Lusix’s $4M acquisition marks end of struggle for Benny Landa’s lab diamond venture

Following financial hardships and intense competition, Lusix’s sale brings closure to a saga of survival in the competitive lab diamond market.

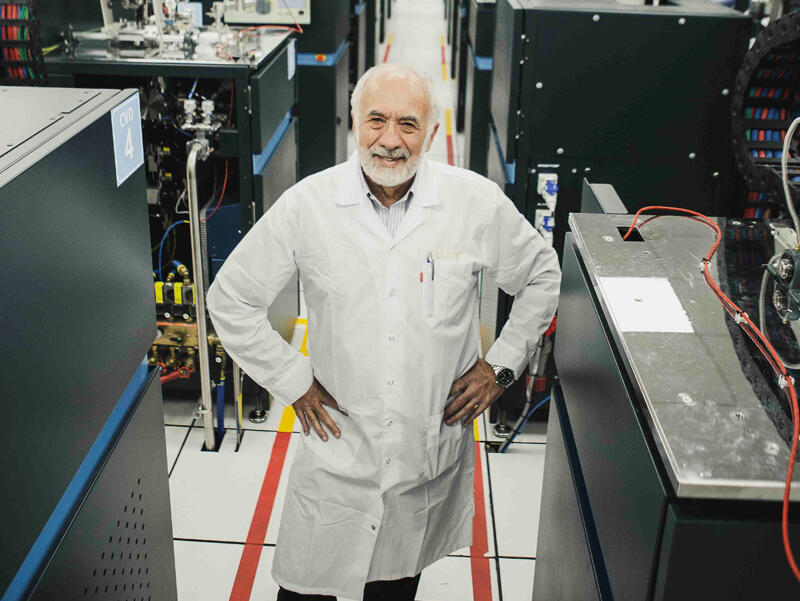

After a prolonged saga, the District Court has ruled that the Lusix laboratory diamond company, founded by Benny Landa, will be sold to the Belgian diamond company Fenix for $4 million.

About a month ago, the Japanese company EDP offered to purchase Lusix for $2.59 million but ultimately decided to withdraw due to the escalation of the war and upon realizing that the highest bid would secure the deal. Since EDP's withdrawal, additional contenders have joined the bidding process, including two Belgian diamond companies owned by Indian investors. These companies, Fenix (owned by the Indian Parikh family) and PD Holdings, each offered $4 million.

Fenix's proposal gained support from Lusix's employees, the Commissioner of Insolvency Proceedings, and the creditors who own the assets leased to Lusix. Fenix committed to keeping 13 employees for at least one year and 10 employees for at least three months.

Lusix was established in 2016, with total investments of $152 million. Benny Landa, who owns 25% of the company, invested $47.5 million, while the More Group, controlled by Yosi Levy, invested $25 million and holds a 17.5% stake, partly as equity and partly as debt.

In a stay-of-proceedings request submitted to the court in August, Lusix reported that it began selling rough diamonds in 2019 and reached profitability in 2020. However, as of June 2022, rough laboratory diamond prices plummeted by about 90% due to increased market competition and lingering effects from the COVID-19 pandemic. In October 2023, facing a sharp price decline in lab diamonds from intensified competition, Lusix conducted an emergency $15 million fundraising round, valuing the company at $5 million.

Overall, Lusix recorded losses of $53.5 million in 2022-2023 and an additional $11.5 million in the first half of 2024. The company, burdened with debts of NIS 103 million, sought court protection and a freeze on proceedings, citing difficulties in attracting new investors amid the ongoing war in Israel. The case was heard by Judge Irit Weinberg Nutovitz at the Central District Court in Lod.

In her decision, Judge Weinberg Nutovitz noted that while both offers provided equal financial consideration, the main differences lay in the employment commitments and payment schedules of each bidder. These factors led her to favor the Fenix proposal. While Fenix committed to employing 13 workers for a year and 10 workers for at least three months, PD Holdings offered to employ only one worker for a period of three months.

Attorney Ofir Ronen, representing the employees, praised the court’s decision, noting that it took into account the workers' preference for Fenix’s offer, which ensured a higher number of retained employees and maintained their full employment conditions.