Epitomee surges 200% in two days on FDA approval for weight loss pill

Investors are hopeful, but the company must now face an uphill battle in a crowded market.

Biomed company Epitomee has seen its shares surge by 200% in two days after announcing that it has received marketing approval for its weight loss pill from the U.S. Food and Drug Administration (FDA).

This update is especially encouraging for Epitomee’s early investors, who have mostly seen the stock decline since its IPO. Now, the company turns its focus to the business challenges standing in the way of turning its dream into reality.

The first challenge is signing a new commercialization agreement, after Nestlé withdrew from the previous one, and facing tough competition—particularly from the Danish giant Novo Nordisk, which markets a more effective injectable treatment under the name Wegovy.

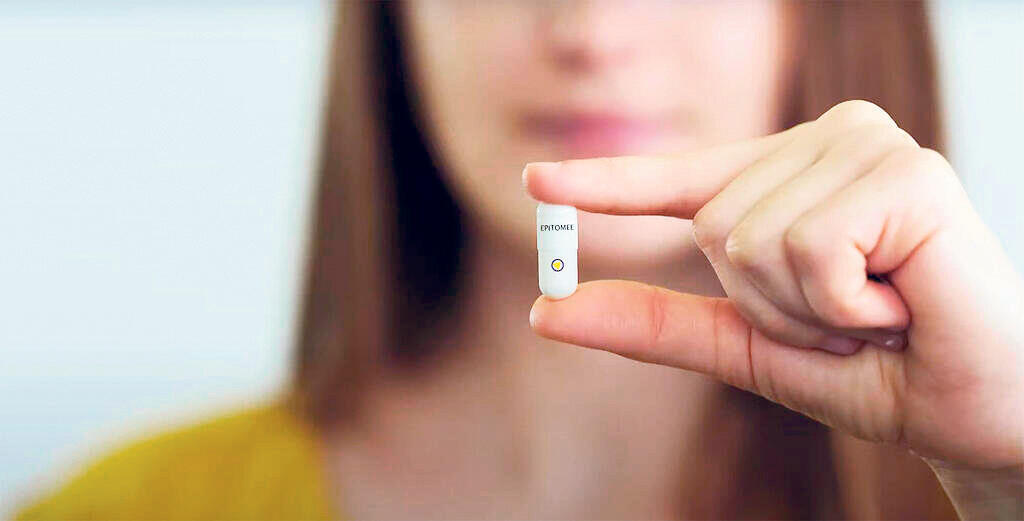

Epitomee’s main product is a capsule that expands in the stomach, increasing the feeling of satiety. Currently, the company is also authorized to market the pill in Europe, but they have chosen to focus on the American market first.

The significance of FDA approval lies in its confirmation that Epitomee’s capsule is effective for weight loss and that the benefits outweigh the associated risks.

Results from the company’s clinical trial showed that the capsule led to a statistically significant weight loss of about 2% of body weight, compared to the placebo taken by the control group. In comparison, competing products like Wegovy demonstrated higher efficacy, with a 12.4% reduction in body weight.

Epitomee claims that its product does not directly compete with Novo Nordisk because it targets a different market segment. According to Epitomee, their product is intended for the tens of millions of people in the U.S. with a BMI range of 25-40, a group classified as overweight but not suffering from a disease.

Epitomee emphasizes that its capsule is unique because it appeals to those with moderate excess weight, unlike other drugs designed for people with severe obesity. In other words, it’s a supplemental option for individuals who don’t qualify for other treatments. For example, Wegovy is only prescribed to those classified as sick and must be administered under a doctor’s supervision. However, in reality, Wegovy has gained widespread popularity in the past two years, even though it requires a medical consultation.

The need for a new commercialization agreement arose after Nestlé canceled its agreement with Epitomee at the end of 2023, citing that the clinical trial results did not meet the milestones set in their contract.

The agreement with Nestlé was highly significant. In addition to a payment of $10-25 million based on trial results, Epitomee was set to receive royalties on sales according to the following tiers: 3.5% on sales up to $50 million per year, 5.5% on sales up to $150 million, and 8% on sales up to $300 million. Sales above that amount would have earned a 10% royalty.

Epitomee went public in December 2021 with a valuation of NIS 632 million ($170 million), raising NIS 162 million ($43 million) from the public, and began trading at a value of NIS 738 million ($198 million). At its peak, the company reached a value of NIS 1.2 billion, but its stock later declined. From its IPO to the FDA approval announcement, Epitomee’s stock had fallen by over 90%.