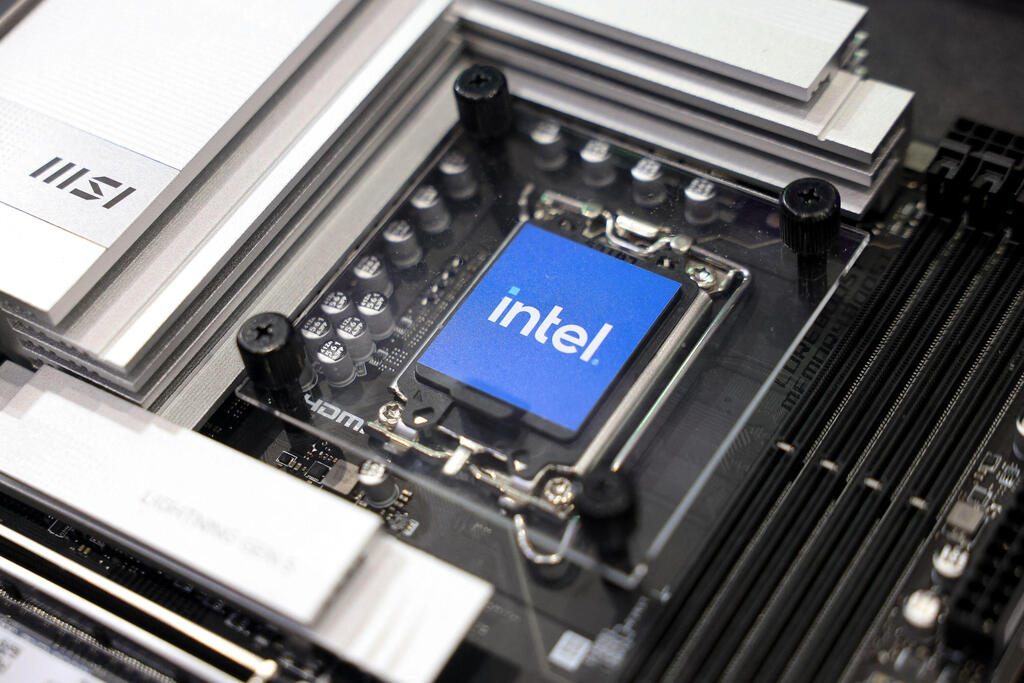

Intel’s foundry spinoff and $7.86 billion subsidy highlight importance of Israeli manufacturing

The chip giant’s restructuring aligns with its ongoing investments in Israel’s advanced semiconductor capabilities.

Intel said on Wednesday its deal for $7.86 billion in U.S. government subsidies restricts the company's ability to sell stakes in its chipmaking unit if it becomes an independent entity. In a securities filing, Intel said on Wednesday the subsidies require it to own at least 50.1% of Intel Foundry if the unit is separated into a new privately held legal entity. If Intel Foundry becomes a public company and Intel itself is not the largest shareholder, the company could sell only 35% of Intel Foundry to any single shareholder before running into change-in-control provisions.

The U.S. Commerce Department announced the subsidy to Intel on Tuesday, part of $39 billion for the sector including Taiwan Semiconductor Manufacturing Co and others in an effort to revitalize chip manufacturing in the United States.

Intel did not immediately respond to a request for comment on the disclosures. A Commerce Department spokesman said the government is negotiating change-in-control provisions with all direct grant recipients.

Intel would need to comply with the restrictions to continue the company's $90 billion worth of projects in Arizona, New Mexico, Ohio, and Oregon and keep manufacturing cutting-edge chips in the U.S., according to the filing. Any changes in control could require Intel to seek permission from the U.S. Department of Commerce, the filing said.

Earlier this year, Intel announced bold measures to address declining revenue and sharpen its competitive edge. Its foundry division, Intel Foundry Services, will operate as a subsidiary, a move designed to attract external investment and reassure potential customers wary of sharing designs with a direct competitor. The subsidiary model aligns Intel with competitors like Taiwan’s TSMC and could provide the flexibility to raise capital independently.

Intel is also consolidating operations, postponing factory projects in Poland, Germany, and Malaysia, and reducing its real estate footprint by two-thirds. These actions follow a $10 billion cost-cutting plan announced earlier this year, including 15,000 layoffs and curtailed employee benefits.

While these moves signal retrenchment, Intel has scored two major wins: a $3 billion contract with the U.S. Department of Defense for defense chip manufacturing and a partnership with Amazon Web Services to co-develop AI chips. Both agreements reinforce Intel’s strategic value in critical industries, particularly as AI drives chip demand.

For Israel, Intel’s restructuring is unlikely to significantly impact its extensive operations in the country beyond the cutbacks that have already taken place, including R&D centers and the Kiryat Gat manufacturing plant. The site, pivotal to Intel’s chip production, could play a key role in the foundry subsidiary’s future.