Finance Ministry: 60% drop in foreign investments in Israel in Q1 2023

According to a Finance Ministry report, the average value of exit transactions in the first quarter of 2023 has decreased by about 80%

There has been a significant decrease in foreign investment in Israel in the first quarter of 2023 to about $2.6 billion, according to a report by the Ministry of Finance summarizing foreign investments in Israel for 2022. This represents a 60% decrease compared to the quarterly averages in 2020 and 2022. It is important to note that the report deliberately avoids comparing 2022 to the exceptional year 2021 when investments were unusually high, amounting to approximately $11.7 billion per quarter - 78% higher than the current period.

1 View gallery

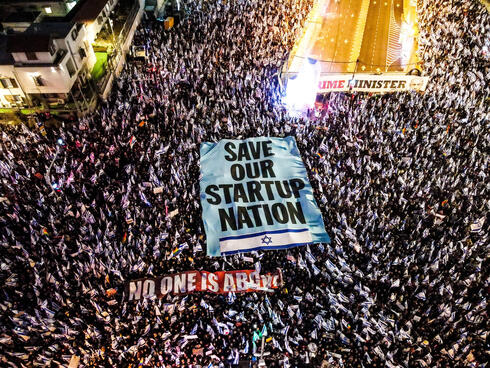

A protest in Tel Aviv over the judicial overhaul.

(Credit: Anadolu Agency/Getty Images)

While a comparison with 2021 may be unfair due to how unusual it was, a closer examination of the report suggests that the Finance Ministry intentionally did not want to emphasize the decrease in 2022. The report does not explicitly state the percentage decrease between 2022 and 2021, but a quick calculation shows it to be around 41%. In contrast, they explicitly cite the decrease in foreign investment in other countries for 2022: 24% worldwide, 21% in the United States, and 26% in OECD countries. All of these figures represent lower decreases compared to Israel's reported 41%. China experienced a 48% decrease in foreign investment.

Curiously, the report barely addresses Israel's unique decrease, and Chief Economist, Dr. Samuel Abramson, merely states that "Israel continues to be an attractive destination for investment, with $27.7 billion invested in Israel in 2022, even higher than in 2020." It's important to note that the decrease in 2022 cannot be attributed to the government’s judicial overhaul, as it predates this policy shift.

According to the ministry, "The decrease is evident both in the number of transactions and the number of investors, both of which have decreased by a third compared to previous years." Their data is based on real transactions rather than data from the Central Bureau of Statistics, making it more reliable for understanding investment trends in Israel. Nevertheless, the ministry notes that even when relying on data from the Central Bureau of Statistics, "direct investment in the first quarter of 2023 amounted to $4.76 billion, reflecting a decrease of approximately 34% compared to the quarterly averages in 2020 and 2022."

The report also notes the average value of exit transactions in the first quarter of 2023, stating that it has “decreased by about 80%, from around $307 million for exits in 2020-2022 to about $56 million for exits in the first quarter of 2023." This is attributed in part to the declining valuations of tech companies in the United States.

One important indicator is greenfield investments, a type of foreign direct investment where a company establishes operations in a foreign country, rather than acquiring existing companies. There has been a decrease in greenfield investments in the first quarter of 2023, with "the total value of greenfield investments amounting to about $180 million, a decrease of more than 50% compared to the data for 2022 and 2020."

However, the number of greenfield investments in the first quarter remains similar to previous years. The report primarily focuses on 2022 and offers only one explanation for the decrease in foreign investment in the first quarter of 2023: "It seems that local and global uncertainty led to a decrease in the volume of foreign investment." Ministry reports have been reluctant to cite "local uncertainty” as a cause as this would be a direct reference to the government's deeply divisive judicial overhaul and the ongoing public protests against them.