Jensen Huang: "We're just at the start of the age of AI" as Nvidia posts record-breaking earnings

Nvidia's quarterly revenue jumps 78% year-over-year, with Blackwell chip demand driving growth despite concerns over market saturation.

Nvidia’s strong first-quarter growth forecast on Wednesday reinforced surging demand for its artificial intelligence chips, with the company calling early orders for its new Blackwell semiconductors “amazing.”

The forecast helped ease concerns about a potential slowdown in AI hardware spending, which emerged last month after Chinese startup DeepSeek claimed its AI models could rival Western alternatives at a fraction of the cost.

Nvidia’s stock initially rose following the announcement but fluctuated in extended trading after closing up 3.7%. The company remains the biggest beneficiary of the AI-driven market rally, with shares soaring over 400% in the past two years.

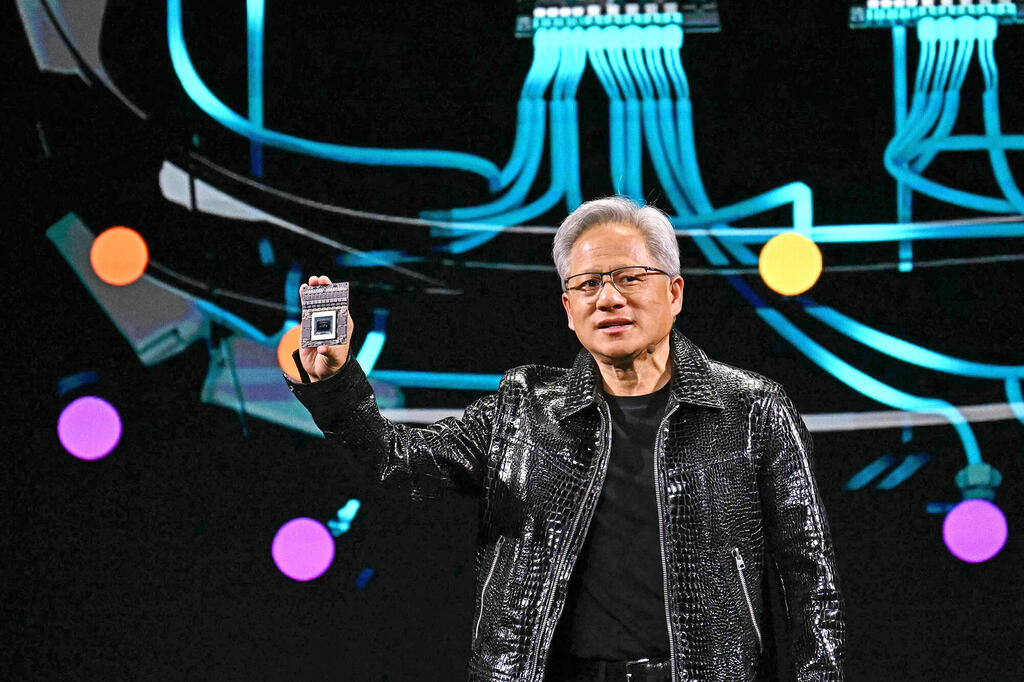

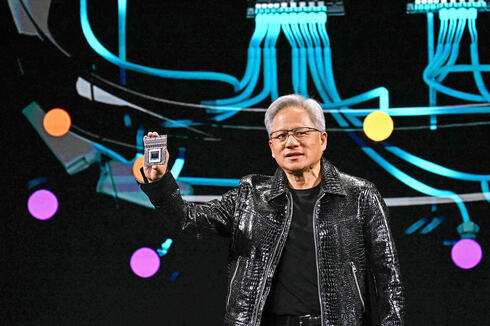

CEO Jensen Huang struck an optimistic tone, declaring that “AI is advancing at light speed” and that and that "demand for Blackwell is amazing," in commentary that should bode well for AI-related stocks that have taken a hit in the past week. He also emphasized that Nvidia had successfully ramped up large-scale production of Blackwell AI supercomputers, generating billions in first-quarter sales.

“We're at the beginning of reasoning AI and inference time scaling,” added Huang. “But we're just at the start of the age of AI, multimodal AIs, enterprise AI, sovereign AI and physical AI are right around the corner. We will grow strongly in 2025.”

The company is undergoing a crucial transition, shifting from selling individual chips to complete AI computing systems that integrate graphics chips, processors, and networking hardware. In the fourth quarter, Blackwell-related products contributed $11 billion—about 50% of Nvidia’s total data center revenue.

Nvidia projected first-quarter revenue of $43 billion, surpassing analysts' expectations of $41.78 billion, according to LSEG data.

However, the Blackwell rollout has been complex and costly, pressuring Nvidia’s margins. The company forecasted a first-quarter gross margin of 71%, slightly below Wall Street’s estimate of 72.2%. CFO Colette Kress assured investors that margins would return to the mid-70% range later this fiscal year as production scales up and costs decrease.

Last month, Nvidia’s stock took a hit after DeepSeek’s rise led to skepticism about the long-term sustainability of AI chip demand. The company lost $593 billion in market value in a single day—the largest-ever one-day loss for a U.S. firm. Investors also questioned whether massive capital expenditures from major tech players like Microsoft and Meta would continue at their current pace. Microsoft has earmarked $80 billion for AI in its current fiscal year, while Meta Platforms has pledged as much as $65 billion.

Despite speculation about oversupply, demand remains strong. Chinese companies are reportedly ramping up orders for Nvidia’s H20 AI chip, driven by DeepSeek’s booming popularity.

In another win for Nvidia, Kress confirmed that the U.S. government’s Stargate data center project will use Nvidia’s Spectrum X ethernet networking products, strengthening its foothold in the AI infrastructure space.

Nvidia reported fourth-quarter revenue of $39.3 billion, a 78% year-over-year increase, surpassing estimates of $38.04 billion. Data center sales rose 93% to $35.6 billion, slightly lower than the previous quarter’s 112% growth but still beating forecasts of $33.59 billion.