The fall of Lusix: Inside the collapse of Israel's synthetic diamond pioneer

The company has submitted a request for a stay of proceedings to the court due to debts of about $28 million. According to the company, it needs six weeks to complete a merger with another company, after which shareholders will inject $22 million. Lusix has raised over $150 million to date.

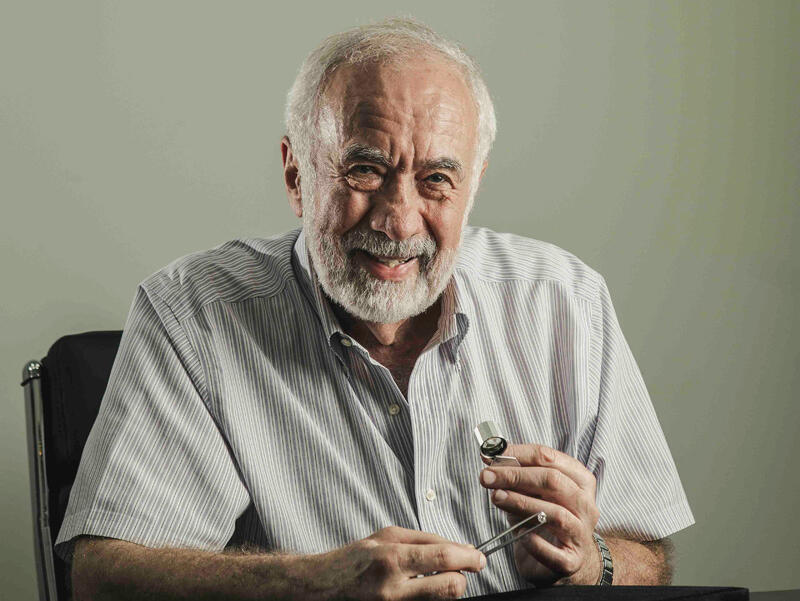

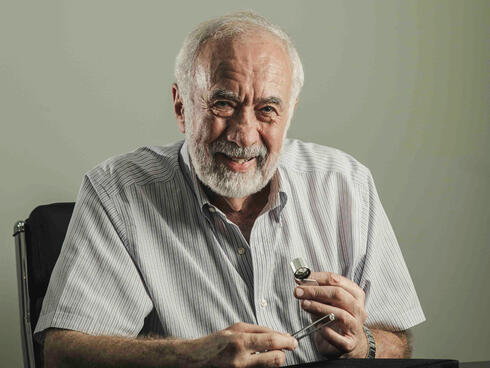

Benny Landa's dream of synthetic diamonds success is nearing its end, about eight years after it began. Lusix, which produces rough laboratory diamonds, has requested a stay of proceedings under Section 4 of the new Insolvency Law—a move designed to provide temporary protection from creditors while attempting to consolidate a debt arrangement and set the company on a new path through a merger with another Israeli company. Lusix is represented in the proceedings by attorney David Hahn, the former Guardian General and the Official Receiver of Israel.

Lusix submitted the request to the court after it urgently appealed to its shareholders last week, asking them to transfer $22 million so it could continue operating. The company clarified that if the amount is not provided, it will become insolvent. Most of Lusix's shareholders are willing to transfer the requested funds, but they have conditioned this on the successful negotiation of a merger with another Israeli company operating in the same field, which also has a marketing arm in the U.S.

For this reason, the company is asking the court for a six-week period during which its debts to Leumi and Discount Banks, to the Amot real estate company—whose property in Rehovot houses the company's offices—and to various suppliers will be frozen. The signing of the memorandum of understanding is not binding, which may allow the release of funds by the company's shareholders. Simultaneously, Lusix has put 60 of its 90 employees on leave without pay, and its plant in Modi'in will be temporarily closed.

Landa, who founded the company in 2016, is its largest shareholder, holding 25%. Until mid-2022, he financed the company alone, injecting $47.5 million into it. In June 2022, the company raised $90 million through a SAFE mechanism—a fundraising method more akin to a loan, where the funds are converted into shares in a future fundraising based on a value determined by various mechanisms. This fundraising gave Lusix a valuation of $300-500 million. The fundraising was led by the fashion giant LVMH, the owner of super brands such as Dior and Louis Vuitton, and included participation from the More Investment House, the Ragnar fund, the Maverick VC fund and provident funds, including those of Tel Aviv Municipality employees and Israel Aerospace Industries employees.

In October 2023, against the backdrop of a sharp drop in lab-grown diamond prices due to increased competition in the field, Lusix conducted an emergency fundraising round, raising $15 million based on a valuation of $50 million. Some existing shareholders participated in this round, including Dudi Weisman, the owner of Sonol, through his private company and the venture capital fund Geffen Capital, and Aaron Frenkel, through a foreign company registered in Malta.

Today, More Investments owns about 17.5% of Lusix shares, Frenkel owns about 16%, and the fashion corporation LVMH owns about 12%. According to sources close to the company, LVMH and Landa have recently been at odds. According to the request for a stay of proceedings, a total of $152.5 million has been invested in the company over the years.

The request outlines the company's downfall. According to the filing, Lusix began selling rough diamonds in 2019, and by 2020, the business had even become profitable. However, as of June 2022, the prices of rough laboratory diamonds have fallen by about 90%, due to the entry of many new players into the field and the lingering effects of the COVID-19 pandemic. Against this background, Lusix had already let go of 80 employees in the past year. According to the request, "In view of the collapse in laboratory diamond prices, the general global situation, and the Swords of Iron War, which led to an increase in raw material costs and delays in the transportation of goods, as well as the costs of establishing the new plant in Modi'in, the company had to secure bank financing and register liens on its assets during the years 2021-2023." Lusix estimates its total debts at NIS 103 million. Of this amount, it owes NIS 31 million to Leumi and Discount, NIS 23 million to other suppliers, and NIS 3 million to government entities, such as the Chief Scientist.

The request states, "Recently, in light of the company's cash flow distress, the company began receiving warning letters from various creditors threatening to cut off electricity to its factories and take legal action against it. In view of the ongoing merger talks, the drop in laboratory diamond prices, and the negative cash flow, combined with the notices the company has received from its creditors, there is insufficient time left for the company to stabilize independently, outside of court. Therefore, it deems it appropriate to request a stay of proceedings to formulate a debt settlement."

In its application, Lusix outlines potential sources for settling its debts if the merger with the Israeli company does not materialize. The company has an inventory of diamonds worth approximately $1.5 million, machinery valued at NIS 75 million, and less than NIS 1 million in cash in banks, not including deposits processed for the banks themselves. These limited assets are the basis for the request to delay proceedings: "A review of the company's assets and liabilities, as detailed in this request, shows that in a liquidation sale and full insolvency proceedings, creditors are expected to receive only a small portion of their debts, and significant economic value will be lost. Therefore, in order to formulate a favorable debt arrangement, the company needs the requested relief, for the benefit of the company and all creditors."

As part of the request, the company also offers a preliminary outline for paying off its debts within five years and presents an action plan for operating while the proceedings are delayed.

Landa, who made his initial fortune by selling the digital printing company Indigo to HP Global in 2002 for $830 million and now owns Landa Printing, told Calcalist, "Lusix was established to bring the leadership of the diamond sector back to Israel. There is no shame in trying and reaching this situation. I am very proud of the company and hope that it will succeed in embarking on a new path."