"The AI revolution is ten times bigger than the mobile revolution"

Legendary investor Shmil Levy, a former partner at Sequoia Capital, took a very unconventional route to the top. In an in-depth interview, he shares how the immigrant boy who dreamed of a military career and survived a near-fatal battle wound rose to become a leading venture capitalist and why it is so important for him to integrate ultra-Orthodox men into Israeli high-tech

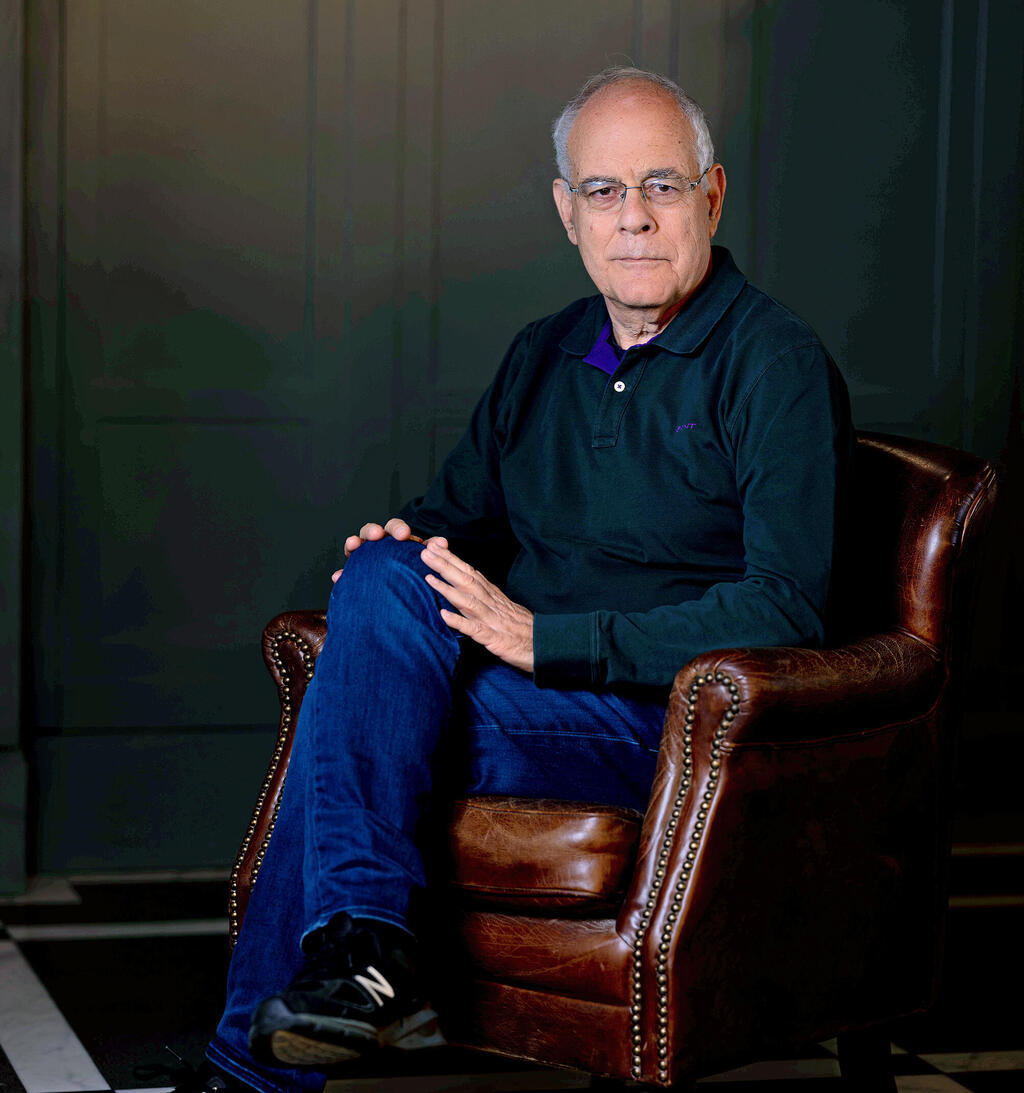

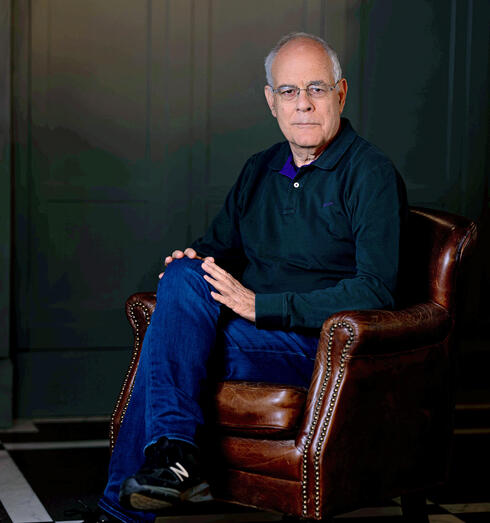

At first glance, it is difficult to recognize in Shmil Levy, a veteran of the Israeli venture capital legend, the "killer instinct" that characterizes his sector. The meeting with him takes place at the offices of Israeli startup Vim, which Levy invested in through global venture capital giant Sequoia Capital when it was still operating in Israel as an independent entity. The colorful design of the company's offices is at odds with Levy's measured appearance, whose speech inspires calm and whose look transmits analytical rationality.

But the calm speech can be deceiving. Levy (70) was once considered one of the leading venture capitalists in the world, among the first Israelis to be included in Forbes magazine's list of 100 venture capitalists with the "Midas Touch". He became a key figure in the venture capital industry in Israel when it was still in its infancy. Levy founded, together with his partner Haim Sedgar, the Israeli branch of Sequoia. They did this during one of the most difficult periods in local high-tech history, just after the bursting of the dot.com bubble, and reaped impressive successes.

But Levy's abnormality in the venture capital world goes beyond the tone of his voice or outward appearance. It begins on the very unusual path taken by someone who immigrated as a child from Egypt and grew up in a working-class family in Be'er Sheva, and went on to reach the top of the venture capital world. "I immigrated to Israel in 1957, aged three, after the Suez War," says Levy. "My father worked in accounting at the Harsa ceramics factory, and my mother was a secretary at a school. I grew up in a home without money."

