2025 VC Survey

Trump's economic policies could boost Israeli tech sectors, says Peregrine Ventures

“Israeli companies must remain agile, strengthen ties with U.S. investors and strategic partners, and tailor their innovations to meet the evolving needs of both American and global markets,” said Lior Shahory.

“The Trump administration's anticipated reduction in federal government spending could have significant implications for the global high-tech economy and Israel's position within it, particularly through increased investments in private equity and venture capital,” said Lior Shahory, General Partner and CEO of Peregrine’s Technological Incubator, Incentive. “Israeli entrepreneurs and startups are well-positioned to benefit, especially in healthcare, fintech, and cybersecurity - sectors where they already hold a competitive edge.”

1 View gallery

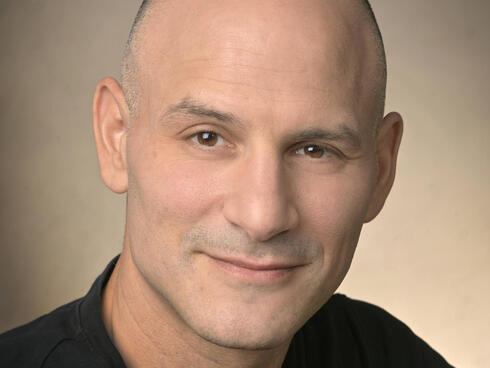

Lior Shahory, General Partner at Peregrine Ventures and CEO of Incentive Incubator.

(Photo: Yossi Zwecker)

Peregrine Ventures joins CTech for its 2025 VC Survey to highlight specific trends in the Life Sciences sector as well as how the industry will react to the incoming second Trump administration.

“To fully capitalize on these opportunities, Israeli companies must remain agile, strengthen ties with U.S. investors and strategic partners, and tailor their innovations to meet the evolving needs of both American and global markets. Building strategic partnerships and focusing on scalable, cost-effective solutions will be crucial to thriving in this environment,” he added.

You can read the entire interview below.

Fund ID

Name of fund/funds: Peregrine Ventures

Total sum of the fund: $600M

Partners: Eyal Lifschitz, Boaz Lifschitz and Lior Shahory

Notable/select portfolio companies (active): Insightec, Momentis Surgical, BrainQ, Endostream Restore Medical, Cordio Medical.

Notable exits: CartiHeal, Cardiovalve, Valtech, Eximo.

2024 is over. How can you summarize it in terms of the Israeli high-tech industry?

2024 was a year defined by mutual support and growth amidst challenges. It was marked by solidarity among citizens, within workplace teams, and between portfolio companies. This year placed greater emphasis on supporting and guiding our portfolio companies as they navigated significant obstacles stemming from the local environment. The geopolitical situation created challenges for economic and professional activities, impacting fundraising efforts, international travel, and workforce availability due to reserve duty. Additionally, as a healthcare investor, we witnessed a decline in deep tech seed funding, which reduced the establishment of new companies, particularly in the Life Sciences sector.

Despite these challenges, the year witnessed remarkable exits in medical devices highlighting the sector's resilience and potential. Mature companies continued to grow, attract investments, and expand their global reach.

Looking ahead to 2025 - What challenges and opportunities await the Israeli high-tech sector in the coming year, and how are you, as investors, preparing for them?

An emerging opportunity we are beginning to observe, and expect to continue in 2025, is a growing trend in the Life Sciences industry, where medical corporates are increasingly engaging with companies earlier in their life cycle. This is a great opportunity for the companies as these players recognize the critical need to invest in and influence these companies which will serve as a source for future growth.

With regard to challenges, company funding could still present some challenges. We see signs of a global financial recovery, but in Israel, renewed growth is likely to take more time or remain uncertain due to the ongoing war. While we anticipate pivotal years that will reignite global investors’ confidence in Israeli investments, it may take time for the full impact to reach the local market.

For us as investors, the 2024 reduction in seed funding in Life Sciences has created a unique "cherry-picking" environment for early-stage opportunities. We view this as a long-term opportunity to build a promising and robust early-stage portfolio. As the market recovers over the next two to three years and funding cycles improve, we will be strategically positioned with a strong portfolio of companies.

With mid-stage and late-stage investments, while some activity persists, there are still fewer active investors, which creates valuable opportunities for the remaining ones.

How will new American leadership affect the global high-tech industry or economy? And where does this place Israel and its entrepreneurs?

The Trump administration's anticipated reduction in federal government spending could have significant implications for the global high-tech economy and Israel's position within it, particularly through increased investments in private equity and venture capital.

Israeli entrepreneurs and startups are well-positioned to benefit, especially in healthcare, fintech, and cybersecurity - sectors where they already hold a competitive edge.

To fully capitalize on these opportunities, Israeli companies must remain agile, strengthen ties with U.S. investors and strategic partners, and tailor their innovations to meet the evolving needs of both American and global markets. Building strategic partnerships and focusing on scalable, cost-effective solutions will be crucial to thriving in this environment.

What are the three most important things the Israeli government should do today to accelerate the high-tech engine in the coming year?

The first and most urgent priority should be ending the war as quickly as possible. This will significantly reduce the negative attention on Israel, allowing foreign companies and investors to resume regular operations and restoring confidence in the local market.

