Aleph Farms raised $140 million—but now it's struggling to survive

The cultured meat pioneer is scrambling to secure $25 million to stay afloat as industry struggles deepen.

The troubles at Aleph Farms, the cultivated meat company that developed the world's first cultured beef steak, are not over. The company is currently in the midst of an emergency fundraising of $25 million, and it needs this money to continue operating. This is according to reports from the listed partnership Millennium Food-Tech, which holds 1.5% of the company's shares (1.3% fully diluted).

Calcalist has learned that at this stage, the company is set to secure only part of the amount, about $10 million, in the coming weeks, which it will raise from existing investors based on a company valuation of $80–100 million. In its last fundraising round in 2021, the company's valuation was about $300 million—a decline of up to 73%. Accordingly, in Millennium Food-Tech's reports, the partnership cut the value of its holdings in Aleph Farms by 75%, now amounting to $1.18 million. Millennium Food-Tech states that the reason for the valuation cut is also "due to the fact that Aleph Farms does not have sufficient cash reserves to continue its operations in the coming year." In other words, if Aleph Farms were a public company, its financial reports would include a going concern note.

This is a dramatic situation considering that since its establishment in 2017, Aleph Farms has raised $140 million. "If Aleph Farms succeeds in completing the current funding round, it will be a tremendous achievement for the company," a senior industry analyst told Calcalist, noting that the entire food tech industry is struggling to raise new capital. This puts companies like Aleph Farms in danger, as they still face years of development before their product can be commercialized. Last year, Aleph Farms attempted a funding round but failed to complete it, partly due to the war. In June 2024, it laid off 30% of its workforce—30 out of the 100 employees remaining after two previous rounds of layoffs. Before those cuts, the company had employed 140 people.

Aleph Farms is not alone in its struggles. According to Statista data, food tech investment in Israel has sharply declined. In 2024, investments in the sector totaled $134 million, compared to $153 million in 2023. In contrast, investments in 2022 and 2021 were significantly higher, at $944 million and $970 million, respectively. The largest funding round in the field was carried out by Aleph Farms itself in 2021 when it raised $105 million from a number of major investors. Globally, the cultured meat industry has also seen a steep decline, with investments dropping 78% from $807 million in 2022 to $177 million in 2023.