What did that mean?

"I remember that it wasn't every day you could buy a newspaper, for example. There was always enough food, but the expenses were very calculated and measured. This was not unusual, it was also like that at my friends' houses."

What language did you speak with your parents?

"They understood Arabic and knew how to speak it, but the spoken language at home was French and I have been speaking the language ever since. From a young age I always chose the most difficult path possible. In high school I went to a boarding school at the Herzliya Hebrew Gymnasium, I was in the same class as Gabi Ashkenazi (Chief of General Staff, 2007-2011), who is a good friend. From there I enlisted in Sayeret Matkal (special reconnaissance unit of Israel's General Staff) on the way to a military career. Ehud Barak was then the commander of the unit and Yoni Netanyahu (brother of current PM Benjamin Netanyahu) was his deputy."

The Yom Kippur War broke out when Levy was 19 and was a forced turning point in his career. "We made it through the canal and I was seriously injured by a grenade that tore my main artery," he recalls. "It was impossible to do a tourniquet there, the medic was busy with the wounded, we were under fire, so the first soldier in the team who saw me pressed his fist on me to stop the bleeding. That's how they transferred me from one to the other, each time someone else put their fist, until I got to a field hospital and they sewed up my artery. I arrived at Beilinson Hospital unconscious and the one who saved me was surgeon Maurice Levy. Many stars had to allign for me to live."

What do you remember from serving under Barak and Netanyahu?

