The Magnificent Seven won’t carry the S&P 500 forever, Goldman Sachs warns

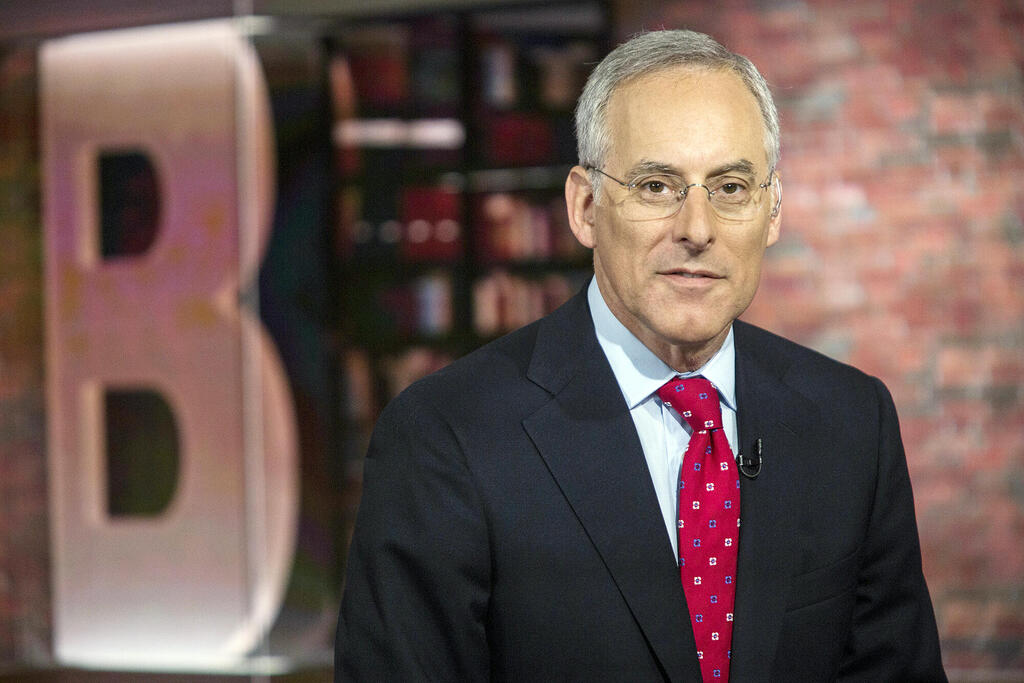

David Kostin, chief US equity strategist for the investment bank Goldman Sachs, predicts broader stock gains as AI giants’ growth moderates.

Americanism is the central motif and leading thesis of David Kostin, chief U.S. equity strategist at Goldman Sachs, in analyzing and predicting Wall Street’s expected behavior. It could be said that the glorification of the U.S. and its uniqueness among nations derives from the very nature of Kostin's role and, more broadly, from Donald Trump's victory in the recent presidential election. However, the stock market's performance over the past 15 years supports Kostin's view.

The U.S. stock market is entering its third consecutive year of gains, but according to Kostin, this should not prevent it from climbing another 7% by 2025.

“The S&P 500 index will rise by 7% to 6,500 points by the end of this year, and we are not concerned about last week’s volatility because our forecast is based on financial reports and corporate earnings rather than valuation multiples,” says Kostin in an exclusive interview with Calcalist during a week in which Wall Street saw mainly declines, driven by anticipation for Nvidia’s earnings report. Nvidia, the company fueling the artificial intelligence trend, released its results late Wednesday night. The S&P 500 fell 1% last week and ended February down 1.4%, largely due to concerns over potential new U.S. tariffs. For Kostin’s forecast to hold, the index will now need to rise 9% over the remainder of the year.

Kostin arrived in Israel for a three-day visit to meet with local institutional investors and funds, as he does annually. However, last year’s visit did not take place due to the war that began on October 7, 2023, which has yet to conclude.

“We stick to our model and don’t assign real weight to geopolitical fears. Our model shows that U.S. GDP will grow at a rate of 2.5%, inflation is expected to be 2.5%, and most companies grow at the rate of nominal GDP—around 5%. Corporate operating leverage enables growth of 6%, and stock buybacks further boost earnings per share. Since buybacks reduce the number of outstanding shares, profits are divided among fewer shares, leading to a total projected growth of 7%, which is precisely our forecast for the S&P 500’s increase,” explains Kostin.

Did you build your forecast for the current year before or after the presidential election?

“We made it in November 2024, immediately after the election results were known. But as I mentioned, we focus primarily on corporate performance. Since the election, there has been enthusiasm and positive developments in business activity, especially among small businesses that anticipate deregulation under the new administration. On the other hand, there is also increased uncertainty regarding policy direction. So while there is optimism, it is tempered by uncertainty.”

How concerned are you about Trump’s proposed tariffs, which could reignite inflation globally? That risk is not factored into your model.

