Wiz leads the way: The top 10 biggest Israeli tech acquisitions of all time

Google’s record-breaking $32 billion deal set the standard, but just months later was followed by CyberArk's $25B acquisition by Palo Alto.

Israel’s tech industry has long been a powerhouse of innovation, producing companies that redefine global markets. Over the years, some of the world’s largest technology firms have turned to Israel to acquire cutting-edge solutions, with deals that have reshaped industries from cybersecurity to autonomous driving. Now, with Google’s record-breaking $32 billion acquisition of Wiz, the Israeli tech ecosystem has reached an unprecedented milestone, more than doubling the previous largest exit.

The following list highlights the biggest acquisitions in Israeli tech history, each marking a pivotal moment in the country’s rise as a global technology leader.

1. Wiz’s acquisition by Google – $32 billion (2025)

Wiz, the Israeli-founded cloud security company, became the biggest exit in Israeli tech history when Google’s parent company, Alphabet, acquired it for $32 billion. The deal reflects Google’s push to strengthen its cybersecurity capabilities and compete with Microsoft and Amazon in cloud security. Founded in 2020, Wiz rapidly became a leader in securing cloud environments, attracting top-tier customers and investors before sealing this historic acquisition.

2. CyberArk's acquisition by Palo Alto Networks - $25 billion (2025)

Just a few months after the acquisition of Wiz by Google, CyberArk registered the second largest exit in Israel history when it was bought by Palo Alto Networks for $25 billion. The price represented a 26% premium over CyberArk’s Wall Street valuation. Founded in 1999 by Alon Cohen and Udi Mokady, CyberArk predates Palo Alto, which was founded in 2005. Mokady served as CEO until recently and now chairs the board. CyberArk employs nearly 4,000 people, including 1,000 in Petah Tikva.

3. Mobileye’s acquisition by Intel – $15.3 billion (2017)

Mobileye, the pioneer in autonomous driving and ADAS (advanced driver-assistance systems), was acquired by Intel in 2017 for $15.3 billion. Founded in 1999, the Jerusalem-based company revolutionized vehicle safety with its vision-based systems and sensor technologies. Intel’s acquisition of Mobileye reshaped the landscape for autonomous vehicles and solidified Israel’s prominence in the future of mobility. Mobileye was publicly traded before Intel bought it and the chip giant floated its shares once again in 2022 in an attempt to raise much needed funds.

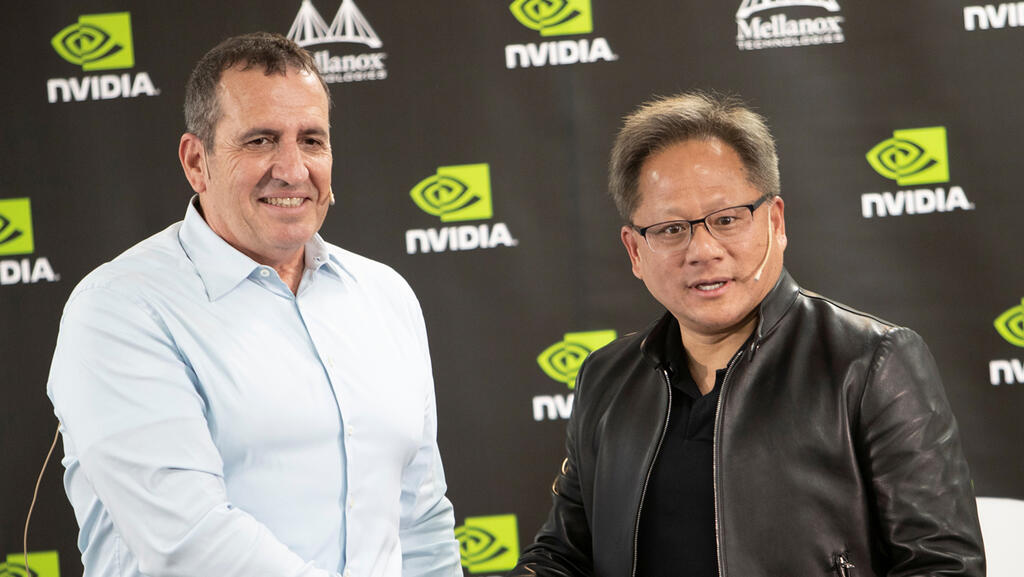

4. Mellanox Technologies’ acquisition by Nvidia – $6.9 billion (2020)

In a deal valued at $6.9 billion, Nvidia acquired Mellanox Technologies in 2020, expanding its portfolio of high-performance computing solutions. Founded in 1999, Mellanox specialized in networking products that powered data centers and supercomputers. The acquisition allowed Nvidia to strengthen its position in the data center market, a strategic move to cater to the growing demands of AI and cloud computing. Nvidia went on to become one of the world's most valuable companies, currently trading at a valuation of over $3 billion.

