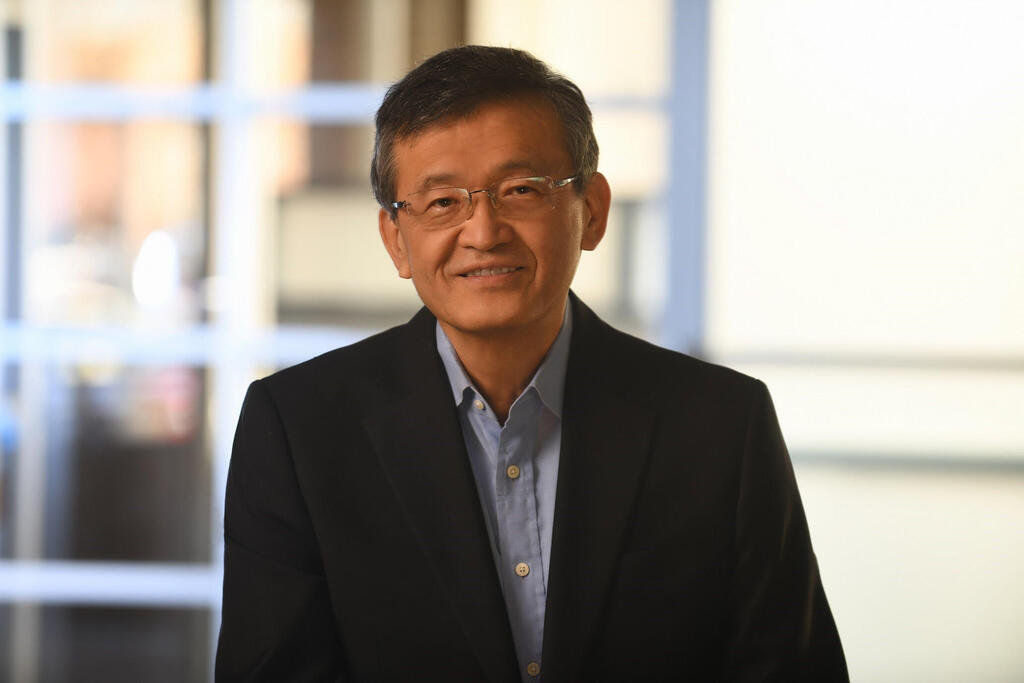

Intel’s last chance? New CEO Tan’s bold move to revive the struggling chip giant

With its future hanging by a thread, Lip-Bu Tan must decide whether to transform Intel or dismantle it entirely.

Lip-Bu Tan, who was appointed CEO of Intel last night, faces an extraordinary task: deciding whether the struggling chip giant will continue to operate as an independent company or be sold off and cease to exist. In the hours following the announcement of his appointment, Tan signaled that he intends to stick with the foundry strategy of his predecessor, Pat Gelsinger. However, market circumstances and the company's difficult situation may leave him with no choice but to agree to a deal in which Intel sheds a significant portion of its operations—or perhaps even disappears altogether.

Tan (65), born in Malaysia, holds a bachelor's degree in physics from Nanyang Technological University in Singapore and a master's degree in nuclear engineering from MIT. He began doctoral studies in nuclear engineering at MIT but retired after the 1979 nuclear reactor accident. Instead, he completed an MBA at the University of San Francisco.

Tan worked in senior positions at energy companies EDS Nuclear and ECHO Energy before moving into the investment field. In 1987, he co-founded the venture capital fund Walden International, which invested in the fields of chips, alternative energy, and digital media. The fund backed companies such as Ambarella, Creative Technology, S3 Graphics, and Sina. In 2001, Forbes magazine named him "the pioneer of Asian venture capital" due to his role in promoting investments in startups across the continent. In 2004, Tan was appointed to the board of directors of Cadence Design Systems, a manufacturer of software and hardware for the development of integrated circuits and chip systems. In 2008, he became acting CEO and later permanent CEO. During his tenure, he was credited with stabilizing and accelerating the company, which now has a market value of $65 billion. Tan left the role in 2021 but remained on as chairman until his appointment as CEO of Intel. Throughout this time, he continued to hold active positions in small and mid-sized technology companies, including as chairman of AI chip company SambaNova and communications chip developer Credo. Through Walden, where he remains involved, Tan continued to lead investments in chip and artificial intelligence companies. In 2021, the fund invested $20 million in Israeli company AI21 Labs. Walden's investments in Chinese AI and chip companies have faced scrutiny from the US Congress, which in 2023 asked the fund for information about investments in companies on the government's blacklist, including those deemed a national security risk.