“If the U.S. imposes the tariffs Trump has proposed, corporate profits could decline by 1%-2%. However, at the macro level, the economic impact would be felt primarily in 2026, so our forecast for the S&P 500 in 2025 remains unchanged. Moreover, it’s still unclear whether these tariffs will materialize—Trump has made statements, but there seems to be room for negotiation. Overall, the expected impact on corporate profits is relatively limited. It’s also important to remember that 70% of total sales by U.S. companies occur domestically. In sectors like pharmaceuticals, that figure rises to 80%, and the financial sector is largely domestic as well, making tariffs less significant for these industries.”

What role does geopolitics play in your outlook? Could a resolution to the Russia-Ukraine conflict or stability in the Middle East boost the stock market?

“It’s difficult to quantify the exact impact of geopolitical events on corporate earnings. These developments tend to affect market valuation levels more than underlying earnings. If uncertainty declines, valuations could rise. But in our model, tariffs remain the primary uncertainty factor.”

Your forecast does not make stocks particularly attractive compared to the risk-free 4.5% return in the bond market. At the same time, U.S. market valuations are historically high. Are you concerned about continued stock market gains in this environment?

“Over time, stock market performance is driven by corporate earnings rather than valuation multiples. Given the current economic environment and known macroeconomic data, corporate performance is expected to improve, supporting continued stock market gains this year.

“Is there more risk due to market concentration? Yes. Seven companies now account for a third of the S&P 500’s value. However, these companies have invested heavily in research and development, are benefiting from the AI boom, and have consistently outperformed. Their dominance reflects fundamental strength rather than market distortion. This outperformance is at the heart of what we call ‘American exceptionalism’—the superior performance of the U.S. stock market compared to the rest of the world over the past 15 years.”

How do you explain Wall Street’s significant outperformance relative to other global markets?

“American companies generate higher earnings and faster profit growth because they invest more in their businesses. Many companies have strong cash flows, and the key question is how they use them. U.S. companies—especially the ‘Magnificent Seven’ (Apple, Nvidia, Alphabet, Meta, Microsoft, Tesla, and Amazon)—reinvest a much higher share of their cash flow into growth than their international peers.

“The average S&P 500 company reinvests 42% of its cash flow into growth, while the Magnificent Seven reinvest 56%. In contrast, companies outside the U.S. invest just 26% of their cash flow into growth.”

The Magnificent Seven have carried much of the S&P 500’s performance. Are their stocks overvalued?

“I don’t believe they are excessively overvalued, but I do think their outperformance relative to the rest of the market will moderate. They will still outperform because they are growing faster, but their earnings growth premium over other companies is shrinking.

“In 2024, their earnings grew by 36%, while the rest of the S&P 500 saw just 4% growth. In 2025, the Magnificent Seven’s earnings growth is expected to decline to 15%, compared to 9% for the other 493 companies. This means their premium has fallen from 32% to just 6%. Additionally, these companies are more exposed to global markets—50% of their revenue comes from outside the U.S., making them more vulnerable to potential retaliatory tariffs.”

Will market concentration decrease? Are other sectors poised to lead gains?

“Yes. The healthcare sector, for example, is currently trading at its lowest valuations in 30 years due to political uncertainty. The materials sector also offers potential upside, as commodity prices have risen, yet related stocks have not followed suit. The financial sector could benefit from regulatory changes that allow banks to hold less capital and distribute more dividends.”

Why focus on the S&P 500? Are the Nasdaq and Dow Jones less relevant?

“The S&P 500 is the world’s most widely followed index. The Nasdaq 100 has become similar to the S&P 500 due to its concentration in technology stocks, while the Dow Jones is no longer a relevant benchmark for professional investors.

“Our top recommendation is actually the mid-cap S&P 400 index. Mid-cap stocks ($2-$20 billion in market value) tend to be overlooked, yet they have a strong performance history and are relatively undervalued, trading at a multiple of 16—far below the S&P 500’s 22. These companies are also more U.S.-centric, with only 25% of their sales coming from abroad, reducing their exposure to tariff risks.”

Despite all this positivity, why are IPOs still absent from Wall Street?

“I expect IPOs to return, as the macro environment is the most favorable since 2021. We track five indicators—CEO confidence, the Purchasing Managers’ Index, price-to-sales multiples, short-term bond yields, and market volatility—all of which suggest that conditions are ripe for new listings.”

What about interest rates?

“Rates will likely be cut once or twice this year. The Federal Reserve has time to make those moves.”

Is there a risk of an economic slowdown or recession?

“Unlikely. The U.S. economy is 68% driven by consumer spending, and consumers still feel wealthy due to stock market gains and high real estate values. Unemployment is low, wages are rising, and disposable income is increasing. Betting against the American consumer has historically been a losing strategy.”