ASML forecast cuts $1 billion from Israeli chip manufacturer Nova’s market cap

Nova, Tower, and Camtek face steep losses after ASML signals slower growth for 2025, impacting global chip demand.

Shares of Israeli chip companies fell on Sunday on the Tel Aviv Stock Exchange, aligning with declines in U.S. stock exchanges where they are also traded. Leading the decliners was Nova, which dropped by about 14.8%, wiping out approximately NIS 3.6 billion (approximately $960M) from its market value, which now stands at around NIS 20.4 billion ($5.4B). Tower decreased by 3.6%, erasing about NIS 720 million, bringing its market value to NIS 19.4 billion ($5.15B). Camtek fell by 3.5%, shedding approximately NIS 540 million for a value of about NIS 14.4 billion ($3.82B).

The background to these declines is a disappointing forecast from the Dutch giant ASML, which manufactures machines for chip production. Alongside the release of its third-quarter results, ASML predicted that 2025 sales would total between €30-35 billion, at the lower end of its previous forecast. This is despite benefiting from the ongoing global demand for chips. As a result, ASML's stock plummeted 16% in one day, wiping €50 billion off its market value.

According to Bernard Manor, investment manager at IBI Investment House, "ASML is expected to continue growing next year, but instead of around 30%, the growth will be closer to 20%. This is still significant growth, but when a company trades at a P/E ratio of 35, a drop of about €2 billion in expected profits leads to a dramatic stock decline." The market, Manor added, had anticipated ASML's 2025 revenues to reach €37-38 billion.

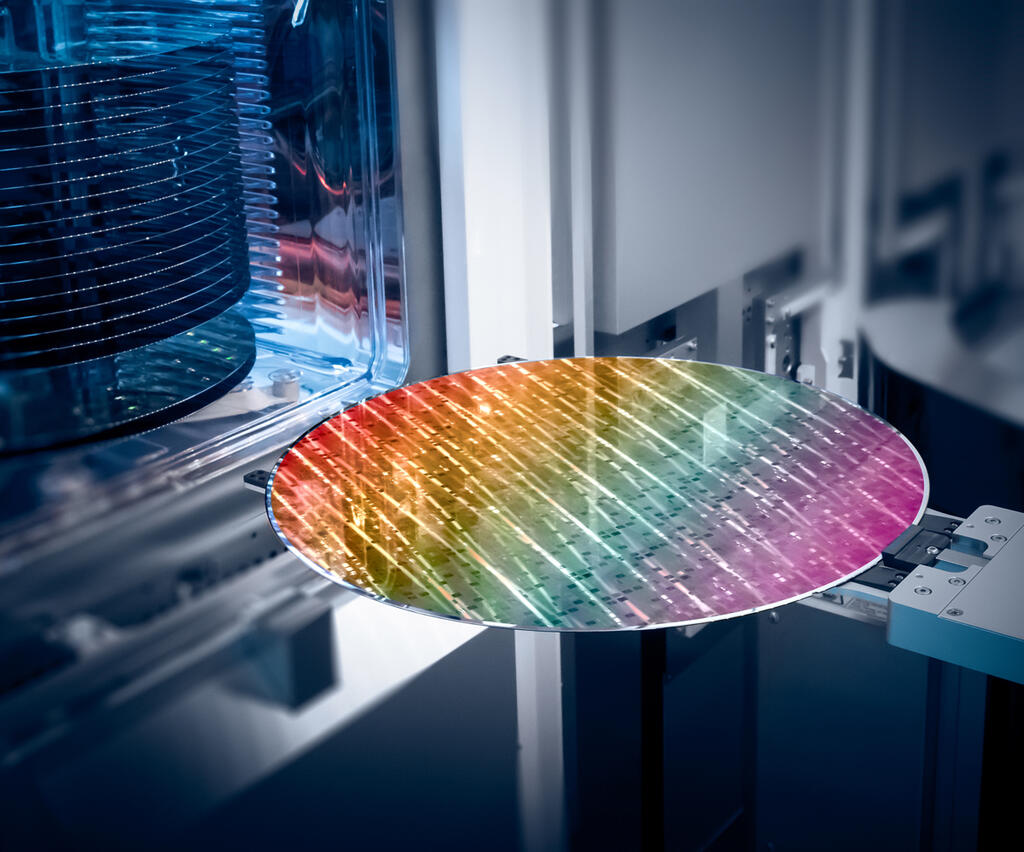

ASML, due to its central position in the chip industry, often signals the broader direction of the sector. "ASML occupies a unique position," said Shahar Cohen of the Lucid Capital fund. "It produces the machines used to engrave silicon wafers into advanced chips. This is the first step in the production process, and ASML holds a practical monopoly." From ASML’s forecast, it appears that attention is now shifting toward artificial intelligence (AI) chips, while demand for other types of chips, such as those used in personal computers and vehicles, is declining. "In practice, what ASML is saying is that the market is now focused on AI chips, while the consumption of other chips is decreasing. Additionally, U.S. chip companies are concentrating on increasing the utilization of existing plants rather than building new ones," Manor said. He added that while Nova and Camtek are also involved in AI, they are not at the forefront of the sector, and investors are reacting accordingly.

Related articles:

In contrast, Tower focuses on analog chips and is thus expected to be less affected by the trends ASML highlighted. Manor explained that Tower produces "chips used in cameras or RF chips for radio communications. Therefore, Tower’s exposure to the trends ASML is discussing is lower." However, he added, "There is still a negative sentiment toward the chip market, which has also impacted Tower. Additionally, the company's exposure to automotive chips might be contributing to its decline."

The weakness highlighted by ASML's forecast stems from two main factors. The first is the weakening positions of Intel and Samsung in the chip market, and the second is declining sales to China. "The crisis at Intel, which has led to global cutbacks, along with Samsung's inability to develop components and memory chips that meet Nvidia's requirements, has led to the postponement of orders for ASML's chip-manufacturing equipment, contributing to the lower forecast for 2025," Cohen said.

The second reason is the decline in sales to China. In 2024, China is expected to account for about 40% of ASML's sales, but in 2025, the company anticipates this figure will drop to 20%. According to Cohen, "Over the past two years, China placed large orders for chip-making machines. The question was whether these orders were driven by real demand or by China's attempt to advance purchases ahead of potential worsening sanctions after the U.S. elections. The current decline in Chinese sales suggests that this was, in part, an effort to stockpile equipment ahead of expected sanctions."