Musk’s potential role as government efficiency czar stirs concerns over power consolidation

With Musk’s influence spanning critical industries, his potential government role fuels fears of unprecedented conflicts of interest.

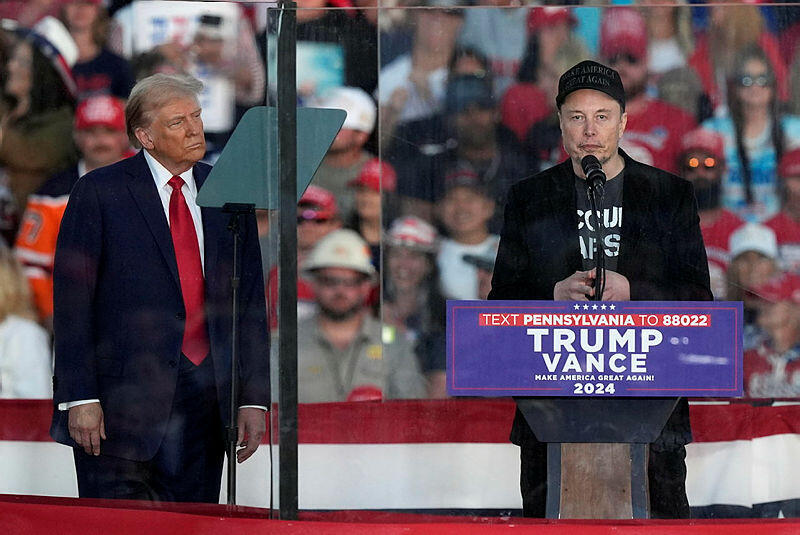

In September, amidst yet another media cycle focused on Elon Musk, it was reported that Musk responded positively to a job offer from Republican presidential candidate Donald Trump. Trump proposed that Musk head an efficiency committee in his administration if elected. On the surface, this seems logical—who better than Musk, a cost-cutting entrepreneur, to oversee government efficiency? ""I will create a government efficiency commission tasked with conducting a complete financial and performance audit of the entire federal government," Trump said in a speech at the New York Economic Club, adding that Musk volunteered to lead the initiative. Musk followed up with a post on X, stating: "I look forward to serving America if the opportunity arises. No pay, no title, no recognition is needed," as if presenting himself as a philanthropist eager to serve the country selflessly.

But this scenario comes with a significant "if" and a major "oh no." First, there's the question of whether Trump will win the presidency in a close race against Kamala Harris. Second, the potential confirmation of Musk in such a role is alarming. Should Musk head a committee that controls the federal government's resources, he would effectively become the first American oligarch in a role that could influence decisions directly tied to his business interests.

The conflicts of interest here are staggering. NASA decides on subsidies and contracts for SpaceX; the Federal Aviation Administration (FAA) approves Starlink satellite launches; the Department of Transportation oversees subsidies for electric vehicles; the Food and Drug Administration (FDA) assesses whether Neuralink can implant chips in human brains; and the Federal Trade Commission (FTC) monitors Musk’s social network, X. Appointing Musk to such a position isn't just a potential conflict of interest—it's an immediate, clear danger.

In the background, Musk’s fan base on X, now a private company, celebrates this alliance between Musk and Trump, both of whom claim to "save the United States" from what they call a "communist dictatorship" under Harris, with Musk even suggesting they might be jailed by the Democratic administration, which he claims could only win through election fraud. Their paranoia and quest for even more power are hard to explain. Trump may fear legal consequences for his convictions, but Musk is already one of the most powerful individuals globally. Musk's business ventures are so intertwined with essential areas that governments today depend on, and he's often seen as an "unelected official."

For example, after Russia invaded Ukraine, Musk generously deployed Starlink satellites to aid Ukraine. But what started as a humanitarian act soon escalated into Musk calling for Ukraine to negotiate with Russian President Vladimir Putin, even proposing new maps for the region. "The idea that battlefield decisions depend on Musk's goodwill is not an ideal situation," said Senator Mark Warner, chair of the Intelligence Committee, expressing the administration's concerns in The Washington Post.

