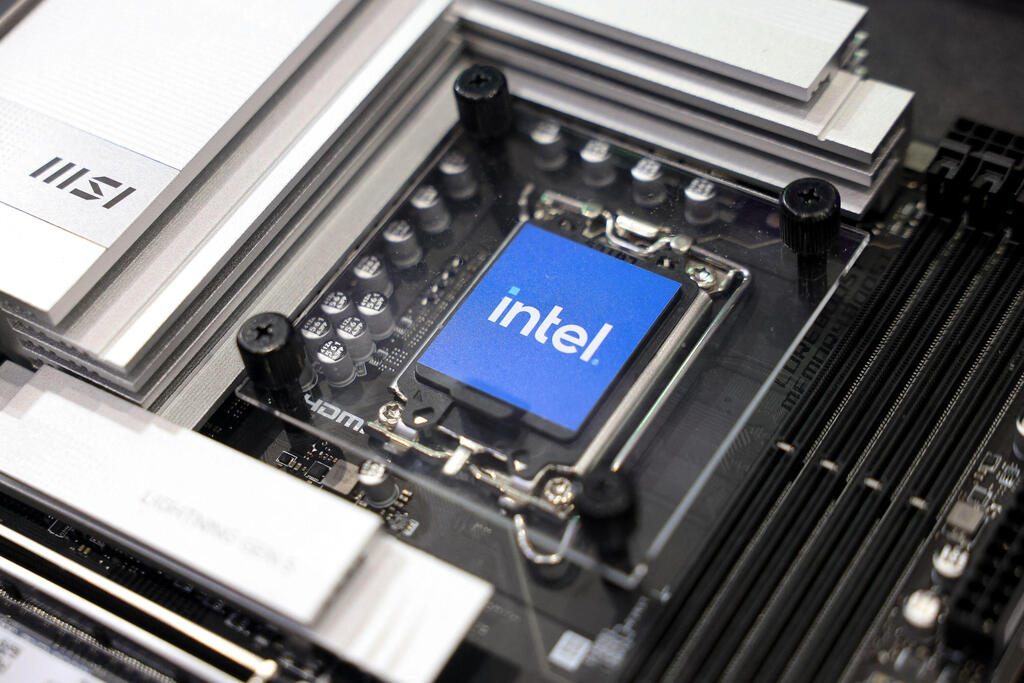

Intel spent $900 million on restructuring last year but enters 2025 on shaky ground

Company scraps AI GPU plans and forecasts weaker-than-expected revenue.

After spending $900 million on layoffs and cutbacks, Intel plans to continue its historic transformation and attempt to emerge from one of its bleakest periods in 2025. On Thursday, the company posted December-quarter results that beat analysts' low expectations, but its forecast for current-quarter revenue fell short as it struggles with tepid demand for its data center chips. Investors are also waiting for clarity on the appointment of a new CEO.

Shares of the Santa Clara, California-based company fell about 60% in 2024.

Intel’s quarterly results and forecast were overshadowed by concerns about its long-term strategy and efforts to replace former CEO Pat Gelsinger, who was ousted last month. Two interim co-CEOs are currently leading the former No. 1 U.S. chipmaker, which is struggling to catch up to its rivals, particularly AI chip giant Nvidia.

On a conference call with investors, co-interim CEO Michelle Johnston Holthaus announced that Intel was shelving its forthcoming graphics processing unit (GPU) design, Falcon Shores, leaving it without a major new AI product in the near term. The company now plans to use Falcon Shores as an internal test chip while focusing on future AI data center products.

In its earnings report, released after the closing bell, Intel said it expects first-quarter revenue of $11.7 billion to $12.7 billion, below analysts’ average estimate of $12.87 billion, according to data compiled by LSEG.

Companies investing in generative AI have prioritized spending on specialized AI processors capable of handling massive amounts of data, reducing demand for traditional server processors—Intel’s core business.

Interim co-CEO and Chief Financial Officer David Zinsner attributed Intel’s outlook for slower demand to "normal seasonality" and potential tariffs from a future administration led by former President Donald Trump. In an interview, he noted that concerns over tariffs may have led customers to accelerate purchases of Intel chips in the previous quarter to avoid potential cost increases.

Zinsner also stated that Intel aims to keep operating expenses at approximately $17.5 billion in 2025.

“In Q2, we began the process of resizing our expense structure to support more modest long-term growth, including adjusting our capacity plans to more conservative levels, driving impairments in Q3, and this accrual in Q4,” Zinsner said on the earnings call. “Q4 operating cash flow was a positive $3.2 billion, down approximately $900 million sequentially due to cash outlays associated with our Q3 restructuring charges.”

Last year, Intel scrapped its 2024 forecast of selling over $500 million worth of its new AI processors, called Gaudi, signaling struggles in competing with Nvidia's dominant AI chips.

For the current quarter, Intel forecast that it would break even on an adjusted per-share basis, while analysts had expected an adjusted profit of 9 cents per share.

Intel is also investing heavily to become a contract manufacturer for other chipmakers, raising concerns among investors about pressure on its cash flow.

Holthaus said in an interview that the board's search for a new CEO was progressing, and until a decision is made, "we're focused and we know exactly what needs to be done." Investors are eager for a new CEO to provide a clearer vision for the company’s future.

"The absence of a new CEO announcement may contribute to investor uncertainty, as leadership stability is crucial for navigating this competitive landscape and executing turnaround plans," said Michael Schulman, Chief Investment Officer at Running Point Capital.

Intel reported that fourth-quarter revenue fell 7% year-over-year to $14.26 billion, surpassing estimates of $13.81 billion.

Part of Intel's better-than-expected revenue and profit margins in the fourth quarter came from grants related to the federal CHIPS Act, Zinsner said.

Meanwhile, the PC market—Intel's largest revenue driver—saw only modest global shipment growth last year, falling short of analysts’ expectations for a strong rebound after months of declines.

Intel has also been losing market share in the PC and server CPU segments to rival AMD, a trend analysts expect to continue into 2025.

Earlier this month, Intel said it plan to transform its venture capital arm, Intel Capital, into a standalone entity, signaling a pivotal moment for one of the world’s most prominent corporate venture funds. The move aligned with the company's broader strategy of optimizing its assets while fostering greater focus and efficiency.

Intel Capital, founded in 1991, has been a cornerstone of Intel’s efforts to drive innovation in the tech ecosystem, with investments exceeding $20 billion across more than 1,800 companies globally. The firm has contributed to over $170 billion in market value over the past decade alone, focusing on areas such as silicon, frontier technology, devices, and cloud computing.

The decision to spin off Intel Capital comes at a time of broader restructuring at Intel. The company has faced significant challenges, including delays in factory projects in Europe and Asia, large-scale layoffs, and the resignation of CEO Pat Gelsinger in late 2024. Gelsinger’s ambitious plans to revitalize Intel through advanced manufacturing and AI technologies struggled to materialize, prompting the company to focus on strategic realignments.

Reuters contributed to this report.