Trump’s tariffs could hit Israeli tech and pharma industries hard

Israel’s government remains complacent despite growing economic risks.

"For Israel, the risk is slightly less direct because our economy is more service-oriented," said Prof. Amir Yaron, Governor of the Bank of Israel and Economic Advisor to the Government, in an interview with Calcalist last week, assessing the implications of Trump’s trade war on the local economy.

In terms of raw numbers, Israel’s exports of business services to the United States totaled more than $20 billion in 2021 (the most recent available data), accounting for 48% of all business services exports (including high-tech). These figures have only grown since then. In contrast, Israel’s exports of goods (excluding diamonds) to the United States in 2024 amounted to $14.2 billion, an increase of about 4.5% compared to 2023. Israel has long been a powerhouse in services, with the majority of its exports (about 52%) concentrated in this sector.

Furthermore, there is a fundamental difference between tariffs on goods and services. "It is true that the trade deficit with the United States is larger in services, but the main emphasis of the American administration is on strengthening U.S. manufacturing industries. The tariffs they are threatening to impose apply only to goods," explained Yoav Saidel, Israel’s economic attaché in Washington, in an interview with Calcalist.

According to Saidel, the word "tariffs" holds particular significance for Trump. "It is a simple and easy-to-understand concept, and it applies exclusively to foreign entities," he noted. But there is another, less discussed reason behind Trump's approach: he is determined to reshape the U.S. tax structure, shifting it back to an earlier model that relies more on tariffs and less on income taxes. This system benefits the wealthy and the business sector while burdening American consumers. Historically, tariffs accounted for 90% of U.S. tax revenues until about a century ago, whereas today, they contribute less than 2%.

Another key point to consider is the political messaging behind Trump’s trade policies. "Trump’s core message is about bringing jobs back to U.S. factories," Saidel added. "According to his narrative, these jobs have moved to countries like China, Canada, and Mexico. It’s a stance that resonates with a large portion of the American public. In his view, tariffs are the best tool to reverse this trend and restore American manufacturing."

One thing is clear: the U.S. market is Israel’s most important export destination, and Trump’s proposed policies are raising deep concerns among trade experts and officials. Yet, Israeli politicians have largely ignored the issue. Those who assume that the 1985 U.S.-Israel free trade agreement—reinforced in 1995, when nearly all tariffs except agricultural ones were eliminated—will prevent Trump from imposing tariffs on Israeli goods may be mistaken. After all, the U.S. had free trade agreements with Canada and Mexico under NAFTA, yet Trump dismantled that deal. Moreover, during his first term, he imposed tariffs on Israeli metals, despite diplomatic efforts to prevent it.

During his visit to Israel in 2017, Trump told then-President Reuven Rivlin that he intended to "reduce the trade deficit between our countries, if that's okay with you"—and he followed through. In July 2018, when he imposed tariffs on metals, Israel was not granted an exemption. Requests for relief were escalated to Prime Minister Benjamin Netanyahu, but U.S. trade officials made it clear that only one person had the power to grant exemptions: Trump himself. At the time, Israel’s metal exports amounted to $25 million, meaning the tariffs caused roughly $2.5 million in damages, primarily affecting four companies in Israel’s periphery. Netanyahu ultimately chose not to raise the issue with Trump.

