Momentick secures $5 million to enter insurance space with its emissions risk management solution

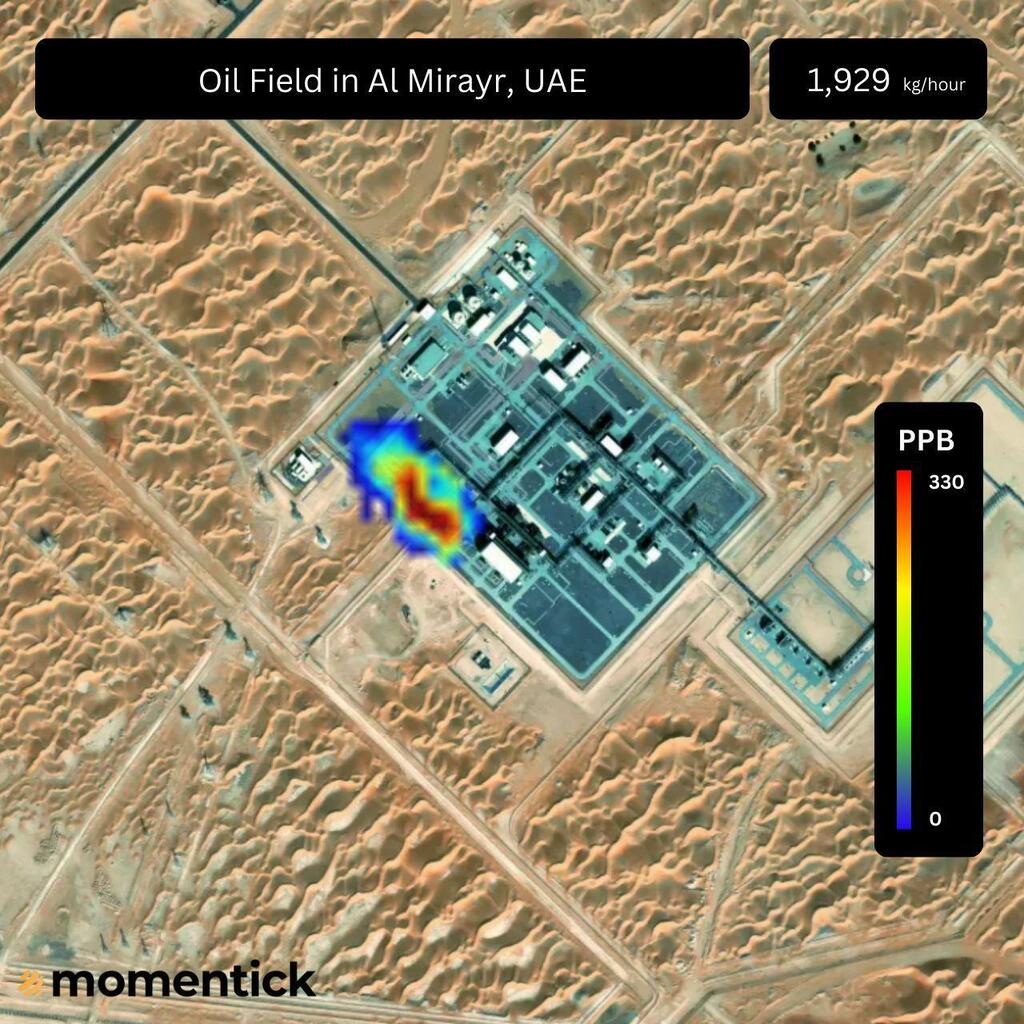

The Israeli startup’s proprietary satellite-based platform delivers precise, global methane detection, enabling real-time emissions monitoring for risk analysis.

Emissions intelligence provider Momentick has raised an additional $5 million to launch emissions risk management solutions for the insurance industry. Led by FinTLV Ventures with support from Menomadin Foundation and TAU Ventures, this funding follows a successful PoC with Sompo Japan.

Momentick’s proprietary satellite-based platform delivers precise, global methane detection, enabling real-time emissions monitoring for risk analysis. The company introduces the world’s first Emissions Risk Management service in collaboration with a leading global insurer, providing tools to evaluate emissions risks and design targeted policies.

"Insurance companies have long struggled with the lack of reliable data to accurately assess the emissions-related risks of energy companies," said CEO and Co-Founder Daniel Kashmir. "Our technology fills this critical gap by providing precise emissions data on a global scale. This represents a groundbreaking step in equipping insurers with the tools they need to evaluate emissions risk and design policies that reflect the realities of a changing climate."

FinTLV’s Gil Arazi highlighted methane’s environmental and systemic risks, emphasizing Momentick’s potential to foster innovative insurance solutions. Menomadin Foundation’s Dr. Merav Galili praised the initiative for advancing sustainability.

Founded in 2020 by Daniel Kashmir, Lev Oren, Dr. Ophir Almog, and Dr. Adam Eshel, Momentick empowers industries to mitigate emissions, develop resilient insurance products, and accelerate the transition to net zero.