Despite innovation, cultured meat is still far from reaching your plate

While cultured meat products were recently approved in the U.S., this alternative to the pollutive meat industry is far from competing on a mass scale

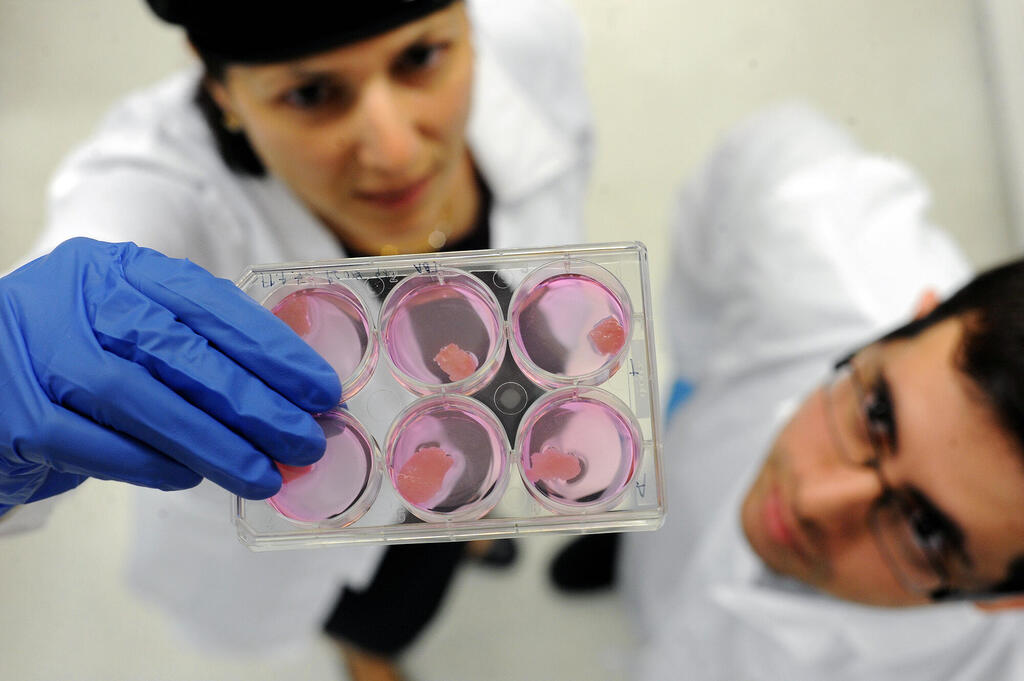

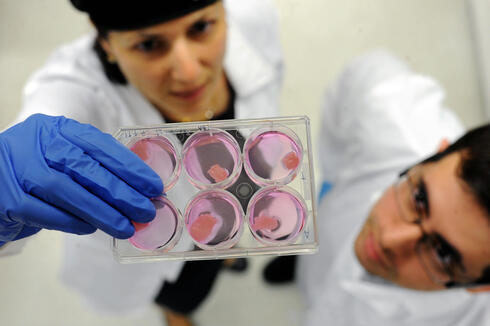

In June, the United States Department of Agriculture approved two companies to market cultured chicken products grown in a laboratory. The two companies, Upside Foods and Eat Just, are the first to have achieved what is considered the holy grail of the foodtech world: cultured meat.

But the road to the transformation of cultured meat to a shelf product is still long, and there are those who doubt its ability to become a significant global food source. The question that has occupied researchers - whether it's possible to produce meat in a lab - has been resolved. Now, the question is whether its cost and availability will allow it to compete with regular meat. Added to this are production challenges and questions about the target audience. As a result, the future of cultured meat is still in question. One thing is certain: we are still many years away from turning cultured meat into a profitable product accessible to all.

The enthusiasm of investors in the cultured meat market is cooling slightly, as they wonder if the future profits of the industry will ever support the research and development that is still required in the field. Without tremendous investment, the industry will struggle to move from the lab to the market. By the end of 2022, the capital invested in cultured meat stood at $2.8 billion. In 2022 alone, investments of nearly $900 million were recorded, a decrease of 33% compared to 2021.

"Among investors, there is a growing understanding of the complexity of making a successful transition from lab production to large-scale consumer production," explains Tal Rosenbloom, Managing Partner at the Boston Consulting Group and FoodTech expert. "Cultured meat’s penetration of the market will take longer than expected. When investors see that what they thought would be available in a year actually takes much longer and costs them more money, they realize that the ability to generate high returns in the near future is diminishing."

Agriculture is the main industry leading the climate crisis, heavy pollution, and destruction of ecosystems. Meat production is estimated to be responsible for around 16.5% of global greenhouse gas emissions, and cows, in particular, contribute heavily as they emit methane, a greenhouse gas, and they also require vast areas of land for cultivation, leading to additional pollution. If animal agriculture were a separate country (slaughtering 80 billion animals every year), its emissions would exceed those of any individual country in the world, except for China.

If the situation continues, by 2050 human nutrition will require a 20% growth in the use of fresh water for agriculture, despite water becoming an increasingly rare commodity as the earth warms.

Studies show that switching to lab-grown meat can significantly reduce greenhouse gas emissions and the use of land and water resources. Other studies indicate that the lab cultivation of chicken and fish cells does not save greenhouse gas emissions, and at this stage it is difficult to know what the environmental footprint of the various manufacturing plants will be. The main difference is the industry's ability to improve technology and become less polluting as it develops, in contrast to the animal food industry, which is becoming a growing problem for humanity.

Even if cultured meat does not succeed in replacing traditional agriculture, experts believe that it will possess a significant portion of the future food market. In Israel, there are already leading companies in the field, one of which, Aleph Farms, is expected to receive approval from the Ministry of Health within a few months, according to industry sources.

"In the next decade, at least, we won't be able to consume 100% cultured meat," says Ronit Eshel, Head of the FoodTech Division at the Israel Innovation Authority. “We will see hybrid cuts, consisting of 30% cultured meat and 70% plant-based ingredients. We will see a combination of various technologies - fermentation, plant-based proteins, and cultured meat - to produce the final products. These will be products that are more similar to what we are familiar with from animals. Biotechnological methods will enable the production of healthier products. Cultured meat will likely continue to be more expensive than other options. Technologically speaking, we see many companies today that are not involved in the product itself but in optimizing the production process. These are companies that can determine the future of the industry."