Tech TLV 2022

Nuvei Israel Managing Director: "The advancement of technology is helping prevent fraud”

"Our war against fraudsters is currently at a stage where we need to make sure that we work with legitimate businesses,” Shemer Katz, Global Innovation Officer and Managing Director of Nuvei Israel said at Tech TLV

"We are a payments company that allows businesses to receive payments using credit cards. We are a company that relies on older models and we are now seeing a boom in our business. Our customers are very diverse and we invest in the customer experience," said Shemer Katz, Global Innovation Officer and Managing Director of Nuvei Israel, speaking at the Tech TLV conference.

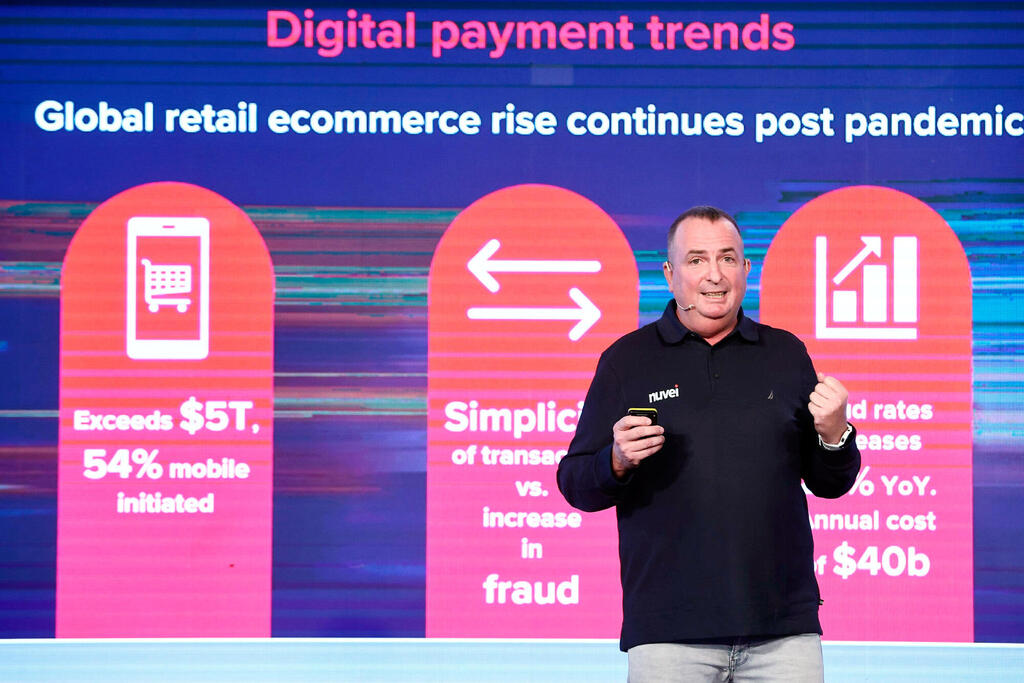

“There is $5.5 billion in e-commerce post-Corona and we want payments to be simpler. We started with cards and today we pay by the clock, but this allows for an increase in the scope of fraud. We want easy payment, but the issue of security is also important to us, a minimum of fraud. To understand this, one must understand the behind the scenes of this world of payments. The principle is faster, stronger and safer."

Katz further emphasized: "If we review our path historically, then we will find that when the world of e-commerce began, it was simple, it worked on credit card information. Of course, the frauds then were simple and based on stealing credit card information. The fraudsters also evolved. In the early 2000s, another dimension was added, the secure transaction feature during which the customer needs to confirm the purchase, but these processes made the transactions complex. But it did give security to the businesses who understood that if the customer entered the code correctly then it is a guaranteed and safe transaction despite the problematic user experience.”

Related articles:

- Israel Innovation Authority VP: “Israel can be the world’s most advanced country in autonomous public transport”

- Oren Zeev: “Mistakes were made. The pricing of deals in 2020 and 2021 was too high”

- Microsoft Israel R&D Chief Scientist: "We are making AI accessible to everyone without the need to be an AI engineer"

According to Katz, the attempts to cheat and defraud are not diminishing because of the advancement of technology, on the contrary: "Our war against fraudsters is currently at a stage where we need to make sure that we work with legitimate businesses. Today, for example, we have a client in the crypto field, and our system recognized in advance a situation in Argentina where people suddenly used all kinds of social security codes in Argentina to make crypto transactions, it's a fraud on the scale of over a million dollars. Today our company handles ten million daily transactions."