Musk’s influence extends far beyond these singular acts. He has masterfully woven together his companies, creating a web of interconnected interests. This makes him a prime candidate for government scrutiny—not someone who should be deciding how to streamline government operations. For instance, in September, it was reported that Musk’s new AI startup, xAI, would partner with Tesla, exchanging technology access for a share of Tesla's revenue. The deal also included xAI developing software like a voice assistant for Tesla’s Optimus robot, with revenues dependent on Tesla’s usage of these technologies.

Although Musk quickly denied the report, calling it "inaccurate," his history suggests otherwise. He frequently merges the operations of his companies through cross-investments, personnel shifts, and resource reallocations, often blurring the lines between them. This complex financial engineering is regularly questioned in courts: who benefits from these actions—the companies, their shareholders, or Musk himself? The answer isn’t always clear.

In June, for example, Tesla redirected a shipment of 12,000 Nvidia processors to xAI—processors that were among the most sought-after on the market. Musk defended the decision, saying, "They would just sit in a warehouse otherwise." Later, Musk polled his tens of millions of followers on X, asking whether Tesla should invest $5 billion in xAI—15% of Tesla's cash reserves at the time. Nearly a million people voted, with 67% supporting the idea. "It seems the public is in favor," Musk tweeted, adding, "we'll discuss with Tesla's board," as though the outcome of the survey was binding.

Musk doesn’t just transfer money and equipment between his companies—he transfers people too. When he acquired Twitter (now X) in 2022, he sent 50 Tesla engineers, two employees from The Boring Company, and one from Neuralink to help run Twitter. After founding xAI, Musk transferred more Tesla employees there. At The Boring Company, so many SpaceX employees were involved that regulators visiting the project sites couldn’t distinguish who worked for which company. During one inspection, a safety manager—himself a SpaceX employee—admitted, "I'm not sure if The Boring Company is separate from SpaceX or just a unit."

The Boring Company even borrowed so many resources from SpaceX that SpaceX investors eventually questioned why their Mars-settlement investments were being used for California traffic tunnels. Boring responded by transferring 6% of its shares to SpaceX in exchange for the resources it used. "Based on the value of the land, time, and other resources contributed," a SpaceX spokesperson said at the time.

In other cases, Musk uses his companies' intertwined operations for marketing value. When SpaceX launched its Demo-2 mission, Musk ensured NASA astronauts traveled to the launch pad in a Tesla Model X. This tradition continues for ceremonial missions to the International Space Station. And, of course, there’s the unforgettable moment when a SpaceX rocket sent a Tesla Roadster into space.

Despite the many unreported small transactions between his companies over the years, in February, Tesla shareholders finally pressured Musk to disclose these inter-company dealings. In 2023 alone, Tesla conducted $9.1 million worth of business with at least four of Musk’s six companies. For example, SpaceX paid Tesla $2.9 million, while Tesla paid SpaceX $800,000. X (formerly Twitter) paid Tesla $1.02 million, while Tesla paid X $280,000. Tesla also paid The Boring Company $1.2 million and another $2.9 million to a security company owned by Musk.

Musk’s financial maneuvers extend to his personal finances as well. As a manager with significant stakes in all his companies, he often uses them to support each other. About a decade ago, Musk borrowed capital from SpaceX to save Tesla from bankruptcy. When SolarCity faced financial troubles, SpaceX bought over $200 million in its bonds. Later, Tesla acquired SolarCity in a $2.6 billion deal, despite it being on the brink of bankruptcy.

When Musk decided to purchase Twitter, he once again drew upon his other companies, reportedly borrowing $1 billion from SpaceX and selling Tesla shares to raise capital. Tesla's reports at the time warned that Musk’s personal loans, backed by Tesla stock, could affect the company’s stock price if he were forced to sell his shares.

Musk’s financial engineering is notable not only for saving his companies but also for his ability to keep the entire empire from collapsing, even though one company’s failure doesn’t necessarily spell disaster for the rest. The connections between his companies are complex, but Musk has avoided consolidating them into one corporation—either because he doesn’t want to or because regulatory issues prevent it.

While this disconnection relieves some regulatory pressure, Musk’s central role in all these companies amplifies the risk. For now, it seems unlikely that he will take the reins of a government efficiency committee anytime soon.