Israel's evolving fintech sector: A 2024 market overview

A new report from Viola has shed light on the sector’s resilience amid a challenging economic environment

Israel’s Fintech sector has remained resilient and robust, with strong signs of revenue growth and solid gross margins amid difficult times both domestically and abroad, according to a new report. After an initial boost in 2021 and subsequent collapse due to raised interest rates, the sector has seen a bounce back in line with the rest of the world’s markets.

“I think Fintech is one of the healthiest industries in Israel,” said co-writer of ‘Israeli FinTech Outshines: Sector Resilience Reflects Investor Confidence, Driving a New Wave of Innovation’, Omry Ben David. As a General Partner at Viola Ventures, he has more than 15 years of technology-focused experience across investment banking, startup operations, and private venture investments. “There’s resiliency in the early stage: the early stage is strong. That means there's always innovation that is coming into the Fintech space.”

One area that led the early-stage funding sector was RiskTech, reflecting Israel’s Cyber and Risk ecosystems, as well as the evolving risk landscape as GenAI sees increased adoption. In 2023 the segment accounted for 23% of total funding compared to just 6% in 2022.

Total early-stage Fintech funding reached $500 million in Israel in 2023 ($1.4 billion in Fintech generally), which while considered low compared to previous years remains in line with the global trends. In total, Israel’s total early-stage funding in 2023 was around $3 billion, making Fintech once again the second most funded sector after Cyber. The report confirmed that Fintech accounted for 18% of all Israel’s investment in 2023 (Cyber claimed 26%). For the last four years, it has remained in second place and its gap is closing following a drop in 2022.

“Everyone knows that Israel is a cyber hub, right?” added co-writer Uri Lampert, Principal at Viola Ventures. “Cyber is very strong in Israel and hopefully it will always be like that. We love cyber, we invest in Cyber, and I think having similar trends to Cyber specifically says very good things about Fintech.”

Major Fintech companies last year that made a splash on the scene include Next and eToro, which raised $265 million and $250 million, respectively, and accounted for 61% of the entire year’s funding. While early-stage companies had their moment to shine with funding rounds, it was these larger companies that managed to take advantage of the market by opting to complete acquisitions in the space. Israeli companies purchased foreign companies, such as Rapyd’s purchase of Netherlands-based PayU for $610 million or Iceland-based Valitor, which was purchased for $100 million. There was only one recorded ‘blue and white’ deal when Israel-based Tipalti purchased local Approve.com for a smaller $40 million.

“The acquisitions made in 2023 highlight a critical aspect of the Israeli FinTech ecosystem – its readiness to innovate and expand even during challenging times. This readiness and capability to invest in growth reflect the sector's overall health and position for continued success,” said the report.

However, it is important to note that IPOs of Israeli companies decreased “significantly” from 78 in 2021 to just three in 2023, mirroring the American trends (454 to 153). Within the Fintech market, there was one IPO in 2022 and none in 2023. Israeli Fintech M&A exits “all but vanished” in 2023, dropping from 10 deals worth $1.1 billion in 2022 to only two deals worth $4 million the following year.

Despite this, the writers remain bullish about the future of Fintech: not only because of the expected lowering of global interest rates and more positive public markets, or the impending AI revolution, but because of Israeli resilience. “I think with the return of most of the reservists back to the offices and the ability to manage some sort of a war life or a war work balance, you see the resiliency of Israeli companies who are managing through all this with excellence,” Ben David concluded.

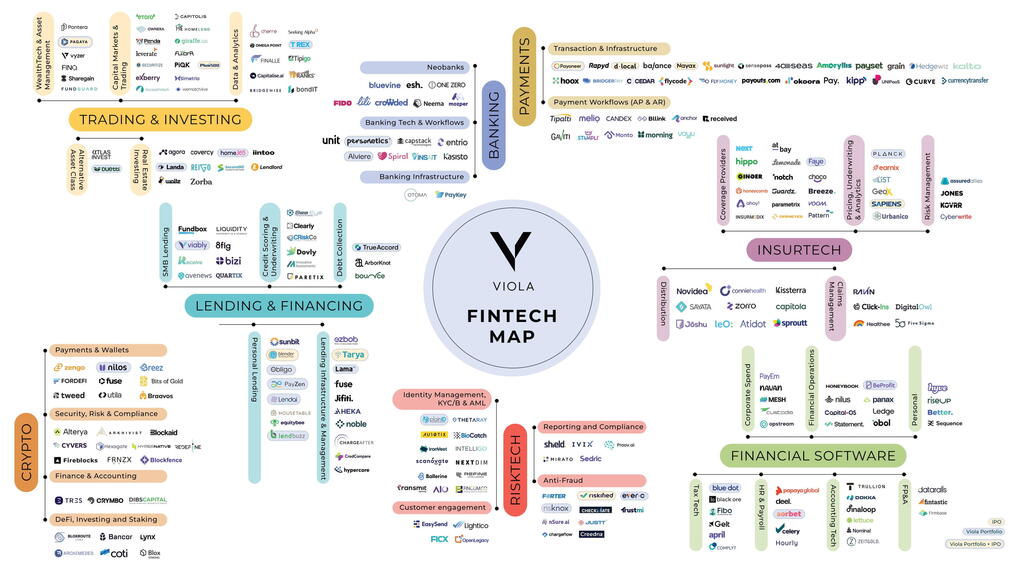

Viola is one of Israel’s leading tech investment groups with more than $5 billion in Assets Under Management. It was founded in 2000 and has backed some of Israel’s leading Fintech companies such as Pagaya, Payoneer, and Faye, recently voted Calcalist’s most promising startup of 2024. It has produced an interactive map of the entire Israeli Fintech ecosystem, which can be found here.