BiblioTech

CTech's Book Review: Exploring Bitcoin's transformative potential

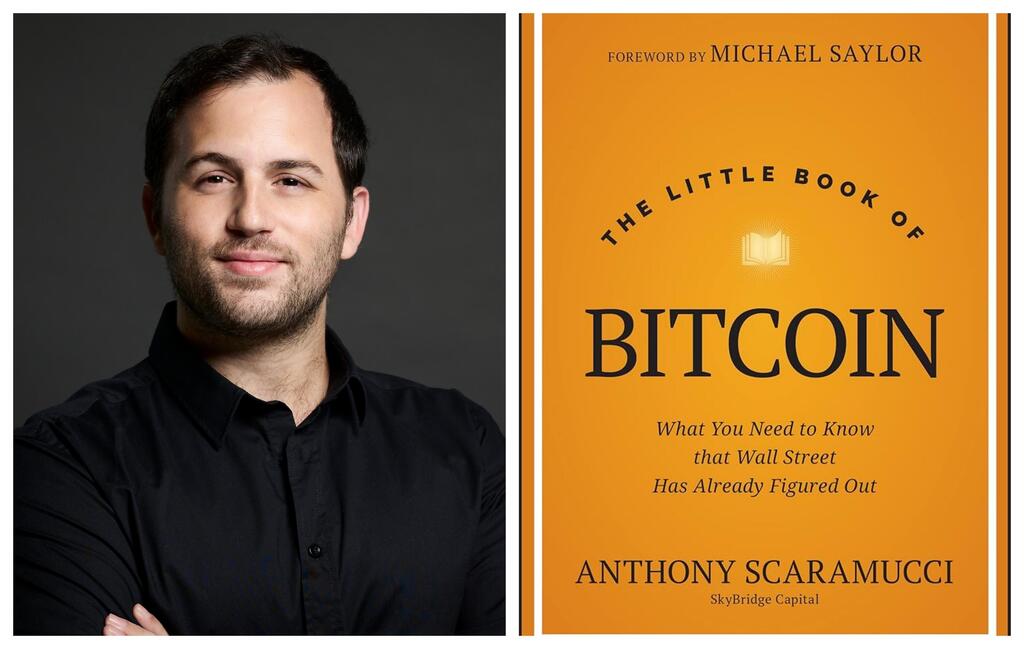

Shahar Shamai, co-founder and CTO of GK8, shares insights after reading "The Little Book of Bitcoin: What You Need to Know” by Anthony Scaramucci.

Shahar Shamai is the co-founder and CTO of GK8, acquired by the U.S.-based Galaxy. GK8 develops a platform for managing and securing digital assets for financial institutions. He has joined CTech to share a review of "The Little Book of Bitcoin: What You Need to Know” by Anthony Scaramucci.

Title: "The Little Book of Bitcoin: What You Need to Know”

Author: Anthony Scaramucci

Format: Tablet

Where: Home

Summary:

When you pick up “The Little Book of Bitcoin” by Anthony Scaramucci—an American financier, entrepreneur, podcaster, and one-time White House Communications Director in the first Trump administration—and follow his journey from skeptic to advocate, you can immediately relate. While the book is designed with newcomers to Bitcoin in mind, it also offers compelling anecdotes and insights that seasoned Bitcoin professionals will appreciate. Scaramucci does a great job blending personal stories with broader industry context, creating an engaging and educational narrative. One of my favorite moments comes early on when Scaramucci recounts a pivotal conversation with Mike Novogratz, founder of Galaxy, the parent company of GK8, and a key mentor in his Bitcoin journey. Over dinner at the Explorers Club, Novogratz laid out his vision for Bitcoin’s revolutionary potential.

Important Themes:

One of the key themes in “The Little Book of Bitcoin” is Bitcoin's transformative potential, not just as a financial asset but as a cultural movement that could reshape how we think about money. Scaramucci highlights Bitcoin’s core attributes—its deflationary design, decentralization, and the financial empowerment it offers to individuals, especially in regions with limited access to traditional banking. This theme ties into the broader narrative of Bitcoin’s capacity to disrupt the financial system, ultimately providing greater financial independence to people worldwide.

Another critical theme is Bitcoin’s volatility and its challenges in achieving mainstream adoption. Scaramucci openly discusses the influence of external actors, such as Elon Musk, whose tweets have been known to cause significant price swings. However, rather than seeing these fluctuations as setbacks, Scaramucci views them as part of Bitcoin’s growing pains, a sign that it’s gaining attention and influence in a way that can’t be ignored. This perspective reflects his optimistic view of Bitcoin's long-term future despite its current hurdles.

Throughout the book, Scaramucci emphasizes the importance of education, open-mindedness, and risk tolerance when engaging with Bitcoin, offering readers a balanced view of its transformative potential and its current challenges. Another highlight is a paddleboarding anecdote with Peter Briger—an esteemed investor and co-chairman of Fortress Investment Group. Reading about these two finance veterans discussing Bitcoin while balancing on boards in the Pacific is both insightful and entertaining. Briger’s case for Bitcoin as a safeguard against inefficiencies in traditional banking is particularly thought-provoking.

What I’ve Learned:

One of the most valuable insights I found in Scaramucci’s book is Bitcoin's role in reshaping how we think about money. As someone deeply embedded in the blockchain security space, I’ve always been aware of Bitcoin's potential from a technological standpoint, and the book reinforced my appreciation for its broader societal implications. He successfully conveys how Bitcoin’s decentralization empowers individuals and offers financial freedom and security in ways that traditional banking systems often cannot. This aspect is particularly relevant in an era where trust in centralized financial institutions is increasingly being questioned.

The book also highlighted the importance of skepticism and critical thinking, especially in a space as volatile as cryptocurrency. Scaramucci’s skepticism, which he openly shares, provided a more relatable perspective for those who might be hesitant to invest or get involved with Bitcoin. His journey from doubt to belief in Bitcoin’s potential is a reminder that the crypto space, while still maturing, is full of opportunities for growth and innovation.

His perspective is optimistic for anyone who’s watched the market with bated breath (and maybe a bit of anxiety). Finally, Scaramucci’s personal anecdotes and the stories he shares make complex concepts more accessible and engaging, showing how Bitcoin is not just a technological breakthrough but a part of a broader cultural shift. By weaving in real-world examples and historical parallels, Scaramucci helps readers see Bitcoin not as an abstract concept, but as an inevitable evolution in the way value is stored and transferred globally.

Critiques:

While “The Little Book of Bitcoin” is informative, it sometimes oversimplifies the complexities of Bitcoin’s technical aspects. As someone who works in the blockchain security field, I found that some of the more intricate details of blockchain technology and security risks are glossed over. For readers who are looking for a deeper dive into Bitcoin’s technical foundations, this book may not provide the depth they desire. Additionally, while Scaramucci touches on Bitcoin’s volatility, he doesn’t fully explore the extent of regulatory challenges or the risks that more prominent institutional actors face.

Who Should Read This Book:

“The Little Book of Bitcoin” is designed for anyone curious about Bitcoin and its potential to transform traditional financial systems. Whether you’re a newcomer looking to understand the basics or a Bitcoin expert seeking a fresh perspective, Scaramucci’s approachable writing style and personal stories will resonate with you. For those working in the blockchain or fintech sectors, the book offers good insights into the broader implications of Bitcoin’s rise.

Scaramucci’s framing of Bitcoin as a “once-in-a-lifetime opportunity” is bold, but he backs it up with clear explanations of its deflationary design and decentralization. It’s a vision of a financial system built on resilience, accessibility, and trust—values that resonate deeply with us at GK8 by Galaxy.