Mapping the Israeli Metaverse startup landscape

The Metaverse is the hottest buzzword in tech, both globally and in Israel. New research by Remagine Ventures has mapped the close to 50 Israeli companies and startups that are already active in building Metaverse technology

“Gaming is an entry point to the Metaverse, and we have very strong gaming talent in Israel and a growing group of B2C entrepreneurs who are at the cutting edge of consumer trends like NFTs, DeFi, etc.,” said Eze Vidra, Managing Partner at Remagine Ventures. “A lot of them are waking up to the big opportunities in this market and we expect to see the number of companies in this space grow rapidly.”

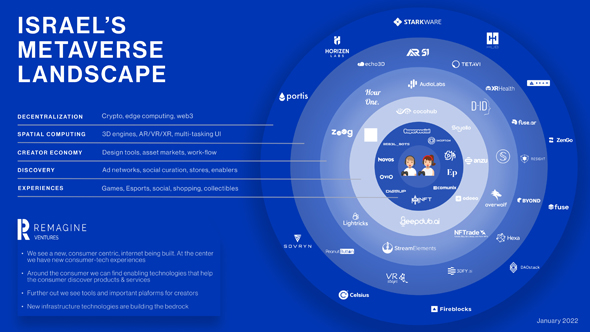

Israel's Metaverse landscape. Photo: Remagine Ventures

Israel's Metaverse landscape. Photo: Remagine Ventures According to Vidra, several of the large tech companies have significant teams working on Metaverse related tech (including Meta, Snap, Unity, etc) that could also play a role in future acquisitions and talent spinning out to build Metaverse related companies. “From a tech perspective, a lot of the challenge of the Metaverse will be addressed by technology that leverages AI: computer vision, synthetic media, NLP, and Israel has a strong cluster in these areas,” explained Vidra.

Metaverse went from relative anonymity to a household term following Facebook’s rebranding to Meta in October 2021, a move designed to capture the trillion dollar valued social network’s intention to become a metaverse-focused company within five years. Several other tech giants quickly also shared their aspirations to build the Metaverse including Microsoft, Nvidia, ByteDance, Samsung, Google and others. Israeli startups are also building the future of the technology and we’re excited at CTech to share the first startup landscape of Israeli startups in the Metaverse space.

Although the term Metaverse is still being defined, in its essence it’s a virtual environment where people can play, shop, socialize, and work. It’s a combination of virtual reality, augmented reality and virtual worlds (which today mostly consist of games like Roblox, Fortnite, Upland, Decentraland, etc and virtual social platforms like Rec Room or Meta’s Horizon Labs). Some define the Metaverse as a point in time when our digital lives become more important than our physical ones.

As people’s attention is wandering toward digital screens, money and resources will follow. According to the State of Mobile 2022 by App Annie, consumers in the top 10 mobile markets spent 4.8 hours a day on mobile (a third of their waking hours). This trend was accelerated by Covid-19, but by no means is the virus the main driver. In addition, consider that in 1999 only 4% of the population was online. In 2020, it was 62%. The result is a $1 trillion opportunity with a potential to disrupt every aspect of our online lives, according to Jefferies analyst Simon Powell.

In order to identify the Israeli companies active in the Metaverse landscape, Remagine Ventures divided up the sector into several field: Decentralization (Crypto, edge computing, web3), Spatial Computing (3D engines AR/VR/XR multi-tasking UI), Creator Economy (design tools, asset markets, work-flow), Discovery (ad networks, social curation, stores, enablers), Experiences (games, e-sports, social, shopping, collectibles).

“To deliver the vision of the Metaverse, we share the belief that a new ‘Internet’ is being built with the consumer at its center and that Israeli startups can play a crucial role in helping create, operate and monetize it. New advanced infrastructure such as 5/6G, powerful GPU chips, cloud and edge computing and decentralized technologies (known widely as Web3) open the door for new opportunities,” noted Kevin Baxpehler, Managing Partners at Remagine Ventures.

Remagine Ventures' Eze Vidra (left) and Kevin Baxpehler. Photo: Daniel Ryter

Remagine Ventures' Eze Vidra (left) and Kevin Baxpehler. Photo: Daniel Ryter “On top of this infrastructure layer we are seeing new ‘picks and shovels’, including spatial computing tech for AR/VR and 3D content (such as Echo3D) as well as new use cases for decentralized tech like crypto gaming and NFTs which are gaining popularity amongst consumers. New enabling technologies such as Overwolf, HourOne, Anzu or Zoog open the door to new creation and monetization opportunities for creators worldwide,” added Baxpehler.

