Grounded: Billionaires duped out of millions in private jet sting

A long list of Israel's wealthiest and top business people each deposited a million shekels with Yaniv Salmon in exchange for the opportunity to fly abroad on a private plane at any time. Now it turns out that Salmon accumulated huge debts and allegedly used the money deposited in his hands to cover them, leaving the billionaires without a plane and without their money.

A private jet is one of the ultimate status symbols for the upper echelon. Figures like Nochi Dankner, Teddy Sagi, Chaim Katzman, and others either owned or currently own such planes, which cost millions of dollars a year. Many others, who can afford it, avoid owning a private plane to avoid drawing attention and attracting criticism. Instead, they rent a private plane as needed, for vacations or business flights.

In 2011, Yaniv Salmon recognized this need and founded the company Galrom, which brokered flight hours for the wealthy. The model worked by Galrom collecting a deposit of around $400,000 (about one and a half million shekels) from each client, committing to arrange flight services on demand. For each flight, Galrom would deduct part of the deposit and leave a "balance to be used."

Over the years, Galrom became almost the sole provider in this field in Israel, with a client list featuring some of the wealthiest figures in Israeli business, including Leon Koffler (Super-Pharm), Yishai Davidi (FIMI), Eyal Waldman (Mellanox), Asi Shmeltzer (Shlomo Sixt), Jonathan Kolber, Shlomo Dovrat (Viola), Rami Kalish (Pitango), Roy Ben Yami (LR), Muki Schneidman (Direct Insurance), Meir Shamir (Shamir Insurance), Drorit Wertheim (Coca-Cola Israel), Zohar Levy (Summit), Danny Zelkind (Elco), Asaf Touchmair (Canada Israel), Yoav Harlap (Colmobil), Omer Adam, and many more.

In exchange for brokering flights between providers and clients, Galrom collected substantial commissions. After 13 years of successful business, Salmon became a wealthy businessman. However, in recent months, everything unraveled. Some of Galrom’s prominent clients, including Kolber and Shmeltzer, filed lawsuits against the company and Salmon. These lawsuits revealed a list of dozens of clients owed hundreds of thousands of shekels each by Galrom and Salmon, most of whom did not receive the full services for the deposits they entrusted.

In a lawsuit filed by Kolber in May for a refund of $329,000, he claimed that for a flight booked in April, the plane's owner demanded he provide a personal guarantee that if Galrom didn’t pay the flight's cost, he would cover it. According to the lawsuit, Kolber was indeed required to pay the flight’s cost three weeks later. "It became clear to me that Salmon took a lot of money from clients in what appears to be a systematic fraudulent scheme, spending money and hiding it in various places," Kolber claimed. He stated in the lawsuit that the company’s services required discretion to maintain user privacy, and that Salmon developed personal relationships with the clients. Most businessmen preferred not to file lawsuits against Salmon to avoid exposure.

It was revealed that Salmon had accumulated debts of NIS 70 million and reached insolvency. Lawyer Lior Marcovich was appointed as a trustee of Galrom by the district court in Beer Sheva. In his initial report submitted in June, Marcovich expressed concerns of fraud by Salmon, who allegedly used funds transferred to the company to pay off other high-interest loans he had taken, effectively operating a pyramid scheme. After the trustee's appointment, the company submitted a list of creditors to the court, which exposed the billionaires who had fallen victim to what some now define as a "sting." Other victims, such as Jacky Ben-Zaken and Eyal Waldman, appear on the list as having provided loans to the company. Salmon himself denies using the deposits of Galrom clients.