In his new role at Intel, Tan will face the most complex challenge of his diverse career. What was once a technology giant and the dominant company in the chip industry now faces an existential crisis, having missed the mobile revolution over the past two decades and likely poised to miss the AI revolution as well. These strategic missteps have caused the company to lose revenue and market share to competitors such as Qualcomm in mobile chips, Nvidia in AI chips, and Taiwan’s TSMC in chip manufacturing.

Gelsinger attempted to turn Intel's fortunes around by radically altering its business strategy, including entering the foundry sector (manufacturing chips for other companies according to their designs). This shift followed decades during which Intel produced only its own chips. The ambitious plan aimed to position Intel as an alternative to TSMC, the world’s largest chip manufacturer, and to turn rivals like Nvidia and Apple into customers.

As part of this move, Intel is investing hundreds of billions of dollars in new manufacturing plants, including a $25 billion commitment to a new, advanced factory at its Kiryat Gat campus and additional factories across various U.S. states. However, despite these efforts, Intel has struggled to attract significant and profitable customers for its foundry operations, and its revenues and profits have continued to decline. The generative AI (GenAI) revolution has further disrupted these plans, creating a major market shift and catching Intel unprepared for the surge in demand for AI chips. The company’s failure to secure a strong position in the AI chip market, combined with the long-term nature of Gelsinger’s plan—where new factories are still months away from becoming active—has intensified pressure from investors. This pressure has grown following several quarters of disappointing financial performance, forcing Intel to implement further cutbacks, including the laying off of 15% of the workforce.

Against this backdrop, Gelsinger stepped down as CEO in December. Since then, there have been reports of potential deals to sell all or part of Intel’s operations. In February, reports indicated that Intel was in talks to sell its chip manufacturing operations to TSMC, while also considering the sale of its chip design operations or a combined sale of both divisions, effectively ending its existence as an independent company. This week, Reuters reported that TSMC was in talks with Nvidia, AMD, and Broadcom to form a jointly owned company that would take over Intel's foundry operations, with TSMC managing the operations but not owning more than 50% of the company.

This is the situation into which Tan steps as Intel's new CEO. His long-term plans for the company remain unclear, but in a letter to employees, he signaled that he intends to continue his predecessor’s strategy. "We will work hard to restore Intel’s position as a world-class products company, establish ourselves as a world-class foundry and delight our customers like never before," he wrote.

The market initially responded positively to Tan’s appointment, with Intel shares jumping over 10% in extended trading. However, it remains uncertain how long the rally will last if Tan continues with Gelsinger’s strategy. The foundry plan is costly and long-term, facing stiff competition from TSMC, which dominates the lucrative market for high-end chip manufacturing. The future of this strategy may also be in jeopardy under the Trump administration, which is working to eliminate the Biden administration’s $52 billion subsidy program that has supported Intel’s U.S. factory investments. At the same time, senior Trump administration officials are backing TSMC’s potential takeover of Intel’s manufacturing operations.

In his letter to employees, Tan spoke of creating a "new Intel." The question remains: what kind of new Intel does he envision? A major foundry company competing with TSMC and supplying chips to companies like Nvidia and Apple, as Gelsinger envisioned? Or a smaller, more focused company that only designs or manufactures chips? Or will the new Intel be a breakup of the company into parts that are sold to other players, leaving only a memory of Intel’s past glory and a missed future?

Tan's room for maneuver may be limited, despite his impressive track record. As he stated in his letter to employees: "We also have a responsibility to deliver for our shareholders." He added that he hopes to achieve this through "our renewed focus on customers." However, it is uncertain whether shareholders will have the patience for this. While the market has reacted positively to the appointment, the trend may shift once Tan’s plans become clear, following a quarter or two of disappointing performance, or if it becomes clear that the foundry vision remains difficult to realize.

In that case, Tan may have no choice but to oversee Intel’s final demise instead of saving it.