According to Remagine Ventures, “discovery” in the Metaverse is critical to help educate and onboard new consumers into the Metaverse, something that today is still very challenging. “What we are already seeing on the ground are a lot of new consumer facing experiences, from play-to-earn games such as Reb3lbots to immersive experiences on Roblox (Supersocial and Toya) to companies like Novos training the ‘athletes of the metaverse’.”

- “The Metaverse can revolutionize education, employment”

- echo3D: “The metaverse is already here.”

- Does the Metaverse need restrictive regulation?

What do you think about the skeptical views regarding the Metaverse model? Is it achievable at all? What needs to happen for it to be popular?

Baxpehler: “New significant shifts in consumer behavior and technology always generate lots of skeptics in the beginning. On top of that some new trends are not mainstream yet, e.g. crypto (NFT) based gaming. While we are very bullish on investing in NFTs and are excited to have invested in Reb3lbots, one has to be careful as this sector is still largely unregulated and will probably go through some sort of hype cycle. Something that AR & VR has already done.

“Where the web3 meets the Metaverse, lets call it the open Metaverse, we still face challenges around onboarding customers that are not crypto savvy. It’s not a mass medium yet, there are around 1 to 2 million play-to-earn gamers, which is not much considering the 2.7 billion gamers worldwide. Another challenge around crypto is high gas prices/slow layer 1 chains. For closed metaverses like Roblox we see challenges around monetization for creators.

“The tipping point will come more quickly than we think. We see an influx of very talented engineers enter web3 and the Metaverse. According to a recent report by Electric Capital, 31,000 developers joined web3 in 2021. That’s still small but the growth and kind of talent that is entering this space is significant. These developers, as well as over $30 billion deployed by VCs in crypto in 2021 will solve a lot of the current challenges we see. Nonetheless, we believe that we are at the early stages of a new internet that is being built and our time horizon is 5 to 10 years.”

Vidra: “There have been old articles circulating recently about people predicting that the Internet is a fad that won’t work. I’m not saying it’s the same, but a lot of big trends start as play and are too easily dismissed at first. We’re still perhaps a decade away from the vision of the Metaverse, but there’s going to be a lot of opportunities for technology companies and creators to play a role.”

Beyond the local initiatives and immediate solutions that come from the grassroots, do you already see tangible investments in Israeli companies in the sector? Millions of dollars? Tens of millions, or more? Who are the big players most interested in investing in the sector?

Baxpehler: “Even though this is a very nascent sector we can already find well funded startups, Overwolf (raised close to $150 million with the last round led by A16Z), Streamelements (raised $111.5 million with the last round led by Softbank) and newcomers such as Toya or SuperSocial with strong international investors. If we look at Israel’s web3/crypto sector we find unicorns such as Starkware or Celsius. The total funds raised by the startups on our map is almost $3 billion.

“The most serious investors are based in the U.S., a16z or Galaxy and in Asia, Makers Fund and Animoca Brands or Tencent. In the U.S. and Asia we also see general funds invest in the space, whether its Sequoia or General Catalyst. As this sector begins to mature a bit we expect a range of M&A activity by the large and dominant web2 companies.”

Israel Metaverse Startup landscape - according to Remagine Ventures

We see a new consumer-centric internet being built. At the center we have new consumer-tech experiences. Around the consumer we can find enabling technologies that help the consumer discover products and services. Further out we see tools and important platforms for creators. New infrastructure technologies are building the bedrock.

Decentralization (Crypto, edge computing, web3): Sovryn, Starkware, Horizen Labs, Celsius, HUB, Portis, Fireblocks, Beam, Zengo, Fuse, DaoStack

Spatial Computing (3D engines AR/VR/XR multi-tasking UI): ByondXR, echo3D, AR51, Tetavi, XR Health, Fuse AR, Restsar, Peanut Button, Hexa, 3DFY.ai, VR Steps

Creator Economy (design tools, asset markets, work-flow): AudioLabs, Zoog, Hour One, D-ID, SCRT Labs, NFTrade, Overwolf, Lightricks, StreamElements

Discovery (ad networks, social curation, stores, enablers): CocoHub, Odeeo, anzu, Sayollo, Multinarity, Deepdub.ai

Experiences (games, e-sports, social, shopping, collectibles): Novos.gg, Inception, Toya, Super Social, Rebel Bots, Art AI/Eponym, Ovio, Communix, Disrup