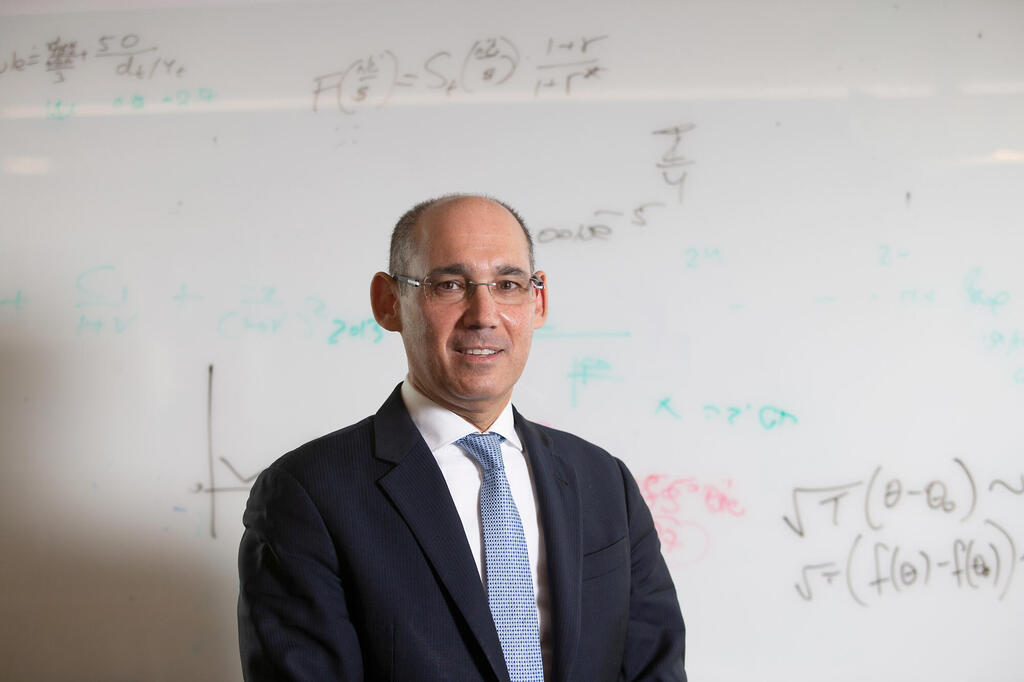

Bank of Israel Governor: “Lowering interest rates now is like putting out a fire with oil”

Amir Yaron highlighted short-term inflation risks and warned against premature monetary easing. “Our baseline scenario assumes one or two rate cuts in the second half of 2025. However, if inflation moderates more quickly, we could act sooner. Conversely, if inflation remains high and sticky, we will need to maintain monetary restraint for longer.”

"The macroeconomic situation in Israel is improving when we take a broader view. We see a revival on the demand side, whether in credit card activity or high-tech activity. The approval of the government budget and the tax measures passed in the Knesset have helped lower the risk premium. While the premium remains high compared to pre-war levels, there is noticeable improvement, which is reflected in the exchange rate and bond spreads. These are, of course, positive developments. However, geopolitical events could arise and challenge the security situation," Bank of Israel Governor Prof. Amir Yaron said on Monday in an interview with Calcalist after announcing the decision to leave the interest rate unchanged at 4.5%.

You mentioned at the press conference that lowering interest rates now is "like putting out a fire with oil." What do you see ahead?

"Looking ahead, we see an improvement in demand, including the impact of fiscal adjustments that place some burden on households—mainly through taxes, which could cool demand. It will take time for supply constraints, caused in part by the war, to ease. The critical question is how quickly the demand curve will shift and, on the other hand, how fast the supply curve will adjust. These are more medium-term issues.

"In the short term, we expect inflation to rise, partly due to taxation measures. However, we anticipate inflation will moderate in the second half of the year. This is the dynamic we included in our baseline scenario."

What assumptions underlie your baseline scenario?

"We assume that fighting will continue at a certain intensity during the first quarter and that we will gradually transition to a more stable security situation afterward. By the way, we project more reserve duty days than in the forecast we published in October.

"However, there is a high degree of uncertainty. There could be geopolitical scenarios that significantly increase risks. On the supply side, constraints could ease more slowly, leading to higher and stickier inflation. Conversely, if the risk premium and geopolitical tensions decline quickly, we could see faster improvement in the exchange rate and inflation moderation."

What does this mean for interest rate decisions?

"This means we must remain data-driven. The uncertainty is very high. Our baseline scenario assumes one or two rate cuts in the second half of 2025. However, if inflation moderates more quickly, we could act sooner. Conversely, if inflation remains high and sticky, we will need to maintain monetary restraint for longer."

Are you concerned that emphasizing expected inflation increases could fuel further price hikes?

"The question is whether VAT and property tax updates will lead to additional price increases. I cautiously believe there will be some increases. The extent of these increases remains to be seen. However, I don’t believe this creates a 'self-fulfilling prophecy.'"

You also mentioned that as the economy improves, the government may feel less urgency to enact sound economic policies. Could you elaborate?

"It’s important to note that the improvement in data, such as the lower risk premium, is not only due to geopolitical developments but also to fiscal responsibility demonstrated by the government. In the updated 2024 budget, we emphasized the need for a committee to review defense spending and for fiscal adjustments tied to GDP. These adjustments, totaling at least NIS 30 billion, were implemented significantly.

"That said, the recovery is gradual, and we are still below pre-war GDP levels. The government must continue its responsible fiscal path to reduce the debt-to-GDP ratio after 2025. This fiscal discipline helps lower the risk premium, strengthens the shekel, and encourages investors to return to Israel."

At the press conference, you cautioned against advancing judicial reforms without broad consensus. What led you to address this issue now?

"We are still in a highly uncertain environment. While the economy has shown resilience, we must avoid introducing additional uncertainty. From an economic perspective, stable institutions are critical for sustained growth and prosperity. Advancing constitutional changes without broad agreement could undermine that stability, and it’s simply not what the economy needs right now."