Innovalve acquired for $300 million in cash by medical device giant Edwards Lifesciences

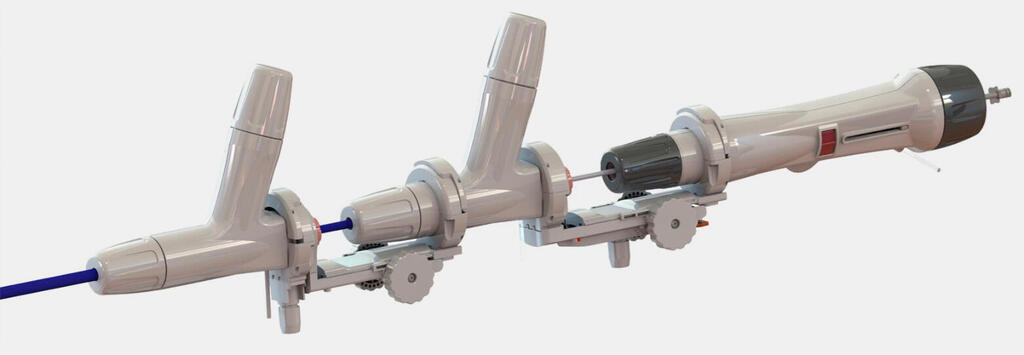

The Israeli startup has developed an artificial mitral valve that can be replaced using a minimally invasive catheter to help treat patients suffering from heart disease.

The American medical device giant Edwards Lifesciences, specializing in solutions for heart disease patients, is acquiring the Israeli technology company Innovalve Bio Medical. According to Edwards, it will pay about $300 million in cash for the Israeli company. The transaction is expected to be completed by the end of 2024.

Founded in 2017 at ARC Innovation in Sheba Medical Center, Innovalve has developed an artificial mitral valve that can be replaced using a minimally invasive catheter to help treat patients suffering from heart disease. Innovalve has received FDA approval to begin clinical studies in humans. To date, more than 40 successful surgeries have been performed with this technology on humans. Edwards has a market cap of around $54 billion.

Innovalve is led by CEO Eyal Bar-Or and Prof. Ehud Raanani, the company's founder and chief scientist. The company, which grew and operates within the heart center at Sheba Medical Center, was established based on an invention by Raanani, who is the Director of Sheba Medical Center’s Cardiovascular and Thoracic Center, and Dr. Boris Orlov, Head of Sheba Medical Center’s Mitral Valve Surgery Unit. In recent years, Innovalve has developed its technology through close cooperation between the company's engineers and the medical team at Sheba.

The company employs about 50 people, all in Israel. Upon completion of the deal, Innovalve will be integrated into the Edwards’ transcatheter mitral and tricuspid therapies (TMTT) product group. Innovalve has raised approximately $30 million since its inception, with investors including venture capital funds ALIVE VC and OurCrowd, as well as private investors. The CBG Group, led by Vincent Tchenguiz, is one of the first and largest investors in Innovalve, directly owning about 5.5% of the company and also investing through the fund's position in ALIVE.

Raanani said in response: "The transplant recipients who underwent the valve transplant using our approach recover very quickly, and the improvement in their condition, including the parameters of the heart's function, continues over time. In light of this, our technology has an excellent chance of treating and saving a very large number of patients suffering from this serious medical problem."

Following the transaction, the ALIVE fund, which focuses on investments in mature companies in the field of medical technology, records its first major Israeli exit. The ALIVE fund was established in July 2020 and raised $110 million. It is managed by partners Prof. Ari Shamiss (Former CEO of Assuta Medical Centers and former Director of Sheba General Hospital), Prof. Rafael Beyar (Former Director and CEO of Rambam Health Care Campus), Michel Habib (former CEO of Hadasit Bio Holdings), and Dudi Klein (Former Head of Ventures and Innovation, Assuta Medical Centers). Currently, the partners in the ALIVE fund are raising a continuation fund to invest in advanced companies in the healthcare field.

Innovalve Bio Medical is one of 12 companies in the ALIVE fund's portfolio. The fund's investors include Leumi Partners, Menora, Carilion Clinic, the CBG Group, and other private, local, and international investors.

"The health system is an engine of economic growth for the Israeli economy, Innovalve's exit joins other Sheba companies acquired in recent months by international biomed giants, which have repeatedly expressed confidence in innovation coming out of Sheba," said Prof. Yitshak Kreiss, Director General of Sheba Medical Center. "These achievements are made possible thanks to ARC – Sheba's unique innovation platform, which encourages the development of groundbreaking technologies through the combination of technological entrepreneurship and extensive clinical knowledge and experience, at the patient's bedside. Soon we will see more and more deals of this kind, the fruits of which strengthen and develop the public health system. This is a real revolution that transforms the health system, which for years had to budget for the state, into a factor that generates significant revenues for the Israeli economy."