The Destiny Fund isn’t beating the system - it's upholding it

The Destiny Tech100 fund is the latest fund that claims to connect unqualified investors with the leading private tech companies, claiming to offer new opportunities to allow us all to invest in major companies like angel investors. This isn’t the reality

The U.S. IPO market knows no bounds - or logic. Amid other successful IPOs including social network Reddit, AI cloud infrastructure company Astera Labs, or the extraordinary IPO of Donald Trump's social network, Truth Social, the IPO of a company named Destiny best epitomizes the spirit of the times. In March, the Destiny Tech100 investment fund of the investment company D/XYZ (pronounced Destiny) began trading on the New York Stock Exchange.

The company, which began operating less than two years ago, entered trading with a price of $8.25 per share. By April 8th, its price had already reached a peak of $105, giving the company a market value of $1.1 billion. This value represents a significant disconnect from the fund's assets, which stand at $53 million. The gap between the trading value and the fund's assets seems almost impossible, indicating that even in a time when valuations, fundraisings, and IPOs in the tech sector are paused, the bubble is alive and well. Perhaps not for VCs, but certainly for the general public.

A business model or social justice?

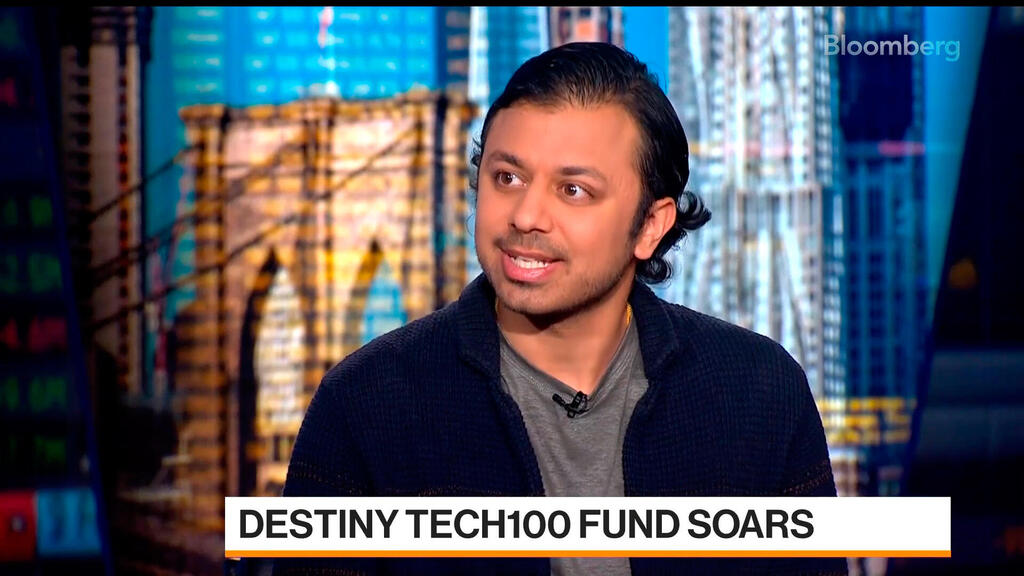

In the last month, Destiny’s stock has fallen as quickly as it rose and is trading around $40 currently, representing a significant loss for those who purchased at its peak and a decent profit for those who bought early on. But, what exactly does Destiny offer that other companies don't? Access to privately held and beloved startups such as OpenAI, Discord, Stripe, Epic Games, and the largest holding of them all: SpaceX, which accounts for 34.6% of Destiny's portfolio. All the stocks the company holds are private and not liquid. In total, the company holds stocks in 23 companies, but it plans to expand to 100, hence the name of the fund. The fund raised about $100 million from investors including Quora founder Charlie Cheever and Coinbase co-founder Fred Ehrsam. Sohail Prasad, Destiny’s founder and CEO, said his goal is to provide everyone with access to ownership of tech’s leading private companies.

Destiny is a young investment company. So young that on its website, the company uses abbreviations, slang, and different font sizes to signal to readers how youthful and disruptive it is. Instead of an ‘About’ section there is TL;DR (Too Long, Didn't Read); instead of spelling the company’s name in a way that is easy to pronounce, Destiny is written D/XYZ with a caption that reads "Pronounced Destiny.”

The company acquires private stocks through a series of methods, one of which, "futures contracts," includes a commitment from an employee to transfer a certain amount of stocks for a price agreed upon between the parties when they become transferable. Destiny says that they bought $3.5 million worth of Stripe shares using this method. However, Stripe - a company that has been around for 15 years with a value of about $65 billion, and is privately held - employees are prohibited from making such transactions. Yet Destiny's reports note that all transactions were conducted in accordance with regulations. Curious.

Destiny presents its business model as if it were pursuing social justice. "Today, the unicorn market is a growing $4.5 trillion asset class," they write on their website, "however, the opportunity to be a part of this growth remains private, only available to a select few who have access." Accordingly, investors who buy Destiny stocks today are likely doing so mainly in the hope that some of the expensive startups the fund invests in will go public one day, their price will skyrocket, and they will be able to make their own exit. In practice, at least for now, Destiny's returns are not impressive and summed up to a negative return of 7.3% in 2023 - the fund's first full year of operation. Overall, since it was officially registered in May 2022, the fund has registered a negative return of 23.2%. Although investments are usually ongoing, nothing about Destiny demonstrates much patience. Fundraising, investments, and even the IPO were extremely quick.

We have all become investors

Since the outbreak of the COVID-19 pandemic in 2020 until the early days of 2023, the tech sector witnessed intense enthusiasm. Tech companies reached every possible milestone - record fundraising, valuations, and exits. The newly enriched were mainly entrepreneurs, developers, bankers, and venture capitalists who had the knowledge and ability to enter and exit offerings quickly. The distribution of all this wealth only moved in one direction - upward, with nothing trickling down or permeating the rest of the population.

This is how new opportunities emerged, such as financial applications (like the Robinhood investment platform), new investment tools (crypto), and investment strategies (such as meme stocks which gain popularity not due to business achievements but by following memes in clips, drawings, or pictures circulated mainly on social networks). Small investors sought every way to participate. The appearance of these tools is usually framed positively as new instruments for financial inclusion or those that offer the possibility to beat the system. Finally, we can all participate in a speculative market, bypassing barriers such as capital and qualifications.

So, now, large portions of the "unbanked" population, who may not have had a bank account until now, can access financial outlets and actually trade stocks, developing countries can circumvent stringent Western rules; and retirees can "beat" hedge funds by buying stocks based on a post seen on Reddit. We've all become diligent, independent, self-taught investors to take part in the new and revolutionary wave. And, why not?

In actuality, these tools uphold and maintain an unequal society, in which, as is the case today, a full-time job is not enough to sustain a reasonable life or generate basic conditions for economic mobility. A reality that encourages people to escape their financial situation through participation in a speculative system, where major players possess an inherent advantage.

Funds like Destiny preserve this system, shielding it by seemingly creating new "opportunities." All this while the system itself is not required to change. None of the original or predatory conditions change - another way is simply created to transfer more resources from the bottom up. While the money of the less sophisticated investors rises, responsibility and risk go down in return. Thus, those who fail to capitalize on the "opportunity," or do so but lose their money, can only blame themselves. All this is just to hide the truth: in the end, most people using these financial tools don’t make money, but lose it, bolstered by the notion that they have beaten the system, when all the while they’ve actually contributed to preserving it.