"Ehud Barak was an amazing unit commander. A genius who thinks completely outside the box. Original, very smart, doesn't hesitate. I remember Yoni Netanyahu came to visit me after the injury and left my mother a note with a phone number in case she needed anything. When he was killed it was a great pain, as if they punched you in the stomach and you can't breathe. Unfortunately, this was not the first loss I experienced, and it still came as a surprise."

And you didn't stay in the army.

"The injury cut short the dream of a military career, so I went to study. I didn't know what to choose, and I asked my parents what was the hardest option and they answered 'electrical engineering', so that's what I went for. After school, I worked in development at the Israel Aerospace Industries, on the world's first drone project. They sent me to study at Boeing. I returned to Israel for the Lavi project and worked there for six years until they closed it due to American pressure. It was very sad."

How was a young engineer from Be'er Sheva chosen to establish the Israeli branch of investment giant Sequoia?

"Things unfolded. After IAI, I was VP of development at Lannet, which dealt in data communications. After it was acquired by Madge, I became CEO, two years later I sold it to Lucent, and in 1998 I was sent to the United States to manage 5,000 people involved in its data communications. At the end of this chapter, I wanted to start a startup, but it was not a good time. The dot.com bubble burst and investments stopped.

"It was then that Sequoia approached me and Haim Sadger, introduced us and suggested that we establish a dedicated fund for it in Israel, which would be the first place Sequoia would enter outside of the United States. I thought to myself, 'In such a dramatic period, when venture capital investments have stopped and there are no foreign funds in Israel, to bring the leading fund in the world to Israel would be super significant'. And I went for it."

"In venture capital, everyone is an ‘alpha"

Sequoia under Levy and Sadger raised five funds in Israel that invested in about 100 high-tech companies, mainly in the Seed stage, to the extent of at least one billion dollars. These investments yielded Sequoia a series of dream exits with Israeli companies. The fifth and last fund, for example, invested in Assaf Rappaport's cyber company Adallom, which was sold to Microsoft in 2015 for $320 million; In the insurtech company Lemonade, which was issued in 2020 at a value of $1.7 billion; And in Moovit, which was sold to Intel in the same year for a billion dollars. This fund is also invested in the fintech security company Forter and the startup BigPanda, who were valued at billions in their latest fundraising rounds. "A good investor must be analytical and rational," says Levy, "but if you invest in the first stages of companies, you also need a good intuition for people and what is going to happen in the market. A sort of 'crystal ball'."

And you're not the only one competing for investments.

"Everyone in venture capital is an ‘alpha’ who wants to get the best deal there is. It takes all your drive, competitiveness and achievements. Because otherwise, why should it be you?"

Why indeed? You had experience in managing companies but you were never an investor. How does one begin?

"I asked for mentoring, and the person who became my mentor was Don Valentine, who founded Sequoia in the seventies, built it as one of the first and most successful funds in Silicon Valley and is considered a legend in the field. I went to him ten times a year, for ten days each time. Sequoia is the fund where you work the hardest to succeed. You learn to check everything before investing, countless checks on the entrepreneurs, up to the level of talking to the entrepreneur's teachers in high school. But the difficult part is actually after the investment, in dealing with the CEOs of the startups.

"Valentine taught me that with a CEO you have two options: empower them or replace them - and it's better to empower. That's why in a room with other people you don't go after them, but when doing a one on one you don't take it easy on them. You can brainstorm with them, but in the end the decision is theirs. You as an investor help yourself to help them build a company, but you don't try to show that you are smarter than them and put yourself in their shoes. It's also okay that they make a mistake and learn from it."

Sequoia Global had success with the internet giants in their prime, after investing in, among others, Yahoo, Google and WhatsApp. In 2016, it decided to close the Israeli branch and continue investing in companies in Israel through its main fund - and Levy continued as a private angel.

Did the Sequoia concept in Israel fail?

