2024 VC Survey

"This isn’t a bump in the road; it will take a couple of years to recover meaningfully"

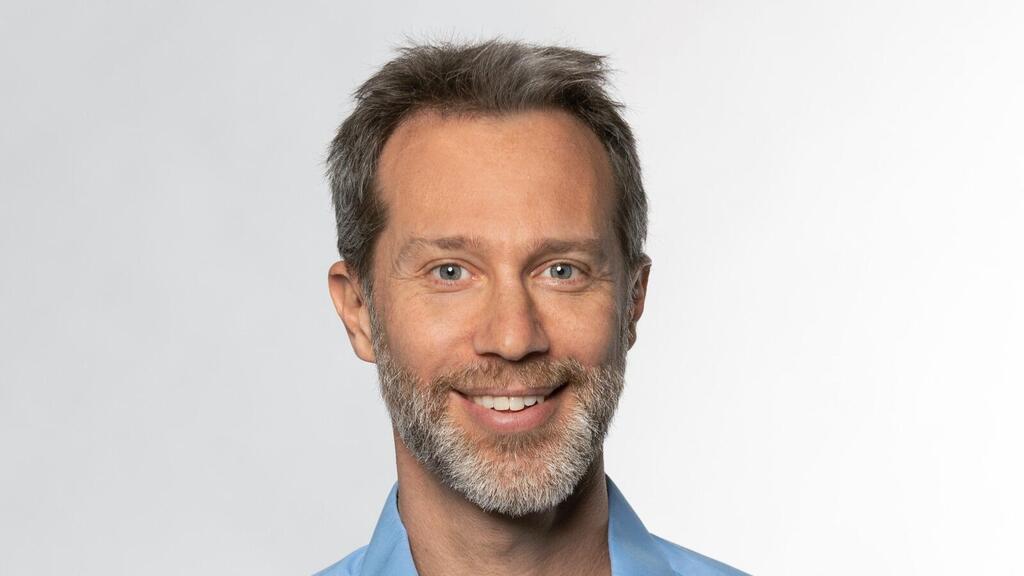

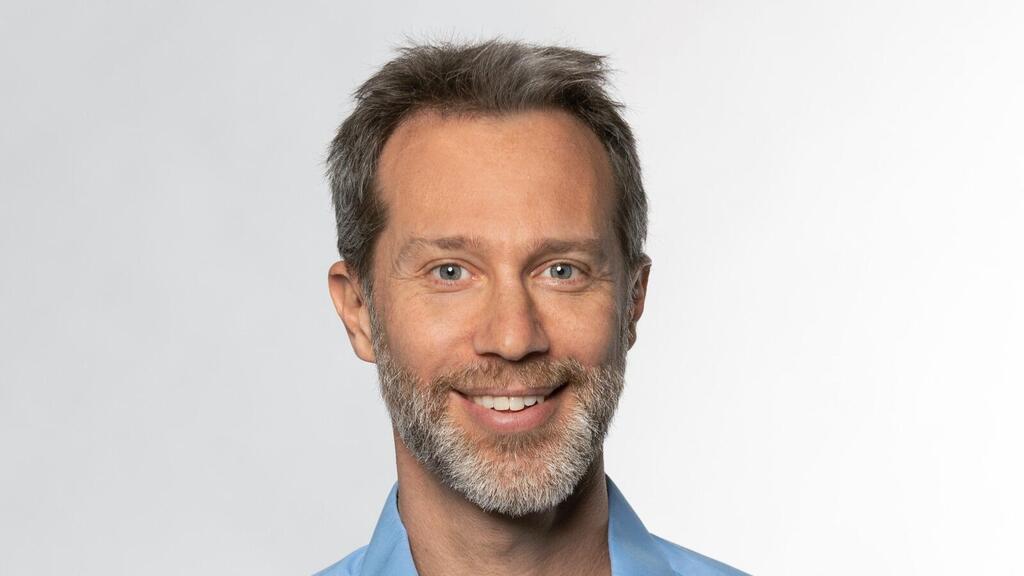

Doron Zauer, General Partner at Earth & Beyond Ventures, joined CTech for its 2024 VC Survey

“I don’t think that the prestige itself has been damaged, meaning the quality of our tech sector is as respected as ever, but investors don’t want to be investing in areas rife with legal uncertainty or war-related turmoil,” said Doron Zauer, General Partner at Earth & Beyond Ventures. “I am considered to be an eternal optimist, but this isn’t a bump in the road; it will take a couple of years to recover meaningfully, assuming swift resolution of civil unrest and war-related hostilities along the way.”

