How did an Israeli startup's valuation plummet from $5 billion to $50 million?

In June 2021, Aquarius Engines celebrated the signing of an agreement with multinational Kampac International (KIP) to sell 10% of the company’s shares at a $5 billion valuation. However, KIP never exercised the option and Aquarius is now traded on the Tel Aviv Stock Exchange at a valuation of less than $50 million

The nature of dreams is that many of them do not come true. But sometimes not only do they not come true, they shatter. As of today, this seems to be the case with Aquarius Engines.

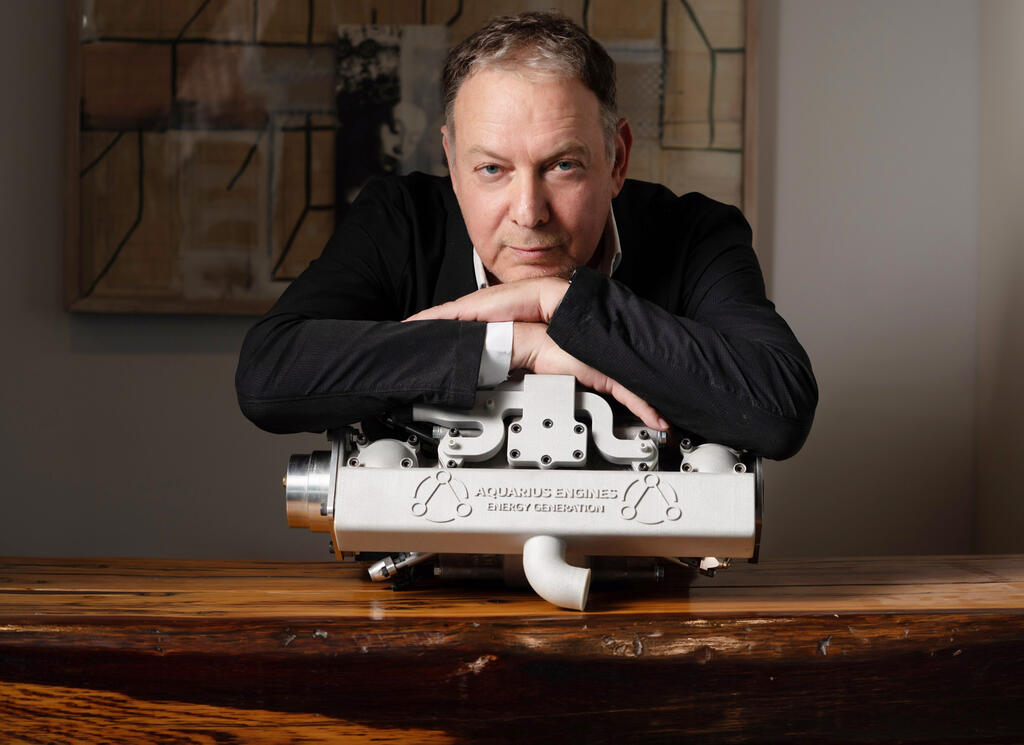

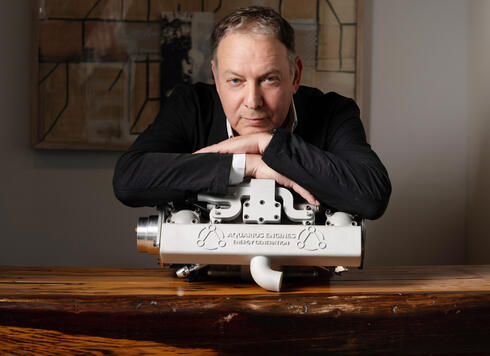

In June 2021, Aquarius, which develops a lightweight linear engine based solely on hydrogen gas, announced that it had signed a memorandum of understanding with the Dubai-based Kampac International (KIP), which includes, along with an agreement on the establishment of a manufacturing plant in the United Arab Emirates, an option to purchase up to 10% of Aquarius shares at a company value of $5 billion. This was while the company was being traded on the Tel Aviv Stock Exchange at a value of about NIS 1 billion. KIP received the option to purchase the shares within 14 months.

Aquarius celebrated the event, but last summer the option expired without being exercised at all. In fact, since the option was granted, Aquarius shares have lost 87% of their value and the company currently has a market cap of only NIS 166 million (approximately $48 million) - far from the value it dreamed of, far from the peak value it reached in February 2021 (NIS 1.75 billion) and also far from the value when it went public (NIS 860 million). As part of the IPO, Aquarius raised NIS 215 million from the public, so that it began trading on the Tel Aviv Stock Exchange at a value of approximately NIS 1 billion.

Aquarius went public as part of the big wave of IPOs which was fueled by the low-interest rates and liquidity injections by the central banks. During 2020 and 2021, about 100 companies joined the Tel Aviv Stock Exchange.

This wave attracted quite a few dream companies into the stock market. These are companies that presented innovative technological ideas, but alongside them did not present revenues. Those companies benefited from the cheap money held by the investors and the enthusiasm for innovative technological ideas, especially those designed, such as the developments of Aquarius, to replace polluting products.

Aquarius still has no revenue and its product - a lightweight linear engine based solely on hydrogen gas - is still in development. During the years 2019-2021, the company lost a cumulative $36 million, and during the first nine months of 2022, it lost an additional $18 million. The bulk of its expenses are R&D expenses, which reached $10 million in the first nine months of 2022.

Because of this, the option agreed upon with KIP in June 2021, according to which Aquarius will be valued at $5 billion, raised many eyebrows among market players. At the time, Aquarius was traded at a value of only NIS 973 million, 44% less than the peak value it reached just four months earlier - NIS 1.75 billion.

The company reached its peak value after signing a memorandum of understanding for cooperation with the Japanese Musashi Group in late January 2021.

As part of the memorandum of understanding that Aquarius signed with KIP, the two also agreed on the establishment of a production facility based on the technology that Aquarius is developing. The site was set to be built in the United Arab Emirates, with KIP agreeing to raise $1-1.2 billion towards its establishment.

Aquarius said in response to the article: "The share price, which is derived from the collapses in the market, does not reflect the company's situation and even creates a distortion. The company is at its peak and has the potential to become one of the largest companies in the world in its field.”