"Not at all, there were very big successes here, but some of them competed with Sequoia USA's investments and a conflict of interest arose."

In what cases?

"For example, in the case of Adallom. Assaf Rappaport was sitting in Sequoia's offices in the United States, where they helped him bring senior executives in the industry to the board, and suddenly the CEO of Skyhigh, his toughest opponent, entered the office, because Sequoia Global wanted to invest in him. It didn't suit us, and Sequoia asked itself how to prevent competition between the main fund and the one that operates in Israel. That's how they came to the decision to invest in Israeli companies only through the main fund."

Why not set up a new fund like your former partners?

"I grew up in a home with no money. I have enough money and beyond a certain amount it doesn't matter how much you have anymore. The civic appetite began to prevail over the business one, and after 20 years I decided to give something back to the state."

"Ultra-Orthodox men are critical"

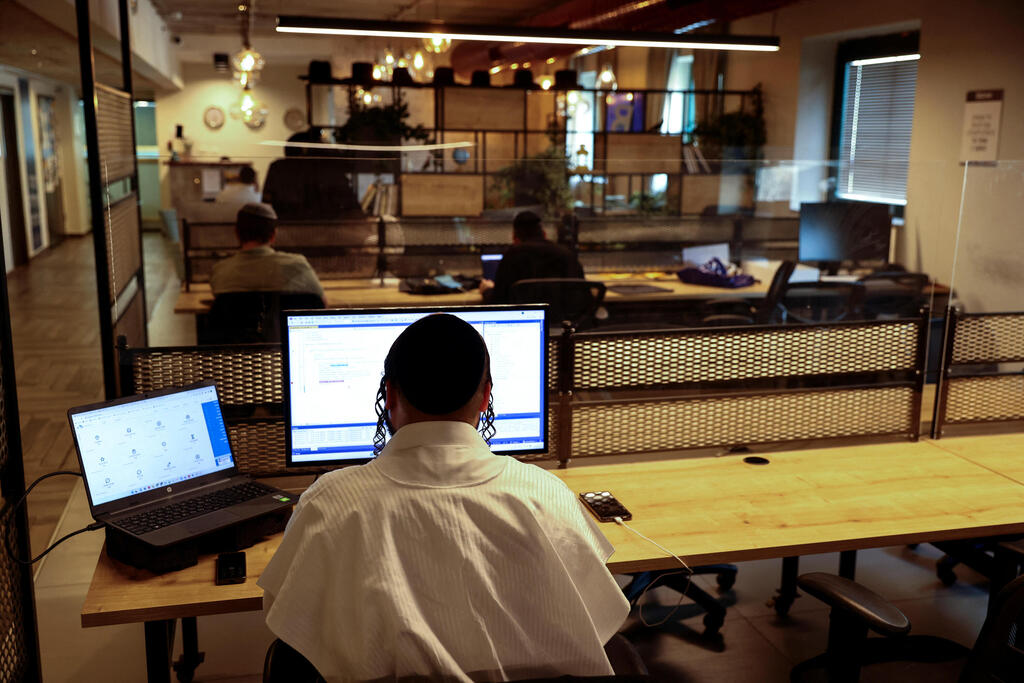

Levy's way of giving back to the country is through investing in integrating ultra-Orthodox men into high-tech. He is a member of the advisory board of JBH, (Jewish Brain in High-Tech. Formerly known as Avratech), a program for training the ultra-Orthodox for high-tech professions initiated by Rabbi David Label. He is also an investor in RavTech, a company that takes in Avratech graduates, whose chairman is Benny Levin, one of the founders of NICE. Another initiative called Kodkod is done in collaboration with the army, in which ultra-Orthodox men are selected to complete educational gaps, enlist, take a software course in the army and serve in elite units such as 8200 and Prisma. "Today, getting up in the morning and knowing that I am doing something important is the most important thing. For me it's about our country, the country I grew up in and was wounded for."

And why specifically ultra-orthodox men?