Zauer made the remarks when asked about the perceived prestige of Israeli high-tech and whether or not the ongoing war with Hamas has had any impact overseas. “Our approach was anchored in transparency, and we kept our LPs regularly informed, offering candid insights into how the fund is adapting to the rapidly changing environment and complex challenges we faced here in Israel,” he added. “This level of openness and mutual concern has been pivotal in maintaining trust and confidence in our ability to manage through adversity.”

1 View gallery

Doron Zauer, General Partner at Earth & Beyond Ventures

(Photo: Earth & Beyond Ventures)

VC fund ID

Name of the fund: Earth & Beyond Ventures

Total assets: $60M

Leading partners: Doron Zauer, Daniel Recanati, Israel Biran

Latest investments in Israel: Atiko

Selected portfolio companies: Atiko, Noga 3D, SpaceTenna, Two stealth mode companies

From your perspective, was 2023 a ‘lost year’, or can the events that happened during it be seen as a springboard for opportunities in 2024?

Times are tough at the moment for Israeli tech, there is no doubt about that, but not all is doom and gloom. Foreign investment has slowed to a halt, but Israeli VC funds have plenty of dry powder to shoulder the load for a fair amount of time, and hopefully in a year market will pick up. Economic downturns are a natural part of financial cycles, and the correction in valuations will ultimately be positive and make our startups more competitive, although it is meanwhile painful. There will be a new wave of startups being established during these tougher times, with great innovation and more realistic valuations, which will be well positioned once they mature and access to international funding improves.

What do you believe is more crucial to the state of Israeli tech: the influence of global processes and the global economy, or the local events ranging from the political protest to the war state?

While the global state of affairs provides broader context as well as funding and sales opportunities for Israeli tech companies, local events directly impact their day-to-day operations. I believe that recognizing and navigating the interplay between these two variables is essential for the resilience and success of the Israeli tech industry. Global economic trends and market dynamics have an enormous influence on the opportunities and challenges faced by Israeli tech firms, even before considering our domestic issues.

However, local events within Israel, ranging from political unrest to security concerns, exert a direct and immediate impact on the day-to-day operations and strategic decisions of tech companies. Political instability, regulatory changes, and security threats can disrupt business operations, hinder investor confidence, and influence talent retention efforts. As a result, Israeli tech firms must navigate the complexities of both the global and local landscapes to ensure their resilience and success.

Has the prestige of Israeli high-tech been damaged, or are the protests and the war merely a 'small bump in the road' from which the sector can recover within months?

I don’t think that the prestige itself has been damaged, meaning the quality of our tech sector is as respected as ever, but investors don’t want to be investing in areas rife with legal uncertainty or war-related turmoil. I am considered to be an eternal optimist, but this isn’t a bump in the road; it will take a couple of years to recover meaningfully, assuming swift resolution of civil unrest and war-related hostilities along the way.

How much effort was required of you to maintain the fund's status with your investors in 2023? What were their primary concerns and how did you address them?

Our approach was anchored in transparency, and we kept our LPs regularly informed, offering candid insights into how the fund is adapting to the rapidly changing environment and complex challenges we faced here in Israel. We were very open to suggestions from our LPs and planned contingencies. This ongoing dialogue ensured our investors were aware of our proactive efforts to navigate these uncertain times. This level of openness and mutual concern has been pivotal in maintaining trust and confidence in our ability to manage through adversity.

How are you preparing for the most pessimistic scenarios, such as the continuation of the war in Gaza deep into 2024, the opening of another front in the north, or further reduction of government support for high-tech?

Currently we are in a comparatively good place as a fund. We are very bullish on Israeli deeptech, valuations are very attractive for new deployment, and we expect the market to recover by the time our portfolio needs to raise follow-on funds. Since we are a new fund, we are also free of a mature portfolio that we need to financially support during these challenging times. However, to prepare for gloomy scenarios, we are actively helping our portfolio raise extra money wherever they can, and we are increasing our network of co-investors and future investors for our portfolio.

Did you raise fund money in 2023 for an existing fund or a new one? What are your expectations regarding this matter for 2024?

No, we established our fund toward the end of 2022, making 2023 the initial year of operation with a focus on deploying the existing fund. Our focus has moved from fundraising for our fund to actively seeking and investing in new innovative ventures.

In your view, will the amounts and/or the number of deals in 2024 be more like those of 2023 or 2021-22?

