Saudi Arabia's $38 billion gamble: Kingdom invests heavily in gaming industry to fuel economic diversification

As part of the plan to reduce dependency on oil, Crown Prince Mohammed bin Salman is overseeing a massive investment in gaming

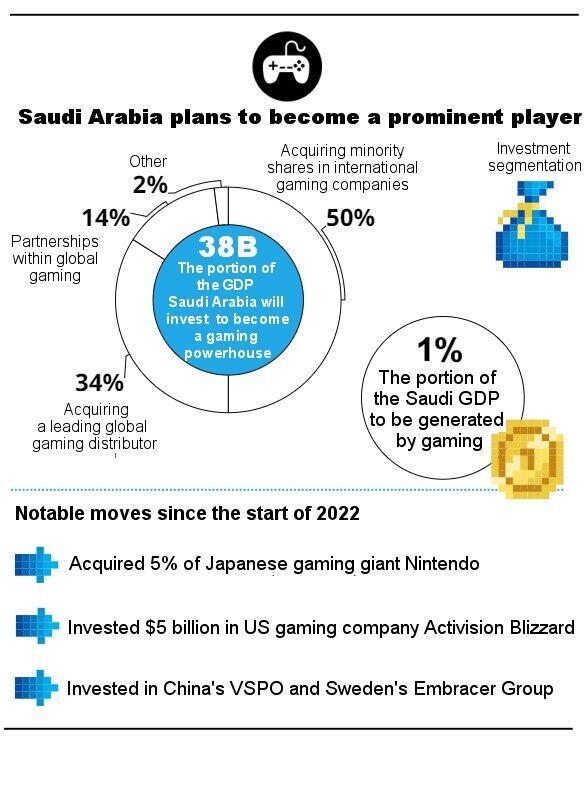

Saudi Arabia has invested $8 billion in the gaming industry in the last year, mainly through purchasing shares in leading global companies, the Financial Times reported. This amount is a relatively small part of the $38 billion budget that the kingdom has earmarked for becoming an international gaming center.

At the end of last year, Saudi Arabia launched a national strategy for the development of the gaming and competitive gaming industry (Esports), with a clear message about its important role in diversifying the country's economy beyond oil. Mohammed bin Salman, Crown Prince and Prime Minister of Saudi Arabia, is leading his country through an economic transformation within the framework of Vision 2030. He is a gaming enthusiast, with Arab media reporting that he spends hours in front of the screen, though this is likely not the main reason behind this move. The gaming industry is one of the hottest in the world, having received a tremendous boost during the pandemic. A study published by PwC last year predicts that in 2026 the global gaming industry will generate about $320 billion, twice as much as in 2019, on the eve of the pandemic.

40,000 jobs

Saudi Arabia wants to be part of this gold mine, and has set ambitious goals for itself, including for the gaming industry to account for 1% of the annual Saudi GDP (about $1 trillion today), produce at least 30 new titles and create about 40,000 jobs by the beginning of the decade, through the establishment of about 250 companies. On the face of it, the Saudis have every reason to succeed. First, over 65% of the population, about 23 million people, are young people under the age of 30, and thanks to the internet and mobile phones, gaming is one of its most promising industries. In addition, Saudi Arabia is entering the field with an organized and well-prepared investment plan, with the Crown Prince closely monitoring his personal project.

Saudi Arabia's investment arm in the field of gaming is Savvy Games Group, which belongs to the government investment fund. Additionally, the Ministry of Communications and Information Technology and its affiliates are active in promoting the gaming industry, with mega-projects currently under construction in the Kingdom (including planned smart city NEOM) contributing to the advancement of the local gaming industry through unique acceleration and investment programs.

However, Savvy is still the main driving force. Last year it presented its investment plan with a total value of approximately $38 billion. The main items include about $19 billion for the purchase of minority shares in global gaming companies and about $13 billion for the purchase of a leading global gaming distributor that will serve as a strategic partner for development. Approximately $5 billion was allocated for investment in partnerships in the field of global gaming. Thus, the kingdom purchased 5% of Nintendo and invested $3 billion in the American company Activision Blizzard. Other significant investments in recent months include the Chinese VSPO, the Swedish Embracer Group and the American Scopely.

Saudi Arabia's progress in the field of gaming is not limited to investing in global companies, but also in developing their local ecosystem. The company Nine66, of the Savvy Games Group, published an annual report in December 2022, showing that Saudi Arabia is making progress in the field, if slowly. According to Nine66, at the end of 2022 there were 24 local startup companies in the Saudi gaming field, almost twice as many as the year prior. However, the report also pointed to difficulties. First and foremost, employees were usually entrepreneurs or young developers with little experience in the field, which shows that there is still a long way to go to develop local talent. The report also shows that most of the companies in the field (75%) have only up to ten employees, and therefore find it difficult to attract talent from abroad. A significant number of the companies even stated that at this stage they are having difficulty generating revenue, which threatens their continued activity in the future. Additionally, women represent 32% of employees in startup companies in the field.

But despite the difficulties, Saudi companies understand that this industry is only in its infancy in the kingdom, and therefore they are optimistic about its future. A study published last week by AstroLabs from Dubai, which surveyed about 130 Saudi entrepreneurs and gaming companies, found that 81% of them are optimistic about the local industry's chances of success. The main reason for this is what they see as the Saudi government's commitment to invest in global companies and the local ecosystem.

Fierce competition with Abu Dhabi

Although in public Saudi Arabia and the UAE appear to be operating as usual, beneath the surface there is enormous tension between the neighbors. Riyadh and Abu Dhabi differ on a number of political issues and are in fierce competition for regional economic hegemony. Until the extensive reforms that the Crown Prince of Saudi Arabia began to implement in 2016, the supremacy of the United Arab Emirates as the regional business center was not in doubt. Now that the Saudi kingdom has woken up, it poses a threat to the UAE.

The competition between the two countries includes the gaming sector, which the UAE government also has significant ambitions for. For this purpose, two entities were established that were designed to attract global gaming companies as well as nurture local talent: Abu Dhabi Gaming and the DMCC Gaming Centre, which offers businesses in the field access to various resources.

Although the UAE is at a disadvantage compared to Saudi Arabia in terms of market size and financial capabilities, it also enjoys advantages. For decades the UAE’s friendly and social business environment has made it a desirable destination for any global company wishing to deepen its activities in the region. This is why the well-known French gaming company Ubisoft runs its regional operations from Abu Dhabi, while Tencent, the world's largest game company from China, has also established its regional office in Dubai.

According to a report recently published by DMCC, the two Gulf countries are competing for a regional market that is growing rapidly. According to estimates, gaming revenues in the Middle East are expected to reach $6 billion in 2027, twice as much as in 2021. The Boston Consulting Group recently published a report predicting continued rapid growth of the gaming market in the region. According to BCG, this growth is attributed to the fact that over 60% of the population in the Middle East are gaming enthusiasts. This figure is reflected in one of the highest download rates of game applications for mobile phones in the world, high disposable income, and the hot climate that encourages activities in closed places.