"I am trying to prove what is happening all over the world, and that is that you can be ultra-Orthodox and also work. In ultra-Orthodox society, it is customary for the wife to work and support her husband so that he can study, but if the ultra-orthodox men continue not to work, it will be a serious problem that will lead to an explosion, and either civil war or a collapse. Today they are 10% of the public, when we reach 30% who will not work, we will no longer be able to bear this burden. Orthodox men have to work in all professions, but high-tech suits their way of studying and thinking. I tell them: stay Orthodox, keep your faith - just go to work.

"The great problem of the State of Israel is unity, and the inequality creates a lot of enmity between the camps and harms unity. This leads to a point where my good friends are angry that I am actually helping the ultra-Orthodox. I answer them that this is self-help, because the State of Israel must take care of the heart of one of its biggest problems.

"I accompany hundreds of ultra-Orthodox people who already work at Elbit, at Check Point, at NICE, at companies that I invest in such as Personetics, also at Venn.

"Then they tell me there, 'It's a shame we waited so long.' It is easy to absorb people who are similar, and sometimes you want (to absorb ultra-Orthodox) but there is a reluctance. It is important to know that the set of rules for men is more flexible than women in terms of separation, and they have no problem mingling or having a female boss."

"A miss on Waze, a correction in Moovit"

Have you given up on the world of investments?

"I still do some angel investing and sit on five boards of companies we invested in through Sequoia. I unusually joined Venn as an active chairman, a company that does good for humanity and works to bring communities together."

And Sequoia gave up on Israel?

"Sequoia continued to invest here long after it closed its Israeli branch. Who invested in Wiz? Gili Raanan’s fund together with Sequoia. I was the one who introduced them to three companies that they invested in. Sequoia invests a lot here even without an independent fund in Israel."

Do you personally miss the IPO or the exit?

"I hope Forter, for example, will be such a company, but I think it's a mistake to go public at the wrong time. And I'm not going to sell my shares in the IPO, because I learned from Sequoia that the IPO is not the exit. Sequoia makes more money on the companies after the IPO than during the IPO, in which it does not sell shares."

And why did you choose to invest in Forter and not Riskified?

"Because Forter, in my opinion, is better than Riskified. It is pure technology, without a human being in the security loop. Riskified made a mistake in going public, it limits them (the company was issued in New York in 2021 at a value of $3.3 billion, and is currently traded at a value of less than a billion dollars). An IPO is not an exit, it's a matriculation certificate to move on. What happened to Palo Alto Networks after the IPO? It increased 25 times in value. One of the mistakes of companies in Israel is that they IPO too early."

How about unicorns? Are you invested in any?

"Yes, and that doesn't interest me. Forter and BigPanda are unicorns, because many companies have become unicorns, perhaps not rightly so. What is interesting is if you managed to build a company that will last for years, bring value and sell in the hundreds of millions. If you don't believe that a company can be big, sell it. I don't despise the unicorn culture, on the contrary. These are entrepreneurs who took advantage of an opportunity to raise money at a high value. I also encouraged my companies to raise money during a hype. But the value set in the fundraising is only a point in time. As an entrepreneur, I would not be blinded by it."

Are there any companies that you missed out on and you beat yourself up over them?

"You don't need to cry about companies you didn't invest in, because there are enough companies you invested in to cry about. I missed Waze three times because I couldn't understand its business model. It was my mistake as an investor, because it was sold to Google for a billion dollars and I didn't make the money I could for investors".

It really didn't have a business model.

"My argument about a business model was correct but not relevant, because it turned out that it was possible to make money from the sale. On the other hand, we invested in Moovit, which was sold for a billion dollars, so we corrected it. If I had been successful in all the investments, it would have meant that I did not take enough risk. We invested at a very early stage in over a hundred companies, 70-60 of which was money pre-Seed (the first money that entered the company). I can be happy and say that the average in the industry is that one out of six startups are successful, and with us it was one out of two."