Looking ahead, we've set a strategic goal to double our investment efforts by planning for eight deals in 2024. We've made strides towards this target with two investments completed early in the year, and more in the works. This progress not only reflects our confidence in the deep tech sector but also underscores our commitment to supporting innovative companies.

Related articles:

Which high-tech sectors will you focus on in the upcoming year? Which areas will maintain their prominence, and which ones appear less attractive?

In the upcoming year, our focus will continue to be on companies operating across the realm of deep technologies, particularly those developing foundational infrastructures that enable broader technological advancements.

Quantum Computing continues to capture our attention due to its revolutionary data processing capabilities, which leverage quantum mechanics principles. This approach allows for complex calculations to be performed far more efficiently than what traditional computers can achieve, offering the potential for significant impacts in areas traditionally bounded by the limitations of conventional computing.

Moreover, our interest in the sustainable materials sector is set to continue, underscored by its critical role in addressing global environmental, energy, and sustainability challenges. Advances in this field promise not just to mitigate environmental impact but also to introduce new functionalities, enhance efficiency, and reduce costs across a range of applications in increasingly growing markets.

Sectors that may appear less attractive are those where the technology has become commoditized, or the market is saturated without clear avenues for disruptive innovation.

Which type of companies stand a better chance of garnering increased attention from VC funds this year - early-stage or advanced rounds?

It’s challenging to predict. On one hand, there are VCs for early-stage startups and there are VCs for later-stage startups, and they can’t easily switch their strategy during their fund lives. However, they can become more hesitant to deploy. The 2020-2021 tech bubble has ushered in a more grounded approach to valuations and growth expectations, compelling companies that benefited from previously inflated multiples to undertake considerable adjustments. This could mean that good opportunities still exist for growth rounds based on real revenue multiples. On the flipside, in this more pragmatic environment, early-stage companies also have an appeal to VCs with their more realistic valuations. Typically, these startups require less capital to reach initial growth milestones, which enables them to maintain agility and respond effectively to market dynamics and shifts.

What changes will you implement in your approach to evaluating investments in startups in the coming year, compared to the previous two years? What practices will you abandon, and what criteria will you now demand from founders?

Our approach as early-stage investors to evaluating investment opportunities in startups is anchored firmly in our core investment philosophy and hasn’t significantly changed. This philosophy prioritizes innovative potential, the scalability of business models, and the capability of founding teams to execute their vision. We still try to avoid hype and look for technology powering innovative solutions to real problems.

Do you think it is likely we will witness encouraging IPOs, the emergence of unicorns, or remarkable exits in 2024?

The IPO market looks to be slow to recover, but no doubt we will see new unicorns and certainly good exits – we are starting to see some already, even amidst a state of ongoig hostilities.

Practical and current tips for founders planning upcoming money-raising efforts:

In the current market, where investors are increasingly scrutinizing opportunities against the backdrop of economic uncertainty, founders embarking on fundraising journeys must adeptly align their strategies with current investor sentiment.

First, you need to analyze which are the correct class of investors for your sector and overlay that with the types of investors that are currently investing in Israel. It is more important now than ever to demonstrate your startup's resilience and adaptability; illustrate how your venture has navigated through challenges and how it's poised to adapt to market changes.

Concrete examples of your business model's flexibility and innovation will speak volumes to investors. Equally important is presenting a clear, realistic financial roadmap. Additionally, the strength and composition of your team cannot be overstated. Highlighting the unique skills and diverse experiences of your team members reassures investors of your startup's capability to execute its vision and leverage great technology.

Portfolio companies that you think will thrive in 2024:

Noga 3D

Sector + description of the product/service: Advanced Materials, 3D Printing, Automotive, Aerospace

High-performance-polymer which combines uniquely strong attributes with the ability to be 3D printed, enabling the manufacture of complex parts to replace existing metal and composite components in industries such as aerospace, space, electronics, and automotive. The polymer, which is resistant to extreme conditions, including temperature, friction, and even space radiation.

Investment amount + total: $1.4m

Founders + year of establishment: Founded by Mike Burshtein, a seasoned professional with years of high-level management experience, Dr. Eitan Grossman, an expert in material science and former head of the Space Environment Department at the Soreq Nuclear Research Center, and Professor Shlomo Magdassi, a world-renowned researcher specializing in 3D printing technologies.

Reasoning why this is their year:

Noga3D is poised for a big 2024. The company has made massive strides in developing its technology and is now beginning to print samples for end-customers. We believe that the growing demand for cheaper and lighter components as well as flexibility in manufacturing will push Noga3D to the forefront in the year to come.