Intel foundry goes independent, secures AWS AI chip collaboration and $3B government deal

CEO Gelsinger pushes bold restructuring with AI chip collaboration and plans for self-financed growth.

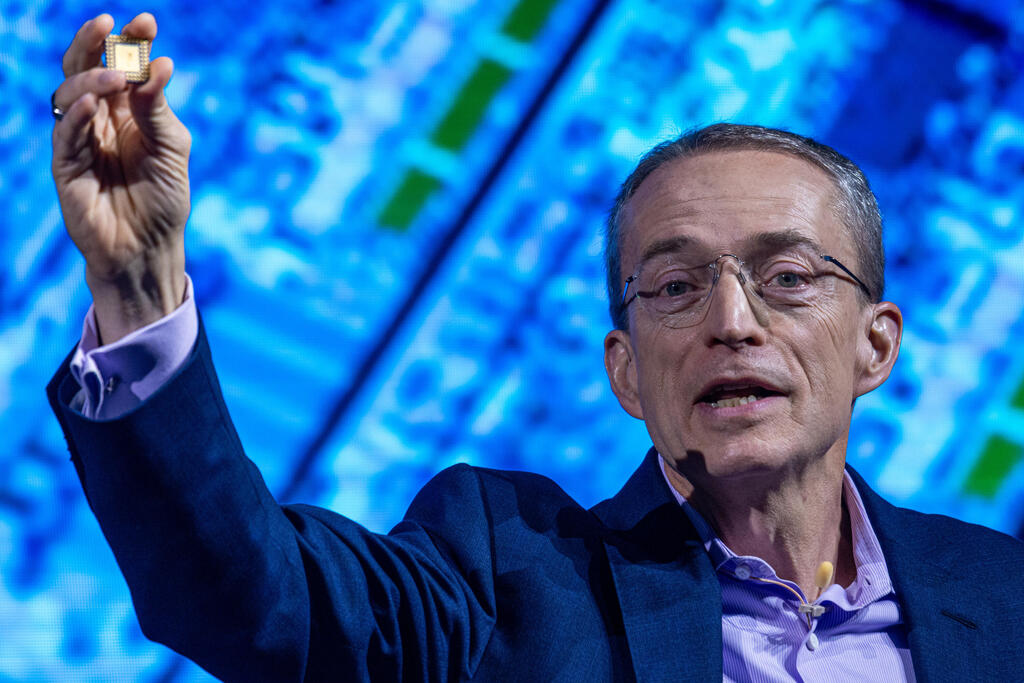

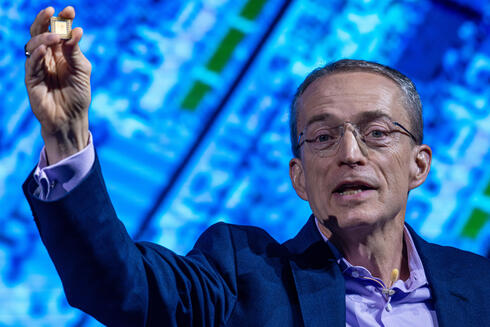

Intel shares jumped about 8% in late trading on Monday after the company's CEO announced plans to spin off its chip manufacturing division into an independent subsidiary within Intel with its own board of directors. CEO Pat Gelsinger explained that the foundry division, which includes the manufacturing plant in Israel, will have the opportunity to "evaluate independent sources of funding."

"All eyes have been on Intel since we announced Q2 earnings. There has been no shortage of rumors and speculation about the company, including last week’s Board of Directors meeting, so I’m writing today to provide some updates and outline what comes next," Gelsinger wrote in a message to employees, in which he also announced a partnership with Amazon's AWS cloud division to develop chips for its artificial intelligence business, as well as securing a $3 billion contract with the U.S. government under the CHIPS Act.

Amazon's AWS cloud computing division already designs several chips for use in its data centers and has hired Intel to package at least one version. Intel will produce an "artificial intelligence fabric chip" for AWS and use the chip maker's 18A process, the most advanced version available for outside customers, the companies said.

Intel said it expects to make additional designs from Amazon on the company's forthcoming 18AP and 14A manufacturing processes.

“To build on our progress, we plan to establish Intel Foundry as an independent subsidiary inside of Intel. This governance structure will complete the process we initiated earlier this year when we separated the P&L and financial reporting for Intel Foundry and Intel Products,” Gelsinger wrote.

“A subsidiary structure will unlock important benefits. It provides our external foundry customers and suppliers with clearer separation and independence from the rest of Intel. Importantly, it also gives us future flexibility to evaluate independent sources of funding and optimize the capital structure of each business to maximize growth and shareholder value creation.”

Intel will also pause its manufacturing operations in Poland and Germany "for approximately two years based on anticipated market demand," Gelsinger said. The chipmaker will also scale back its plans for a factory in Malaysia. U.S. manufacturing projects will not be affected, according to the company.

In the past year, Intel has shed 60% of its stock market value, currently trading at around $89 billion, while seeing competitor Nvidia experience its best year, with a market value nearing $3 trillion. Following its declining performance and a disappointing second-quarter report released in August, Intel announced layoffs of approximately 15% of its workforce as part of a $10 billion efficiency program. According to Gelsinger, Intel has already completed about half of the layoffs.

“Through our voluntary early retirement and separation offerings, we are more than halfway to our workforce reduction target of approximately 15,000 by the end of the year. We still have difficult decisions to make and will notify impacted employees in the middle of October,” Gelsinger explained. “Additionally, we are implementing plans to reduce or exit about two-thirds of our real estate globally by the end of the year.

“As we continue acting with urgency to execute the plan we announced last month, we are also working to carefully manage our cash as we meaningfully improve our balance sheet and liquidity. This includes through selling part of our stake in Altera—which is something we have talked about publicly several times and has long been part of our strategy to generate proceeds for Intel on Altera’s path to an IPO.

“All eyes will remain on us. We need to fight for every inch and execute better than ever before. Because that’s the only way to quiet our critics and deliver the results we know we’re capable of achieving.

“We must maintain our focus on innovation while also becoming an engine of operational efficiency and financial performance that’s built to win in the market.

“As I’ve said before, this is the most significant transformation of Intel in over four decades. Not since the memory to microprocessor transition have we attempted something so essential. We succeeded then—and we will meet this moment and build a stronger Intel for decades to come.”