Check Point expands AI efforts with new research center amid record financial results

Cybersecurity giant surpasses $1 billion in annual profit as it doubles down on artificial intelligence.

Check Point is set to establish a new AI research center, newly appointed CEO Nadav Zafrir revealed on Thursday. Speaking after the company announced its earnings for the fourth quarter of 2024, Zafrir emphasized that a significant portion of his focus will be on the artificial intelligence revolution, which is transforming cybersecurity for both attackers and defenders.

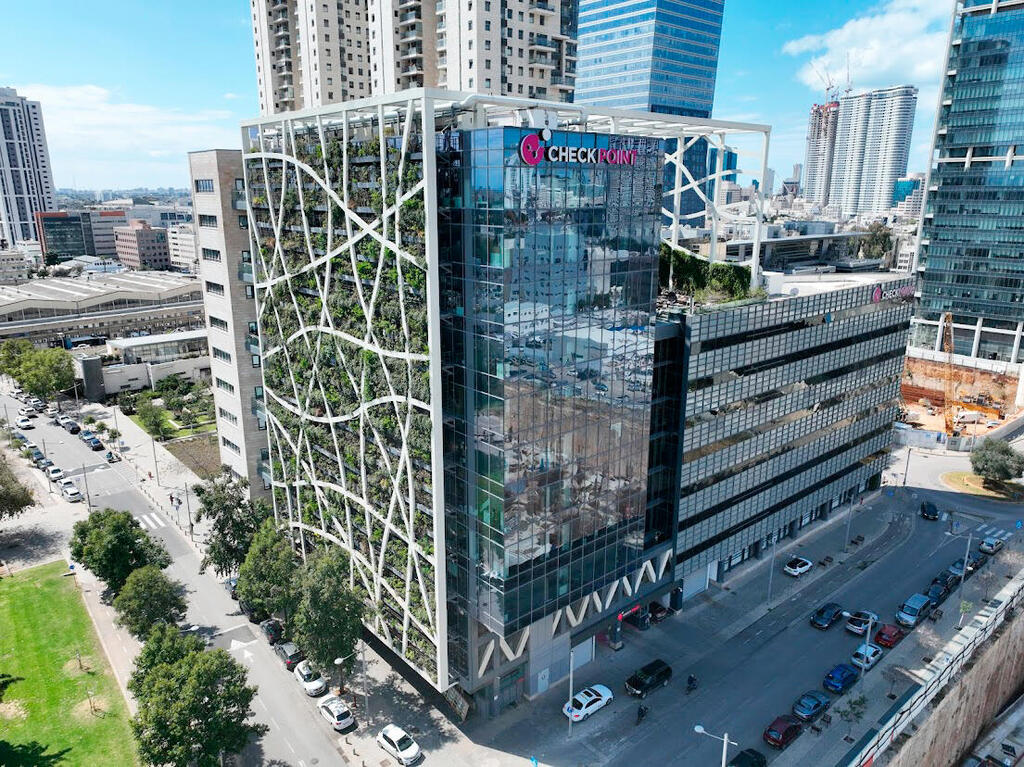

"We will repurpose our Tel Aviv center, located in our building on Leonardo da Vinci Street, which was lent to the hostage release headquarters last year," Zafrir said. "The center will house dozens of employees, including both existing Check Point staff and new hires that we will recruit.

"In the coming year, we will embark on a major talent recruitment effort in Israel and abroad—we have already begun this process. We need the best people at Check Point," he added.

Check Point delivered strong results in its final quarter under longtime CEO Gil Shwed, reporting revenues of $704 million—a 6% increase compared to the same period last year—falling within the mid-range of the company's forecast. Quarterly profit rose 5% year-over-year to $2.70 per share.

For the first time, Check Point surpassed $2.5 billion in annual revenue, closing 2024 with $2.56 billion, reflecting 6% growth from the previous year. The company also achieved a milestone in profitability, with annual earnings per share reaching $9.16—a 9% increase compared to 2023—bringing its net profit past the $1 billion mark for the first time.

Check Point ended the year with cash reserves of $2.8 billion, providing the new management team with ample financial flexibility. The company’s stock has already climbed nearly 10% since the start of 2025, pushing its market capitalization above $22 billion and bringing it close to an all-time high.