Big Tech’s $325 billion AI bet: Why cheaper models won’t change the game

Companies see rising AI efficiency as a reason to invest even more in infrastructure.

DeepSeek is not shaking the tech giants: Amazon, Google, Meta, and Microsoft plan to invest more than $320 billion in capital expenditures this year, primarily to upgrade their infrastructure and artificial intelligence (AI) capabilities. This reflects the expectation that the introduction of cheaper AI models will drive increased demand for AI services and computing power.

In January, when DeepSeek unveiled its R1 model, it generated significant attention in the AI market due to its reported high capabilities and lower development costs compared to similar models from companies like OpenAI. The initial market reaction was dramatic—Nvidia’s stock lost more than half a trillion dollars in value, though it has since recovered some of those losses. Fears briefly surfaced that the foundation of the modern AI ecosystem had been upended.

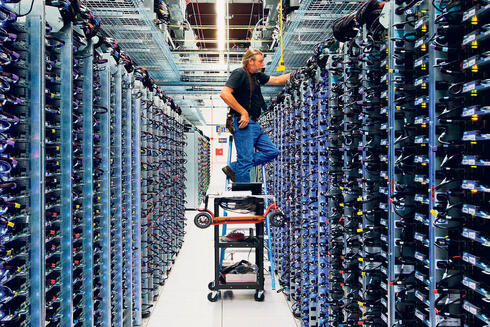

However, after the initial shock, it is becoming clear that demand for AI chips and infrastructure is not expected to decline. On the contrary, industry leaders anticipate significant growth, driven in part by the availability of lower-cost AI models. According to Business Insider, the tech giants’ capital expenditures—investments in acquiring or upgrading long-term assets, including data centers and AI infrastructure—are expected to grow by 30.1% in 2025 compared to 2024, reaching an estimated $325 billion.

Amazon is set to make the largest investment, with capital expenditures expected to reach $105 billion, a 36.4% increase from last year. "We are seeing clear signals of demand for AI-based services," CEO Andy Jassy said in a call with analysts. "When AWS is expanding its capex, particularly what we think is one of these once-in-a-lifetime type of business opportunities like AI represents, I think it's actually quite a good sign, medium to long term for the AWS business." CFO Brian Olsavsky downplayed concerns about DeepSeek, stating, "Customers will continue to invest in technology."

Microsoft plans to increase its capital spending by about 60% to $80 billion. According to CEO Satya Nadella, demand for AI services has already exceeded expectations. "Our AI business has crossed $13 billion in annual revenue, up 175% year-over-year," he noted after the company’s latest earnings report. In January, Nadella referenced DeepSeek in a post on X (formerly Twitter), invoking the Jevons paradox—the idea that increased efficiency in resource use often leads to greater overall consumption. "The Jevons paradox strikes again!" he wrote. "As AI gets more efficient and accessible, we will see its use skyrocket, turning it into a commodity we just can't get enough of."

Google is also ramping up investment, projecting capital expenditures of $75 billion in 2025—a 29.3% year-over-year increase. "The company is operating at a faster pace than ever—building, testing, and launching products at an unprecedented rate," said CEO Sundar Pichai. "That translates into product usage, revenue growth, and results."

Meta, meanwhile, plans to boost its capital expenditures to $65 billion, a 65.7% increase, with much of the investment directed toward AI infrastructure. Founder and CEO Mark Zuckerberg emphasized AI as central to Meta’s growth strategy. “We are aggressively investing in AI-driven initiatives to drive revenue growth,” he said. “We have a plan to accelerate the pace of these initiatives in the coming years. A significant portion of our headcount growth is focused on AI, and our success in this area will shape our financial trajectory.”

Apple has not disclosed its capital expenditure plans for 2025, but CEO Tim Cook addressed DeepSeek’s impact on the company’s AI strategy. “Innovation that drives efficiency is a good thing, and that’s what we see in this (DeepSeek) model,” he said. “Our tight integration of bio-silicon into hardware will continue to serve us well. In terms of capital spending, we have always taken a cautious and deliberate approach, and we will continue to do so.”

The tech giants are not alone in their commitment to AI investment. "Huge week for Big Tech earnings as Zuckerberg, Nadella, Cook, and Musk doubled down on their AI visions and what this means for each of these tech stalwarts looking ahead," Wedbush Securities managing director Dan Ives wrote on X. "This is an AI arms race and the Temu of AI DeepSeek not changing that…AI Revolution just starting."