IL Tech in NY

“NYC-based startups and Israeli counterparts both have hustle and a no-nonsense attitude”

IBM Ventures joined CTech for its IL Tech in NY Series in collaboration with Israeli Mapped in NY.

“We find NYC-based startups and Israeli counterparts quite similar; both tend to have hustle and a no-nonsense attitude,” says IBM Ventures. “Typically, local companies tend to be more plugged into the local tech and enterprise ecosystem as their backgrounds are often at large enterprises before starting their company.”

The CVC joined CTech for its IL Tech in NY Series in collaboration with Israeli Mapped in NY to discuss some of the differences between American and Israeli companies. IBM Ventures was founded in 2020 and co-invests with VCs in early-stage enterprise startups.

“In contrast, Israeli founders usually must do more work to break into this ecosystem but have the advantage of a talent network in Tel Aviv that most local companies cannot access,” it added.

Fund ID

Name and type of VC: IBM Ventures; CVC

Main fields of investment: AI, Hybrid Cloud, and Quantum Computing

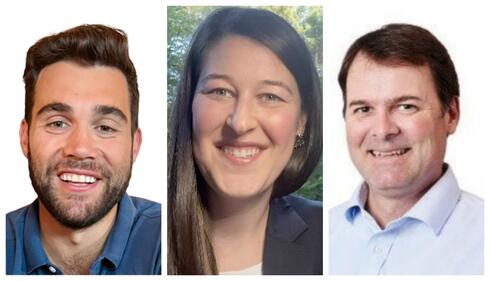

Names of managing partners: Emily Fontaine, IBM Global Head of Venture Capital; Thomas Whiteaker, Partner; Ben Daniels, Partner

Partners and/or other backers: N/A

Year of founding/start of NY operations: IBM Ventures 2020; IBM 1911

Total sum of investments/size, number of funds: 23 Investments to date

Median investment amount/Average investment in startups: Invest primarily Seed-Series B Startups, taking 3-5% ownership

Number/size of rounds led: IBM Ventures does not lead investments; we co-invest with top tier VCs

General background on the organization, its managers, its founders and partners:

The mission of IBM is to be a catalyst that makes the world work better. We aim to positively impact globally, and in the communities where we operate, through business ethics, environmental commitment and responsible technology. IBM Ventures is tasked with investing in early-stage enterprise start-ups that drive innovation and fuel IBM's strategy. In November 2023, we announced our $500M Enterprise AI Venture fund, demonstrating IBM’s commitment to the responsible deployment of AI in early-stage startups. Since the announcement, we have made several investments in leading AI companies such as Hugging Face, Hidden Layer, Unstructured, Writer, and more. Going forward, we will continue to invest in companies that are leading in enterprise AI.

The VC vision:

At IBM Ventures we offer much more than capital through our capital-plus model, providing a differentiated value proposition for founders with access to our software, AI, and consulting businesses. We invest with a thematic approach, looking for companies that align with IBM’s strategy. After investing, we leverage IBM’s unique capabilities to help portfolio companies grow and succeed. As strategic investors, we commit to sharing expertise, opening doors globally to customers and partners, and co-branding, providing credibility with IBM Ventures as an investor.

What types of Israeli startups/entrepreneurs are you interested in?

We are interested in companies innovating at the intersection of AI and the enterprise - AI applications, infrastructure, tooling to build and secure applications, or new compute paradigms like quantum computing. We invest in our areas of expertise and look for a strategic element to fill a gap and enhance our offerings. We look for founders with deep technical backgrounds and networks ready to engage with the IBM ecosystem. We work closely with IBM’s overall strategy and focus on companies that can credibly advance its core strategic priorities: AI, hybrid cloud today, and quantum computing in the future.

Why invest in an Israeli company in New York? What advantages do such companies have? How is the New York market different from the Israeli market?

When we’re looking at any investment, there are a couple of critical pieces that differentiate successful teams:

1) deep technical talent for today, and to fuel R&D for the future, and

2) access to large tech buyers locally and abroad.

Israeli entrepreneurs often check these boxes, making them great partners. Once a portfolio company, there’s the added advantage of IBM Ventures NYC connections to help navigate the large enterprise ecosystem in NYC.

How do Israeli entrepreneurs/startups differ from their local counterparts?

We find NYC-based startups and Israeli counterparts quite similar; both tend to have hustle and a no-nonsense attitude. Typically, local companies tend to be more plugged into the local tech and enterprise ecosystem as their backgrounds are often at large enterprises before starting their company. In contrast, Israeli founders usually must do more work to break into this ecosystem but have the advantage of a talent network in Tel Aviv that most local companies cannot access.

Are there any legal or regulatory considerations that you take into account when investing in Israel?

IBM Ventures evaluates companies on innovation, financial viability, their ability to complement IBM’s capabilities and systems, and potential synergies with IBM's focused business strategy. We do deep regulatory, legal, financial, strategic, and compliance diligence for every investment we make regardless of location.

How do you deal with possible law/regulation changes in Israel?

As part of regulatory, legal, and compliance diligence, we leverage internal experts to ensure we are aware of any risks related to possible law/regulation changes.

Are there global trends that influence your decisions to invest in Israeli high-tech?

As we look to invest at the intersection of AI and the enterprise, we are keenly aware of AI's potential to disrupt and change entire industries. Historically, Israeli entrepreneurs have been at the center of building the infrastructure and security tools for each new technology trend.

Two suggestions for Israeli entrepreneurs on what to do in New York:

Leverage the local Israeli organizations already engaged in the NYC tech ecosystem. Attend events hosted by Israeli investors with a strong NYC presence, engage with US-based investors who have invested in Israeli companies and network with other founders who have been successful in NYC before.

Expand your network and engage with the NYC tech community. Attend events (IBM often hosts local tech events), grow your buyer network, and try to create new relationships with founders and investors.

Two suggestions for Israeli entrepreneurs on what not to do in New York:

Take time to study the local competitors, refine your messaging, and clearly articulate your unique value proposition in a way that resonates with the enterprise buyer ecosystem in New York. Don’t underestimate local competition for customers and talent.

Invest in networking and creating relationships outside of the Israeli community. Aim to expand your reach to investors and customers who might not be familiar with the Israeli ecosystem. Don’t just live within just the Israeli community bubble.

Examples of 2-3 of your most successful investments:

Gem Security: We partnered with Gem at their Series A, alongside Notable Capital and Team8. Gem expanded its market presence significantly and securing major enterprise clients, including joint go-to-market efforts with IBM, proving the power of our capital-plus model. In 2024, they were acquired by Wiz, an excellent outcome for the founders, employees, and investors.

Authmind: We partnered with Authmind in their Seed round led by Ballistic Capital. Shortly after our investment Authmind signed an IBM Global OEM to bring AuthMind's unique platform for securing identity infrastructure and access across the entire enterprise to IBM customers.