Tech meets real estate: Why Neumann, Rappaport, and Andreessen Horowitz are backing Canada Global

Canada Global secures $27M investment from Flow, Andreessen Horowitz, and Wiz’s Assaf Rappaport for major U.S. projects.

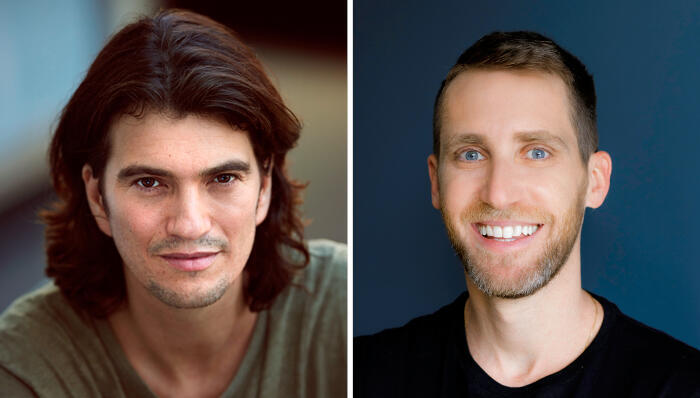

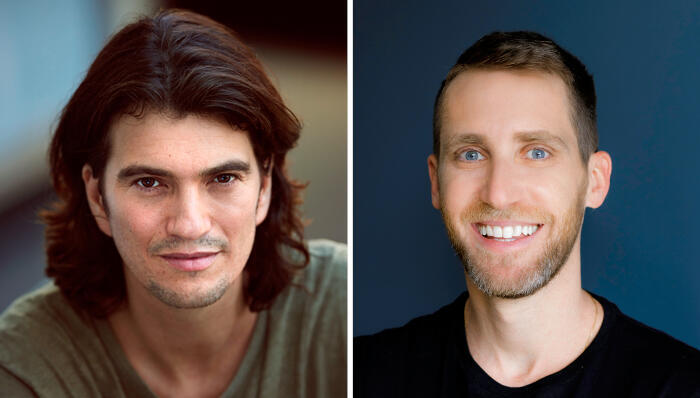

Assaf Tuchmair and Barak Rosen surprised the Israeli capital market on Sunday with a particularly flashy deal: the entry of Adam Neumann, Andreessen Horowitz, and Assaf Rappaport as partners in Canada Global, a real estate company under their control, which operates abroad—or rather, will operate abroad. Following the announcement, Canada Global shares soared by 54%. Rosen and Neumann have known each other for 15 years, and recently Neumann became acquainted with Rappaport, making the deal a product of personal connections.

The transaction announced by Canada Global involves several stages. First, Flow, a company controlled by Adam Neumann—founder of WeWork—and supported by the American venture capital firm Andreessen Horowitz (a significant shareholder), will be allocated shares representing 25% of Canada Global's equity post-allocation. These shares will be issued at NIS 6.01 per share, reflecting a 51% premium over the share price prior to the transaction's announcement, amounting to a total consideration of NIS 85.3 million (approximately $23M). Simultaneously, Flow will purchase an additional 4% from other shareholders at the same price for NIS 13.5 million, bringing the total investment to NIS 98.8 million ($27M), with Flow holding 29% of Canada Global.

Moreover, Assaf Rappaport, co-founder of Israeli unicorn Wiz, will also be allocated shares representing 1% of the company, valued at NIS 3.4 million, priced the same as Flow's shares. Altogether, a total of NIS 88.7 million will be injected into the company’s coffers—a significant sum given that, at the end of the second quarter, Canada Global had only NIS 17.1 million in cash. The transaction is based on a valuation of NIS 252 million ($68M) for Canada Global, which was worth NIS 167 million on the stock exchange prior to the deal. Following the transaction, the company's valuation will rise to NIS 341 million, and its current market value is now NIS 257 million.

Upon completion of the deal, Tuchmair and Rosen's combined holding will drop from 79.2% to 58.7%. Their shares will be valued at NIS 200 million, a substantial increase considering that they invested just NIS 11 million for 90% control of the company in December 2022. The deal with Neumann, Andreessen Horowitz, and Rappaport has thus generated a paper profit of NIS 190 million for the two. However, Canada Global remains a smaller venture compared to their control of Israel Canada, a local real estate giant with a market cap of NIS 4.3 billion ($1.16B).

Canada Global is the current iteration of the former Aviv company. Tuchmair and Rosen acquired 90% control from the Aviv family at the end of 2022. By January 2023, after allocating shares to several investors, the company's value jumped to NIS 250 million, despite owning only three apartments in London, valued at NIS 3.8 million. Since then, Canada Global has been finding its direction and has not closed any major deals.

Tuchmair leads the company, and alongside the announcement of the investor deal, Canada Global also reported an operational arrangement with Israel Canada. The agreement establishes that Canada Global will focus on real estate outside of Israel, except in countries where Israel Canada is active—Greece, Cyprus, Canada, Panama, the Dominican Republic, and Portugal.

Calcalist has learned that Canada Global plans to focus on the Miami real estate market, specifically in the residential rental sector, aiming for deals with a minimum value of $100 million per transaction, using a combination of equity and debt. Each project will consist of hundreds of apartments, and the first deal is expected to close in the coming weeks. Canada Global will concentrate on developing and operating rental housing projects, which will then be managed by Flow. Flow will have the right to enter as a partner in up to 50% of each project initiated by Canada Global, leveraging its familiarity with the local Florida market. However, Flow will remain a financial investor in Canada Global, without involvement in management.

Canada Global is focusing on Miami due to its belief that the city’s residential rental market will benefit from favorable conditions, such as tax reductions in Florida, which are attracting many Americans. Additionally, the company sees Miami’s large Jewish community and low levels of antisemitism as key factors that could attract more Jewish residents.

Flow was founded by Neumann in late 2022, raising $350 million from Andreessen Horowitz at a valuation of $1.7 billion. The venture capital firm, founded by Ben Horowitz and Marc Andreessen in 2009, manages $42 billion across 28 funds, investing in software, crypto, biomed, cyber, artificial intelligence, and fintech. The deal with Canada Global marks Andreessen Horowitz's first investment in an Israeli public company.

For Neumann, Flow represents a comeback after being ousted from WeWork in 2019. At its peak, WeWork was valued at $47 billion, but after becoming a public company, it had to undergo a creditor protection process. Neumann may have lost his position at WeWork, but not his wealth—he received a $1.6 billion exit package. Neumann used part of this money to invest in Flow, which focuses on residential rentals. Last week, Flow announced the acquisition of three apartment buildings in Riyadh, Saudi Arabia, where 920 apartments will be rented out, alongside local investors.