5. NDS Group’s acquisition by Cisco – $5 billion (2012)

In 2012, Cisco acquired NDS Group for $5 billion to bolster its video and content delivery technology. Founded in Israel, NDS was a leader in video encryption and content security. The deal helped Cisco enhance its services for pay-TV operators, allowing it to compete more effectively in the growing global video distribution market.

6. Chromatis Networks’ acquisition by Lucent Technologies – $4.5 billion (2000)

Lucent’s $4.5 billion acquisition of Chromatis Networks in 2000 was a landmark event in the optical networking market. Chromatis, which develops networking solutions, helped Lucent expand its product offerings during the dot-com boom. The acquisition was meant to strengthen Lucent’s presence in high-capacity fiber-optic networks, providing telecom companies with cutting-edge tools to meet skyrocketing internet demand.

7. Mercury Interactive’s acquisition by HP – $4.5 billion (2006)

In 2006, HP acquired Mercury Interactive, a leader in business technology optimization software, for $4.5 billion. Founded in 1989, Mercury helped enterprises optimize IT infrastructure. The deal allowed HP to extend its reach in software services, marking a key shift toward enterprise software and services in addition to its hardware business.

8. Galileo Technologies’ acquisition by Marvell – $2.7 billion (2001)

Marvell’s 2001 acquisition of Galileo Technologies for $2.7 billion positioned the company as a major player in semiconductor networking solutions. Galileo, based in Israel, specialized in chip technologies that supported networking, storage, and telecommunications infrastructure. This acquisition allowed Marvell to expand into communication semiconductors, capturing a growing market in broadband communications.

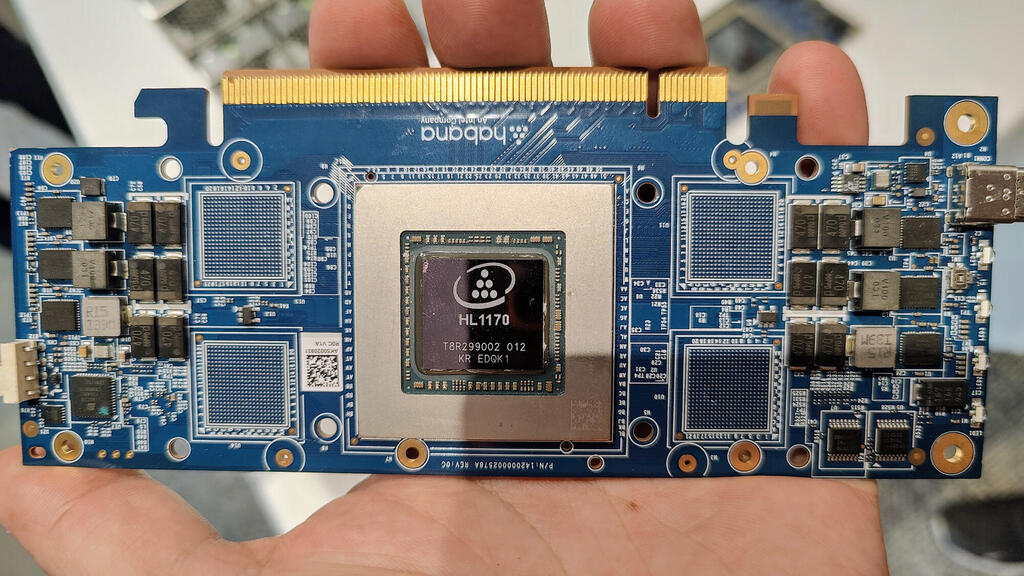

9. Habana Labs’ acquisition by Intel – $2 billion (2019)

Intel acquired the AI-focused chipmaker Habana Labs in 2019 for $2 billion, aiming to diversify its portfolio in the rapidly growing AI and data center markets. Founded in 2016, Habana’s processors for machine learning workloads offered significant performance advantages. The acquisition reflected Intel’s goal to strengthen its competitive position against rivals like Nvidia and AMD in the AI hardware space. However, Intel struggled to leverage the acquisition and has since moved away from its original vision of Habana as an independent AI brand, casting further doubt on the future of its roadmap.

10. Own (formerly OwnBackup) acquisition by Salesforce – $1.9 billion (2024)

In 2024, Salesforce acquired Own, a data protection and management company, for $1.9 billion. Founded in 2015, Own specializes in providing solutions for backup, disaster recovery, and data protection. With this acquisition, Salesforce aimed to enhance its offerings in the rapidly growing cloud computing and enterprise software markets, reinforcing Israel’s growing role in global data management innovation.

First published: 15:36, 18.03.25