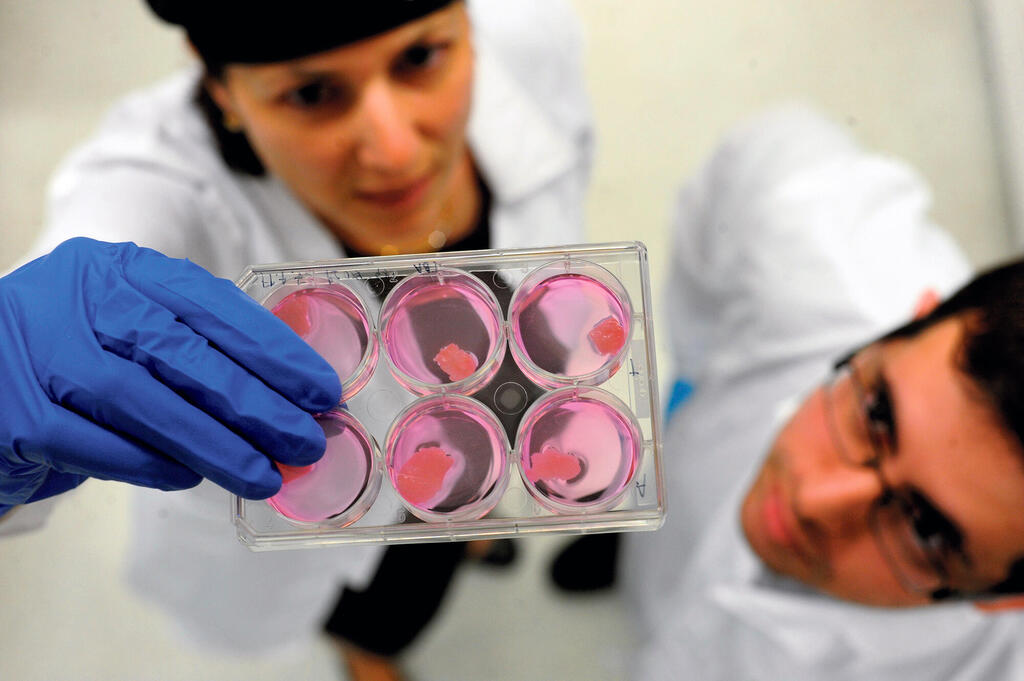

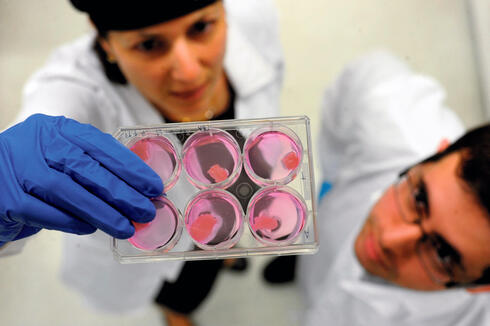

Aleph Farms is considered a pioneer in Israel and one of the leading companies in the field worldwide. It has secured investments from the Abu Dhabi Wealth Fund, Strauss Group, and major global investment funds. So what went wrong? The company was founded in 2017 by Didier Toubia, Dr. Neta Lavon, and Prof. Shulamit Levenberg from the Technion’s Faculty of Biomedical Engineering, in collaboration with Strauss Group’s The Kitchen incubator and the Israel Innovation Authority. In early 2024, it received approval from the Ministry of Health to market its products, but its difficulties began soon after. The political and security situation in Israel contributed to the failure of the funding round the company had planned to meet its milestones and investor commitments. The worsening conditions scared off investors, delaying the planned product launch following regulatory approval.

According to market sources, Aleph Farms also made several strategic missteps, such as expanding too quickly after its large 2021 fundraising and burning through cash rapidly. The company prioritized initiatives that did not significantly advance its core promise and struggled with the transition to commercial-scale production of raw materials that are particularly difficult to cultivate. This challenge is common among the most advanced cultured meat companies worldwide.

Beyond Aleph Farms, only two other cultured meat companies have received approval to market their products. The first, U.S.-based Good Meat, secured marketing approval in Singapore in 2020. It began selling its chicken nuggets at just one restaurant in Singapore, in limited quantities and at a loss-making price. Even after raising more than $580 million since 2011, Good Meat has been unable to commercialize its products for the general public.

In June 2023, the U.S. approved the sale of two cultured chicken products, from Good Meat and Upside Foods. Two luxury restaurants briefly added the products to their menus, but they were later removed. Despite regulatory approvals, both companies face significant commercialization difficulties, reinforcing investor hesitation.

The cultured meat industry faces deep technological and financial challenges. These include difficulties in scaling up cell differentiation, reducing the costs of essential raw materials such as amino acids and growth factors, and making products affordable enough for mass-market adoption. Many companies are unable to move beyond the laboratory stage and produce commercial-scale quantities of their products.

Last May, Good Meat attempted to expand its sales by offering its cultured chicken in a Singapore supermarket. However, the ingredient list revealed that the product contained only 3% cultured chicken, with the rest comprising plant-based proteins. This raised questions about the actual contribution of lab-grown cells to the final product.

Investors and executives in the alternative protein industry argue that the hype surrounding cultured meat has not yet been justified by results. "Cultivated meat is a marketing concept that has caught on well, but it is not yet a viable product or scalable technology," said one industry expert. A December 2023 article in MIT Technology Review labeled lab-grown meat as one of the "worst technology failures" of the year, citing production difficulties and high costs.

Currently, there are no success stories in the cultured meat industry. While it is too soon to declare the industry's demise—given that it is still in its early stages—there are growing concerns that the lofty promises made in recent years may turn into significant failures. In fields requiring long-term development, it is uncertain whether companies will continue to attract private investment, especially now that industry hype is fading and investors realize that returns may take years to materialize.

Aleph Farms responded: "Like any organization—especially one developing innovative, groundbreaking technology from Israel—we are also affected by market conditions and the geopolitical situation. We are adapting to the global economy by managing a leaner budget. Today, more than ever, we are focused on three key areas: streamlining production and reducing costs, commercializing our first product and proving its market need, and most importantly, achieving profitability. These priorities now take precedence over rapid expansion, which was a central focus of our 2021 strategy.

"Aleph Farms is in the final stages of the first closing of a financing round that began in 2024, which builds upon an interim investment raised in 2023—demonstrating our resilience and continued investor confidence. This financing will strengthen our financial stability, extend our cash reserves, and enable us to launch the world’s first cultured beef steak in restaurants, in collaboration with chef Eyal Shani.

"Like all companies in the industry, Aleph Farms is adjusting its valuation to reflect 2024–2025 market conditions. We view this process as a natural and healthy correction following the enthusiasm of 2020–2021.

"In recent months, Aleph Farms has achieved significant breakthroughs, including a 97% reduction in production costs compared to 2022, signing commercial agreements with leading global food corporations, and demonstrating product demand through collaborations with chefs in four countries. With regulatory approval from the Israeli Ministry of Health, we are now preparing to launch our product in Israel, leveraging an improved production platform and building our brand with key market players. Aleph Farms continues to lead the global cellular agriculture sector, driving meaningful change in food systems toward a safer, more sustainable, and resilient future."