The government should focus on incentivizing the establishment of venture capital funds, particularly in deep tech and earlier stages. This is particularly critical given the extent of the venture capital gap in Israel, and as dependence on international funding at these stages is not sufficient.

Current initiatives by the Ministry of Finance, such as programs aimed at encouraging institutional investors, may achieve a meaningful impact in 2025. The government could enhance these efforts by introducing broader incentives to attract local and foreign investors in addition to institutional investors.

Are there new sectors you see as relevant? Are there any fields you anticipate will weaken significantly in the coming year?

The Life Sciences sector will always remain relevant, with a stable demand for innovative technologies. This is driven by the necessity for medical corporations to demonstrate continuous innovation, an area where Israel serves as a significant source of groundbreaking advances.

A promising new sector within the Life Sciences industry is neuromodulation, particularly in addressing neurodegenerative conditions such as Alzheimer’s and Parkinson’s. This field, driven by therapeutic devices, holds significant potential despite the historical challenges and pharmaceutical setbacks associated with these conditions.

Is Israel missing out on the AI revolution in the global arms race? If not, what should the local industry focus on to join the global race?

In Israel, AI has long been a key tool for software development across many sectors, including Life Sciences. The country is among the global leaders in implementing AI across a variety of platforms, driving innovation and impactful applications.

Could the global IPO drought end in the coming year?

Perhaps. There are positive signs suggesting a potential recovery, but it may take another year for the global IPO market to fully rebound. Geopolitical uncertainties and the pace of recovery across key sectors will likely influence the timeline, with a broad revival possibly requiring another year or two.

From an investor's perspective: will the coming year be better for early-stage startups or more mature companies?

As previously mentioned, in deeptech, we are observing significant challenges in early-stage investments, particularly due to the scarcity of seed funding, which has greatly reduced the establishment of new companies. We believe this trend will shift with more players entering this stage in the next couple of years.

Mid-stage and late-stage investments will continue to attract interest, as they offer greater stability. These companies have a broader base of players in Israel and continue to draw investors from abroad, even amidst the current situation in the country.

Did you raise fund money in 2024 for an existing fund or a new one? What are your expectations regarding this matter for 2025?

We did not raise fund money in 2024. Assuming the broader geopolitical and economic situation stabilizes, we anticipate a more optimistic outlook in the second half of 2025, as investors will still require time to complete their due diligence.

How many investments did you make in 2024, and how does it compare to previous years?

In 2024, Peregrine made 16 investments, which, according to the Start-Up Nation 2024 Health Tech Map, was recognized as the 'Most Active Investor' of the year in the health tech sector. This is in comparison to 23 investments in 2023.

Provide an example of an intriguing investment you made in 2024. What sets this company apart, or what is distinctive about its sector?

In 2024, we built a cluster of medical device companies specializing in electroporation technology for cancer treatment. The primary challenge in each indication lies in delivering energy efficiently to destroy the tumor without harming surrounding tissues. This technology stands out due to its unique advantages:

When properly designed, the energy delivery does not generate heat, resulting in minimal side effects.

The technology effectively eliminates cancer cells while preserving the surrounding cellular environment, enabling the growth of new cells, tissue regeneration, and restoration/recovery of organ function.

The technology trains the immune system to recognize the cancerous cells, improving its ability to detect and attack similar cancerous cells in other areas of the body.

It is synergistic with both chemotherapy and immunotherapy treatments, amplifying their effectiveness.

Two notable companies that you think will thrive in 2025. These can be from your portfolio or not.

Company Name: Cordio Medical

Sector + description of the product/service: Digital Health. Cordio’s innovative software detects heart failure through speech analysis via a mobile phone. This groundbreaking technology can sense fluid accumulation associated with heart failure and provide early notifications, enabling patients and their doctors to take proactive steps to prevent hospitalization. The technology has been tested on over 1,500 patients and is currently in clinical studies with major pharmaceutical companies and U.S.-based payers and providers.

Investment amount + total: N/A

Founding Year: 2013

Reasoning why this is their year: 2025 is set to be a milestone year for Cordio Medical, driven by significant progress toward FDA regulatory approval. The pivotal clinical study is slated to conclude in Q1 2025, with approval anticipated by mid-year. Cordio’s robust financial model underscores the vast market potential, addressing 6.5 million eligible U.S. patients with substantial reimbursement rates—representing a multibillion-dollar annual market.

Company Name: Momentis Surgical

Sector + description of the product/service: Medical Devices. Momentis is revolutionizing robotic surgery with its compact, cost-effective Anovo™ Surgical System, designed to enable minimally invasive procedures with enhanced precision and accessibility. Featuring miniature, humanoid-shaped robotic arms with 360˚ articulation, Anovo™ empowers surgeons to perform complex surgeries, improving patient outcomes while reducing costs and expanding access worldwide.

Investment amount + total: N/A

Founding Year: 2013

Reasoning why this is their year: Towards the end of 2024, Momentis Surgical achieved two pivotal FDA approvals for its Anovo™ robotic surgical platform, positioning the company for transformative growth in 2025. These milestones not only validate the platform’s innovative technology but also significantly expand its addressable market. The approval for laparoscopic ventral hernia repairs allows Anovo™ to extend its applications beyond gynecology into general surgery, broadening its impact across multiple specialties.