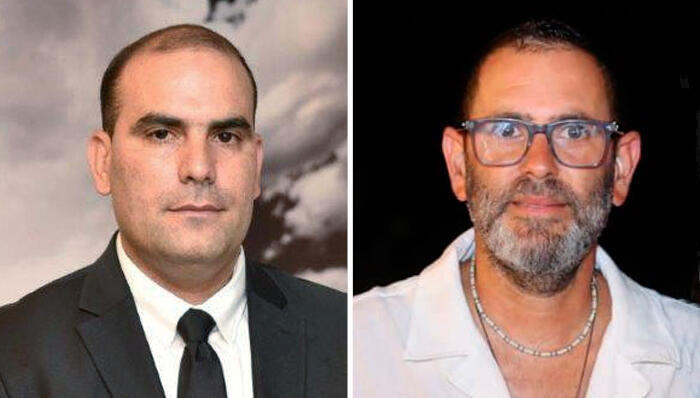

Salmon, 47, a resident of the town of Lachish, claimed through his attorney Yariv Vaknin that Galrom’s decline began with the coronavirus pandemic after it attempted to expand its business into other areas. Galrom invested in another company founded by Salmon, PlanetFood, which had a franchise to establish a restaurant under chef Moshe Segev at Yes Planet in Beer Sheva. Salmon invested five million shekels and suffered additional losses of millions of shekels. The trustee claimed in his report that the company paid significant amounts while favoring certain creditors and that it lacked tangible assets.

One businessman left with a debt told Calcalist that Salmon "probably doesn’t have a penny to his name" and that the creditors are now trying to recover part of the debt by locating Salmon’s property. The Insolvency Commissioner determined that Salmon would pay NIS 5,000 per month to the creditors' fund.

Another lawsuit against Salmon, for NIS 715,000, was filed on behalf of Carmel Shipping Company. The lawsuit claims that Salmon defrauded the company and fraudulently took 650,000 shekels from it. It also claims that Salmon deceived many clients out of huge sums, borrowing NIS 1.8 million from a flight attendant, which she borrowed from her father, and never repaid the amount.

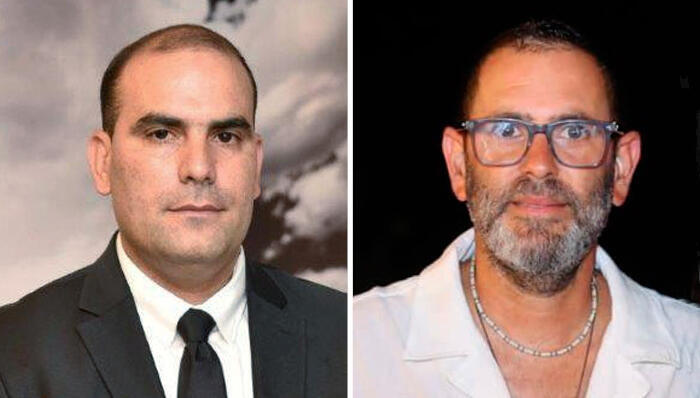

Salmon's lawyer: "There is no truth in the claims that my client acted in bad faith"

Lawyer Yariv Vaknin, representing Salmon, responded: "If there was any truth to the claims that my client acted in bad faith, the court and the special manager would not have allowed him to return and operate the company in order to reduce its losses. Since the outbreak of the coronavirus pandemic, my client has lost everything he worked for all his life: the company, his private home, and his family. Despite these difficult days, he is determined to work and repay his debts in full.

"My client worked for many years, serving Israel’s wealthiest individuals and providing high-quality private flights to all destinations worldwide. Galrom Aviation Company was excellently managed. After accumulating profits in its coffers and consulting with a company accountant, a legal decision was made to expand the company’s investment avenues with the aim of increasing profits. Indeed, the company decided to invest in additional areas, such as the restaurant sector, and even contributed to promoting important issues like encouraging women’s soccer.

"With the outbreak of the coronavirus pandemic, all of the company’s businesses, naturally among the weaker sectors, such as flights and restaurants, came to a halt. From that moment, the company began to incur deficits and struggled for its survival. Unfortunately, the state was also unable to compensate the company adequately, and the compensation provided was much lower than the damages incurred.

"As a result, funds that entered the company were used, among other things, to cover arrears and payments for the purpose of operating and recovering the company. My clients and the company never misappropriated deposit money. In fact, the company's revenues were used for all company expenses, including management, marketing, advertising, maintenance, and payments to companies that provided VIP services to the company’s customers. It is clear to all that no single deposit account was opened. Instead, my client’s clients purchased a bank of hours, prepaying for those hours, with funds mostly transferred to various airlines and covering various company expenses.

"After about three years of trying to recover the company, and after my client believed he could overcome the economic crisis, the banks began closing the company’s bank accounts, leading to difficulties totaling over NIS 70 million. My client is cooperating with the special manager appointed in this case and has even agreed to the proposal to return and operate the company under court supervision in order to try and repay all creditors."