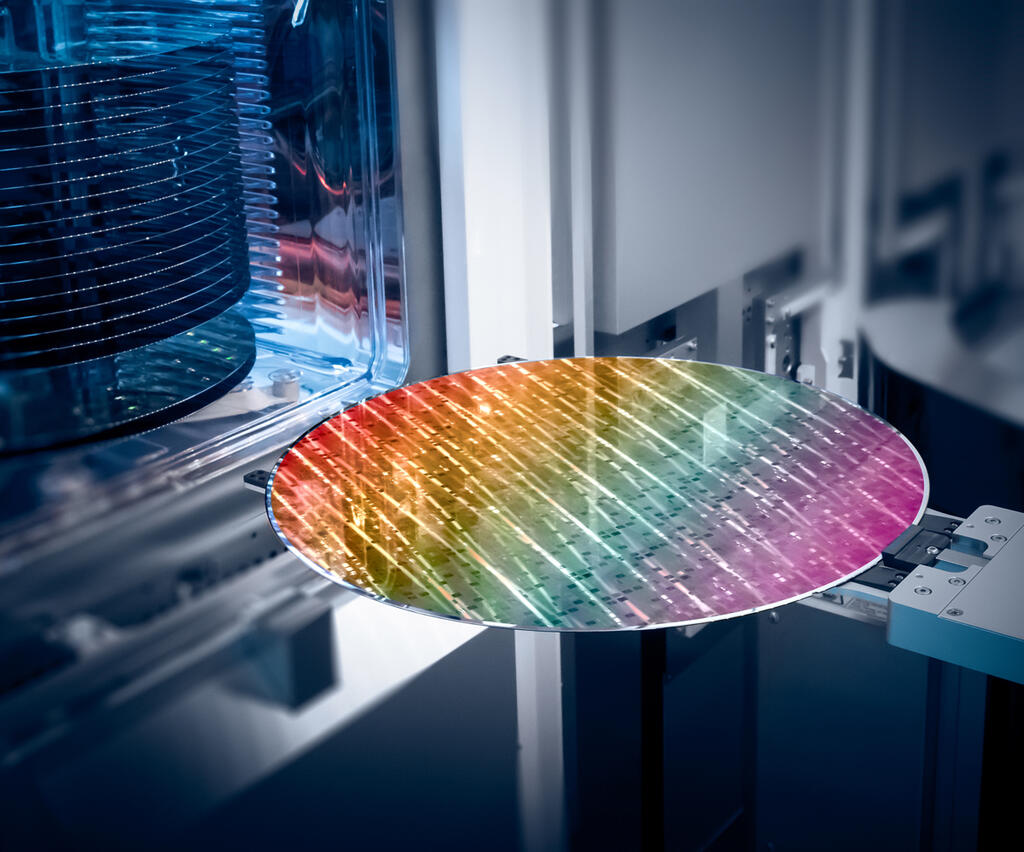

Now, despite warnings from trade experts, the Israeli government appears complacent, believing that Trump’s personal affinity for Israel will lead to exemptions. However, this assumption is flawed. The U.S. trade deficit with Israel has jumped by nearly 30% over the past three years, while Israel imports 52% more goods from China than from the United States. Additionally, compared to Trump’s first term, the economic landscape has shifted. He is now determined to impose universal tariffs, as well as targeted tariffs on industries critical to Israel—such as semiconductors and pharmaceuticals.

According to Israel’s Central Bureau of Statistics, the country’s pharmaceutical exports total about $2 billion annually, while electronic board exports amount to roughly $6.5 billion—together accounting for about 12% of Israel’s industrial goods exports. These figures dwarf the relatively minor impact of previous metal tariffs.

Meanwhile, Israel’s diplomatic efforts are focused on lobbying against outgoing President Joe Biden’s decision to impose restrictions on the sale of advanced AI chips. Biden’s policy divides countries into three tiers: 18 nations are granted unrestricted access, others are barred from purchasing the chips altogether, and Israel falls into the middle tier—able to buy advanced AI chips, but with restrictions. Given the strategic significance of these chips, Israel is pushing to gain full access, with support from Nvidia and Microsoft, both of which have urged the incoming Trump administration to reconsider Israel’s classification.

Beyond Israel, Trump’s trade policies are poised to have far-reaching global consequences. A recent report by the International Institute of Finance (IIF), which represents about 400 financial institutions and is led by Dr. Marcelo Estevao, analyzed the impact of Trump’s previous trade war with China. The findings suggest that tariffs alone did not significantly or sustainably reduce the U.S. trade deficit. However, the proposed new tariffs are broader, covering a larger share of imports, and major companies—including Microsoft and Taiwan Semiconductor Manufacturing Company (TSMC)—are already investing heavily in U.S. manufacturing to mitigate potential risks.

The most severe consequences of Trump's policies, however, concern inflation and economic growth. A key lesson from the 2018–2019 trade war is that tariffs create unintended ripple effects that extend beyond their intended economic goals. Studies consistently show that the cost of tariffs is passed on to U.S. consumers, driving up prices for household appliances, automobiles, and electronics.

A February study by the Peterson Institute for International Economics estimates that if Trump were to impose his proposed tariffs—25% on Canada and Mexico (excluding oil, which would face a 10% tariff), plus an additional 10% on China—it would cost the average American household more than $1,200 per year. Since these tariffs target almost every sector, they risk fueling inflation across the board.

The Boston Federal Reserve estimated in February that tariffs of this magnitude could increase overall U.S. inflation by 0.5 to 0.8 percentage points, with core PCE inflation rising by 0.3 to 0.5 percentage points this year alone. “While Trump is campaigning on a tax-cut platform, most Americans would experience a net tax increase due to the tariffs,” the report noted.

Furthermore, the distributional effects of the tariffs are stark. The Peterson Institute’s analysis found that households in the lowest income brackets would see their disposable income decline by more than 2%, while middle-income households would experience a drop of 0.5% to 1.3%. In contrast, the wealthiest 1% of Americans would see their disposable income rise by 2.6%. In other words, Trump’s trade policies—combined with planned income tax cuts that disproportionately benefit the wealthy—would likely exacerbate income inequality, already among the highest in the developed world.

Beyond economics, Trump’s trade doctrine threatens to destabilize the global trading system. Supply chain disruptions, heightened geopolitical tensions, and shifting alliances could add new layers of uncertainty. The U.S. withdrawal from supporting Ukraine has already strained transatlantic relations, and a full-scale trade war would further unsettle global markets. In the end, while Trump's policies may be aimed at revitalizing American manufacturing, they could come at the cost of weaker global growth, reduced investment, and slower job creation.