Elon Musk bets on India as Tesla struggles in key global markets

With sales falling in China, Europe, and the U.S., Tesla turns to a new frontier.

After a wave of speculation and multiple attempts to enter the Indian car market, Tesla has begun hiring employees in India. This week, the electric vehicle manufacturer posted job listings for 13 positions, including service technicians, sales managers, branch managers, and parts specialists, in Mumbai and Delhi.

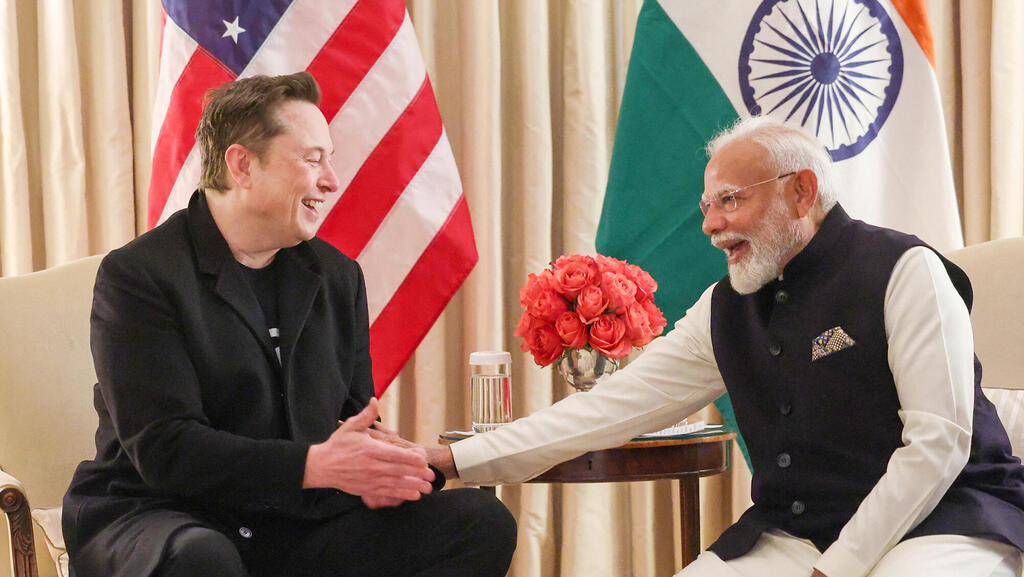

The timing of the job postings is not surprising. Less than a week ago, Tesla CEO Elon Musk met with Indian Prime Minister Narendra Modi in Washington, D.C., shortly after Modi’s meeting with U.S. President Donald Trump. Musk currently heads the DOGE agency, the U.S. government's arm responsible for efficiency. However, when Trump was asked why Musk had met with Modi so soon after his own meeting with the Indian leader, he responded, "I really don't know."

Indian government incentives

This is not Tesla’s first attempt to enter the Indian market. The American automaker has been exploring opportunities in India for years, but this time, conditions have changed. Reports have surfaced multiple times about Tesla’s interest in building a manufacturing plant in India, with local media claiming in 2023 that Tesla was considering a facility for producing affordable electric cars. Last year, Tesla representatives reportedly scouted locations for a factory, but those plans did not materialize—and they likely won’t this time either.

Tesla’s interest in India stems from government incentives. The Indian government, eager to accelerate local electric vehicle production to combat severe air pollution, introduced a taxation plan in 2023. Under this policy, any vehicle—electric or otherwise—costing more than $40,000 is subject to a 70% purchase tax, up from 60% previously.

For completely knocked-down (CKD) vehicles—those assembled in India by foreign manufacturers—a 35% tax applies. However, the government also offers incentives: automakers that invest $500 million or more in Indian manufacturing receive tax benefits on the vehicles they import. Tesla, which produces the Model S, Model X, and Model 3—all priced above $40,000—had reportedly considered investing $4 billion in a local factory in 2023. However, recent reports suggest that Tesla now plans only to sell its vehicles in India, rather than build a plant.

Why India matters to Tesla now

India is currently the world’s third-largest automotive market, with 4,286,423 new cars sold last year, a 4.6% increase from 2023. However, the country’s electric vehicle sector remains in its early stages. Official data shows that 106,966 electric cars were sold in India last year—a modest figure compared to the overall market, though a significant jump from 2022, when just 47,639 EVs were sold.

Manufacturers with local production facilities dominate India’s car market. Last year, India’s Maruti led gasoline car sales with 1,755,423 deliveries, followed by Hyundai (605,433) and Tata (562,482). The electric vehicle sector is similarly led by Tata, which sold 66,561 EVs, including the bestselling Punch EV. China's MG took second place with 28,879 deliveries, and India's Mahindra ranked third with 7,881 EV sales. These top-selling models are largely affordable, mass-market cars—unlike Tesla’s premium offerings.

So why is Tesla investing in a market where EV sales remain low? The answer lies in global shifts and political circumstances. Tesla does not currently plan to establish a factory in India, relying instead on its Chinese production facilities to serve the region. Meanwhile, Trump’s trade policies are expected to limit the entry of foreign-made vehicles into the U.S.

Beyond that, Tesla’s global standing has weakened. Of its five models, only the Model 3 and Model Y remain bestsellers, while the Model S and Model X are aging, and the Cybertruck is already being offered at discounts.

Tesla’s challenges in key markets

In its largest international markets, Tesla is struggling. In China, BYD has overtaken Tesla as the dominant EV maker, with other domestic brands—such as Dongfeng and Changan—also posing a growing threat. In Europe, Tesla’s deliveries are in sharp decline. The company faces waning consumer interest in EVs and growing controversy surrounding Musk himself. In Germany, Tesla sales fell 59% in January compared to the same month in 2024, amid accusations that Musk is interfering in local politics in favor of the far-right AfD party. In France, sales dropped 63% year-over-year, and in the Netherlands, they fell by 42%.

Mounting protests in the U.S.

Tesla is also experiencing setbacks in its home market. While the company does not break down sales figures by region, analyst firm Cox estimates that Tesla delivered approximately 634,000 vehicles in the U.S. in 2024, marking a 5.6% decline from 2023.

Compounding Tesla’s troubles, Musk’s controversial cuts to government agencies have sparked protests, including demonstrations outside Tesla dealerships. Even in California—Tesla’s strongest market—sales dropped 11.6% last year to 203,221 units, according to the California New Car Dealers Association.

Against this backdrop, it’s clear why Musk is turning to the Indian market—one where Chinese automakers have not yet taken a dominant position. For Tesla, every market now counts, even if India’s EV sector remains relatively small.