While the American economy recovered from the increase in interest rates in 2022 and the global recession, which significantly damaged the demand for technology products, the Israeli economy is still faltering due to the effects of the judicial reform on investments, and then the war in the Gaza Strip - which, paradoxically, reduced the risk that the government would continue to promote the unilateral legislative moves. According to Levy, "the reform is more harmful to investments than the war."

Some people think the reform is dead.

"I hope so, but I haven't heard Justice Minister Yariv Levin say that yet. The war is a point in time and everything will go back to what it was. It will take another two or three months and it will be over. The reform drove away American investors, who were afraid of the legal system in case a problem arose - and it happened at the worst time. All the funds had reduced their activity anyway because it was difficult to raise money, so the first thing is to cut in the Middle East. Since then in the United States investments have increased again, but not in Israel. In your eyes the reform may be dead, in the eyes of the world it has not been proven yet. And there is also a war."

Must there be a clear statement that the reform is done?

"We need a statement like this, for us. Although we continue to invest in new companies here, but more slowly than the rest of the world. That's why a statement that the government's plan is dead, gone and won't come back, is critical. It will help the money to return."

Today, as an angel, you are invested in Aim Security and Clarity. Why?

"AI deep fakes are a huge problem. Clarity helps you check if what you're about to post is true or not, because AI's ability to create fake content is so high. It has done a great job of proving which of the October 7 videos are real and which are not. Aim secures organizations in the GenAI sector. It protects their data and prevents GenAI from accessing information is shouldn't be. These are investments designed to prevent abuse of this technology, so that humanity can benefit from its contribution. The AI revolution is ten times bigger than mobile, and this is an understatement."

What are you staying away from?

"From the medical field, where we invested and I was very disappointed, unfortunately. We made amazing investments in five companies in Israel, which progressed, but not in value. Companies in the medical field take an infinite amount of time to mature, and in the end the value is very small."

For example?

"Most people of a certain age need glasses. We invested in the company Orasis, whose development was eye drops that provide focus for 12 hours. It received FDA approval after eight years, approved drops for 12 hours that most people in the world need. But it will sell for several hundred million dollars, while if it was a cybersecurity or cloud company it would have been a unicorn long ago."

As a seasoned investor, which investment should you enter?

"I've learned to invest in what I understand. Many who happen to be successful in their investment think they know how to invest, but it's like gambling in Vegas. That's why by definition I don't invest in what I don't understand, or involve a partner who does. If you don't understand it, don't invest in it."

Are you currently involved in your hobby of filming documentaries?

"I like to capture the moment, I always have, but I've had time in recent years," says Levy and shows a photo from an African village. "It's classic, there is a puddle here and children are playing. One of them jumped over it and I shot it."

Seizing the moment is the essence of investing. Is it possible to catch the exact moment to enter or exit the market?

"The industry works in a cycle, and you mustn't delude yourself that you know when it starts and when it will end. On Wall Street they say: only pigs get slaughtered. Who is slaughtered? The one who tries to buy at the lowest market and sell at the highest market. That's why I say you shouldn't do super-optimization: When you're in a high cycle, you'll raise money for your companies even if you don't need it, but you'll invest less as an investor. And in a low cycle, you'll invest in young companies. It's no coincidence that Sequoia, a super sophisticated fund, entered Israel in 2001 after the bubble burst. Good investors come when the market is in a slump. You need courage, because the natural tendency is the opposite, and the conclusion is not to go with the herd."

You’re already a grandfather to eight grandchildren, what have you learned about life at the age of 70?

"I've always looked at the age of 70 as some kind of end. When you hear on the radio that a 70-year-old has been killed in a car accident, you say, 'it’s not so bad.' But I see so many more things I still want to do, that I try to ignore the age and keep busy day and night. I didn't set up a fund, and it's not because I ran out of gas. There are things that are more important to me today than making more money."