToro is also its main rival - Robinhood. In July of this year, the popular trading platform was actually responsible for the positive sentiment towards eToro after completing its IPO on Wall Street, carried by the spike in trading on its app by young investors. At its peak, Robinhood soared to a $40 billion market cap but has since plunged by more than 70% and is now trading at 40% less than its IPO value. When Robinhood, with its 22 million active users is worth $17 billion, how can eToro and its 2.14 million users justify a $10 billion valuation?

eToro and Robinhood operate in the same market, but up until this year the Israeli company had not operated in the U.S., while Robinhood has a strong presence there. Some 70% of eToro’s revenue comes from Europe, where it is considered a very popular app. It does not operate in Israel despite having 1,100 out of its 1,700 employees here. It was founded in 2007 by brothers Ronen and Yoni Assia, and during the past year, it has been making tremendous efforts to enter the U.S. market, having received the license to operate in it at the end of 2019.

At the end of the third quarter, 13% of eToro’s revenue came from the Americas (including Latin America, where it has already been operating in the past) compared to 6% at the beginning of the year. 2021’s first half was dreamy for the company as it reached revenues of $700 million when according to the yearly forecast it should have had annual revenues of $1 billion. The company anticipated the slowdown that came during the third quarter, as Robinhood reported a 35% drop in revenue during the same period.

While in terms of revenue the Israeli company is likely to reach a target of $1.2 billion by 2022, the situation in terms of profit is far less bright. The annual EBITDA forecast is expected to be $15 million. In the first two quarters it did not seem to be a problem to meet the target with a profit of $69 million. However, in the third quarter a negative EBITDA of $25 million was recorded, meaning it must present at least the same result in the fourth quarter to meet expectations.

Beyond the SPAC-related expenses, eToro recorded high accounting expenses ($60 million in the third quarter) for allocating options to employees and also invested large resources in penetrating the U.S. market. Against this background, its operating expenses doubled to $203 million in the quarter.

Investors want an exit

eToro still has $370 million in cash, so can afford to run even without fundraising in the near future. However, this is a fairly old company whose shareholders - including the Barkat brothers’ BRM fund; Hemi Peres, a founding partner of the Pitango Venture Capital fund, and veteran high-tech investor Eddy Shalev - already want to see a significant exit. Furthermore, becoming a public company is supposed to help eToro strengthen its brand when competing with Robinhood.

eToro wrote in response: "eToro is in the process of becoming a public company via a business combination with FinTech V. We are working with all relevant parties to conclude this as soon as possible. We are incredibly excited about this next chapter in the eToro story."